Pound Traders Sweat as Narrowing Polls Boost Election Jitters

EghtesadOnline: The U.K. elections are getting tighter, which could mean a nervy couple of weeks for pound traders.

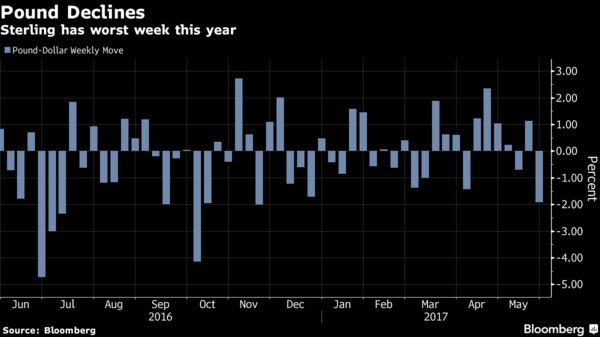

Sterling dropped Friday, rounding off the worst week this year, as a poll showed Theresa May’s Conservative Party leading the main opposition Labour Party by just five points, a gap that even this month had been as high as 24 points in some surveys. That left investors questioning whether the Prime Minister would achieve the increased majority that had been baked into the pound for the past few weeks, Bloomberg reported.

If the result of the poll is uniformly spread nationwide, it could mean the Tories end up with a smaller majority than in 2015, according to the Times, a result which analystssay could spell more losses for a currency that was buffeted by the Brexit vote in 2016.

“If there is one thing markets do not like it’s uncertainty and for the next two weeks the election looks to be providing just that,” Jordan Rochester, a foreign-exchange strategist at Nomura International, wrote in a note to clients. The latest poll “shows the Tory lead narrowing to just five percent, which is the key level of when Theresa May’s majority starts to be put into question.”

The pound was at $1.2786 as of 4:30 p.m. in London on Friday, on course for a 1.9 percent weekly decline, the biggest since November.

Rocky Spell

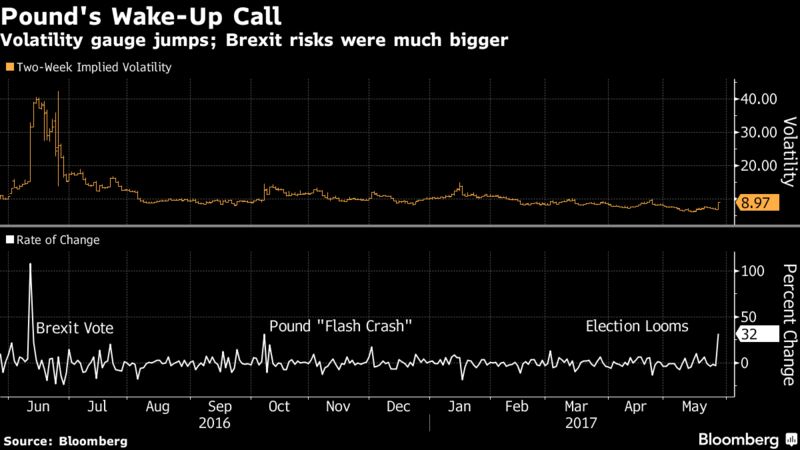

The latest polls presage what could be a rocky spell for sterling, with the June 8 election coming against a backdrop of a slowing economy and increased security risks.

A measure of two-week implied volatility for the pound against the dollar increased more than 2 percentage points on Friday, the biggest jump since October’s flash crash. While the measure climbed to 9 percent, the highest level since April, it’s still well below the more-than 40 percent level reached before the Brexit vote.

Data last week showed growth in the first quarter was slower than first thought while consumer confidence has also fallen to its lowest since the Brexit vote, according to an index compiled by YouGov and the Centre for Economics and Business Research. At the same time, the threat level posed by terrorism to the U.K. has been raised to “critical” from “severe” following the Manchester bombing.

Below is a selection of strategists’ views on sterling:

Credit Agricole SA

- The risk “is one of growing political uncertainty,” Valentin Marinov, head of group-of-10 foreign exchange strategy, wrote in a note to clients

- “It seems that rising central bank rate expectations and/or falling political uncertainty are needed in order to trigger fresh buying to the benefit of the currency”

- Recommends selling the pound against the Swedish krone, targeting 10.60 from about 11.14 on Friday

MUFG

- The poll “certainly has the potential to prompt some further pound selling over the short-term,” says Derek Halpenny, European head of global markets research

- “The consensus of a clear victory for PM May has been very strong and that in itself might be enough for further weakness over the short-term”

- Even so, “we suspect this bounce in the polls will either fade quickly or prove once again to be entirely inaccurate” and “pound depreciation on this issue will be unlikely to last”

Nomura International

- Sterling “is likely to continue to be under pressure now until the election is out of the way if polling continues to indicate it’s a tighter race,” writes Rochester

- “For the market the worst outcome is if we have further uncertainty with the chances of a hung parliament”

Mizuho Bank

- “Five percent is starting to cause people to factor in a lower majority,” says Neil Jones, head of hedge-fund sales. “People are starting to sell sterling again”

- “We’ve not yet got to the prognosis of a hung parliament”

- Sees further downside to the pound, potentially even below $1.25 if the poll spread continues to close and the chance of a hung parliament looks more likely

Standard Bank

- Recent polls cast some doubt on the assumption that the Conservatives will secure a majority and “hence we think the pre-election rise we’ve seen so far in the pound is likely to be given back,” Steve Barrow, head of group-of-10 strategy wrote in a note to clients

- Expects pound to drop below $1.25 before the election