Why OPEC’s Breakthrough Might Be Short-Lived: QuickTake Q&A

EghtesadOnline: The oil-producing nations of OPEC achieved an elusive consensus on reducing output. Can it last?

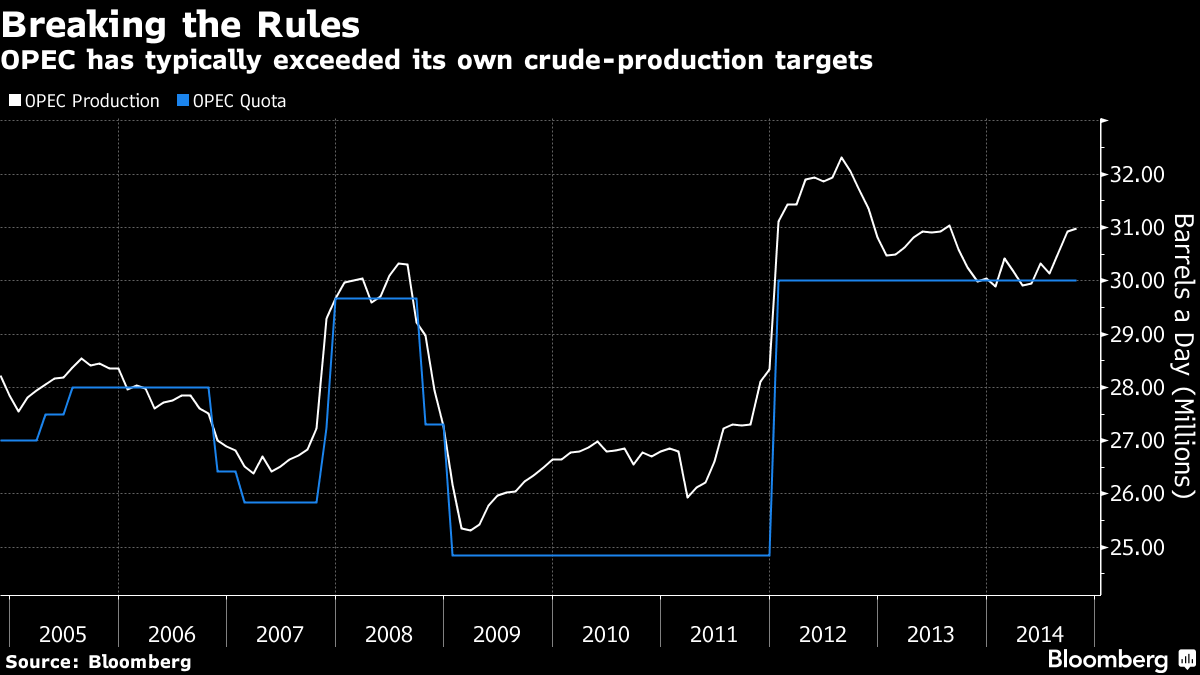

According to Bloomberg, OPEC members have broken quota agreements before, and the fruits of this cut -- the rally in oil prices that began immediately -- might last only a few months. It’s still far from clear that OPEC can reclaim its longtime role as arbiter of global oil prices.

1. Why cut production?

To drain record global oil inventories caused in part by OPEC’s policy of unfettered production. Saudi Arabia, the group’s de facto leader, opened the floodgates in 2014 when it decided that protecting its market share was more important than price stability. Despite plunging prices, OPEC last cut production in December 2008.

2. Have similar cuts worked before?

The December 2008 cut -- OPEC’s largest ever, 2.2 million barrels a day -- was prompted by price per barrel dropping to near $30 a barrel. Within a year, the price had recovered to around $75 a barrel.

3. Who will cut, and by how much?

Eleven of OPEC’s 13 members will reduce their output by a combined total of 1.2 million barrels per day, starting Jan. 1. The biggest reductions on a gross basis are by Saudi Arabia (486,000 barrels a day) and Iraq (210,000 barrels a day). Nigeria and Libya were exempted from the reductions.

4. How will compliance be monitored?

Algeria, Kuwait, Venezuela and two participating non-OPEC countries will serve on a committee "to closely monitor the implementation of and compliance with" the agreement. For the most part, though, the deal relies on self-compliance.

5. Who might not comply?

Nobody’s been immune to a bit of quota busting, but Saudi Arabia, the United Arab Emirates and Kuwait have traditionally stuck to their promises. Elsewhere, compliance has tended to be patchier.

6. What’s the goal?

OPEC officials have expressed the hope that by midnight on the last day of 2016, oil will be approaching $60 a barrel, or double what it was in January. Analysts see $60 as possible, but fleeting, with the price retreating to $50 or even $40 next year.