Turkey State-Run Bank Sinks After U.S. Sanctions Case Arrest

EghtesadOnline: The biggest state-owned bank on Turkey’s stock market plunged the most on record on Wednesday after its deputy chief executive was arrested in the U.S., accused of using his position at the bank to help facilitate evasion of U.S. sanctions on Iran.

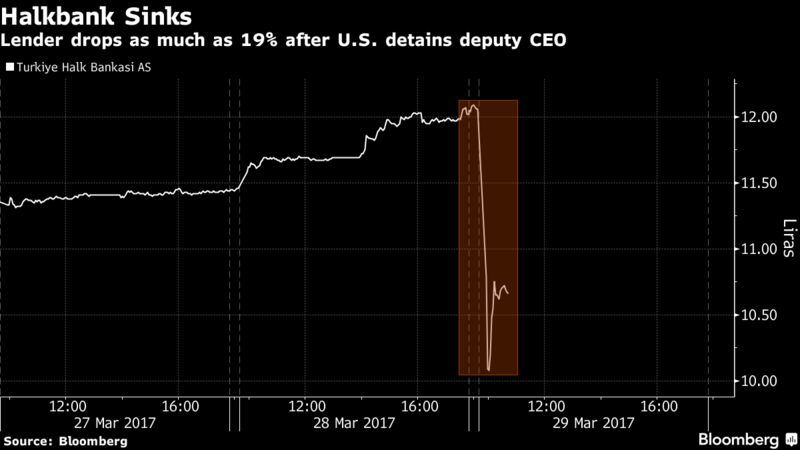

The shares of Turkiye Halk Bankasi AS, as the lender is formally known, fell as much as 19 percent in Istanbul, knocking 2.2 billion liras ($600 million) off its market value. Traders exchanged almost 110 million shares by 12:50 p.m., the most since the shares were listed, according to data compiled by Bloomberg. Mehmet Hakan Atilla, the deputy chief executive officer now detained in the U.S., faces charges including conspiring to evade trade sanctions on Iran and banking fraud, Bloomberg reported.

Investors have been on tenterhooks since Reza Zarrab, an Iranian-Turkish gold trader accused of running a scheme to help the Iranian government launder hundreds of millions of dollars, was arrested in the U.S. last March. Tapes released in a previous corruption investigation in Turkey showed Zarrab coordinating with Halkbank officials including Atilla.

“The main concern is whether Halkbank will face a penalty or not, and how much that would be if it happened,” Michel Danechi, a fund manager at Duet Asset Management in London, said by email. “The fines the U.S. government has imposed in such cases in the past have been huge.”

Corruption Charges

Zarrab was also at the heart of a corruption probe in Turkey in 2013, in which Turkish prosecutors accused him of bribing the country’s ministers in a gold-trading operation, a charge he denied. Turkey’s President Recep Tayyip Erdogan called the investigation a coup attempt and all charges against Zarrab were later dropped, as prosecutors and police involved in the case were fired, jailed or fled the country.

In an indictment in May, prosecutors in the U.S. accused Zarrab of paying $1.4 million to the bank’s former chief executive officer, Suleyman Aslan. Halkbank had replaced Aslan in February 2014 after a police raid on his home discovered millions of dollars in cash stuffed into shoeboxes. Aslan said the money was donations intended for Islamic schools.

Halkbank’s decline comes a day after the shares got a boost following news that Rudolph Giuliani, the former mayor of New York and an ally of U.S. President Donald Trump, had visited Erdogan and would aid Zarrab’s case. But on Tuesday, U.S. District Judge Richard Berman scheduled a hearing for April 4 asking the defense to explain Giuliani’s role in the case, amid concerns about a conflict of interest.

Valuation Discount

A 51.11 percent stake in Halkbank formerly owned by the Turkish Treasury was transferred to the newly formed Turkey Wealth Fund earlier this month. Owners of the publicly traded shares include Vanguard Group Inc. and Blackrock Inc., the world’s largest asset manager, according to data compiled by Bloomberg.

While Halkbank’s stock has 12 buy recommendations, 16 holds and no sell calls from analysts on Bloomberg, it’s been trading with the lowest valuation multiples among the most widely followed Turkish banks. Halkbank was trading at 3.98 times its expected earnings over 12 months, compared with a multiple of 6.36 times for Turkiye Garanti Bankasi AS, Turkey’s largest bank by market value.

The Borsa Istanbul 100 Index fell 1.2 percent on Wednesday, led by the banking index, which declined 2.7 percent. The yield on Halkbank’s dollar bonds maturing in July 2021 jumped 36 basis points, the most since November, to 6.4 percent.

Halkbank had hired Bank of America Merrill Lynch as global coordinator, along with Citigroup Inc., Commerzbank AG, HSBC Holdings Plc, JPMorgan Chase & Co. and Unicredit SpA as joint lead managers and joint bookrunners to arrange a roadshow for a sale of Tier 2 bonds in Europe and the U.S. from March 23-27.