Latin American Markets Feel the Pressure From Political Turmoil

EghtesadOnline: It’s been a tumultuous few days in Latin America with anti-government protests in Venezuela and Paraguay, an attack on the opposition presidential candidate in Ecuador and recurring unrest in Brazil, where the president’s popularity is tumbling amid attempts to reform the pension system.

All are reigniting concern about political stability in some of this year’s best-performing emerging markets and key U.S. trading partners.

According to Bloomberg, below are some of the continent’s market pressure points.

Venezuela

The country’s sovereign bonds due 2027 slumped to the lowest level since August after the Constitutional Court said on March 29 it would take over the duties of the opposition-controlled National Assembly. The decision was reversed Saturday, signaling a possible rebound in prices.

“While political turmoil might affect the credit in short term, the oil price trajectory will ultimately decide the fate of the sovereign,” Citigroup Inc. analysts Munir Jalil, Esteban Tamayo and Donato Guarino said in a March 31 report.

The disruption comes as Petroleos de Venezuela SA, the state-owned oil company known as PDVSA, faces a $2 billion bond payment due this month. The bonds traded near the lowest level since February on Friday.

Paraguay

Paraguay’s $500 million of dollar-denominated bonds have gained since they were sold less than two weeks ago. The rally is under threat after demonstrators set fire to the Congress building in Asuncion over a proposal to allow President Horacio Cartes to run for a second term.

Cartes replaced his top security officials Saturday. Local newspaper ABC Color said protesters returned to the Congress that day, but no new violence was reported.

Ecuador

Ecuador is in the spotlight as voters pick a successor to Rafael Correa, the self-declared socialist who has led the oil-producing nation for a record 10 consecutive years.

Opposition candidate Guillermo Lasso was attacked last week by group of people at Quito’s Atahualpa Stadium after attending a World Cup qualifier between Ecuador and Colombia.

The country’s $2 billion in bonds due in 2024, Ecuador’s most liquid dollar-denominated notes, still offer investors a higher yield than similar securities issued by Nigeria, which is rated at the same level by Standard & Poor’s.

Brazil

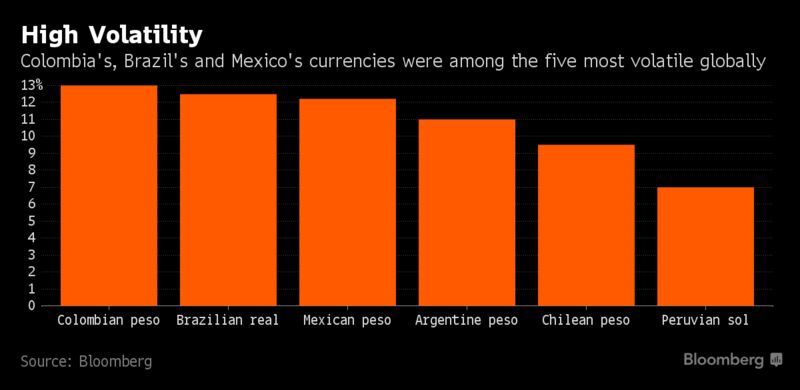

Brazil’s real joined the Colombian peso and Mexican peso in the five most volatile currencies among 31 major peers tracked by Bloomberg on Friday, based on their one-month implied volatility.

President Michel Temer’s disapproval rating has jumped to 73 percent from 64 percent in December, according to an Ibope poll published Friday by the National Industry Confederation, or CNI. Temer, who took over after the impeachment of Dilma Rousseff last year, is pushing ahead with unpopular austerity measures even as an economic recovery remains elusive.

Even so, Japanese investors are warming to Latin America -- or at least to Brazil, after getting burned in 2015. Holdings of Brazilian debt among Japanese mutual funds stood at 455.6 billion yen ($4 billion) in February, up about a fifth from the most recent low point in early 2016, according to Japan’s Investment Trust Association.

Mexico

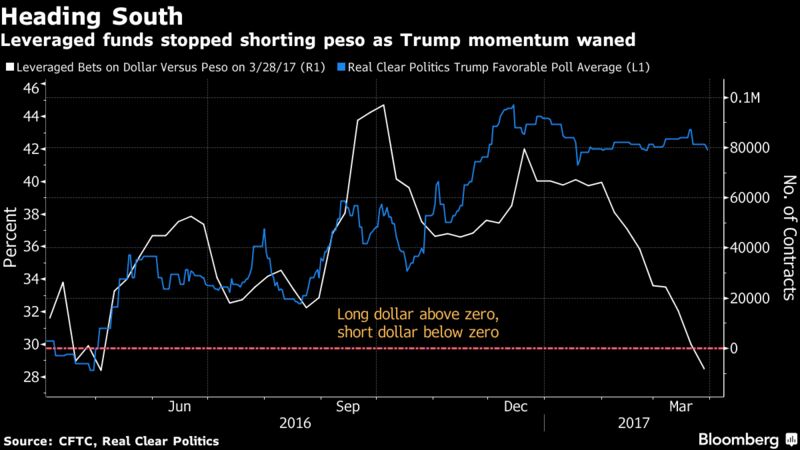

There are other markets in the region drawing interest from investors, with Argentina exiting recession and Mexico’s peso going from last year’s worst-performing major currency to this year’s best. Leveraged funds have taken note. They are shorting the U.S. dollar versus the Mexican peso for the first time since May, as Donald Trump’s presidency has so far proven far less toxic for the relationship between the U.S. and Mexico than his campaign-trail rhetoric suggested.