Global Stocks Rally With Commodities as Clinton Gets FBI Boost

EghtesadOnline: Global stocks rallied with commodities and the Mexican peso on speculation Hillary Clinton’s chances of a U.S. election win increased after the Federal Bureau of Investigation stuck to its finding that her handling of e-mails wasn’t a crime. Demand for havens waned, with higher-rated bonds, the yen and gold retreating.

According to Bloomberg, European shares rebounded from a four-month low and Asian equities rose with S&P 500 Index futures after the boost for Clinton, who is seen by investors as the more predictable presidential candidate. The peso jumped the most in four weeks, while a rally in the dollar versus the yen showed investors were close to fully pricing in a victory for the Democrat. A gauge of commodities jumped by the most in a week, buoyed by industrial metals and oil, while gold dropped for the first time in eight days. Treasuries fell and perceived credit risk declined the most in six weeks. HSBC Holdings Plc surged after a surprise jump in profit.

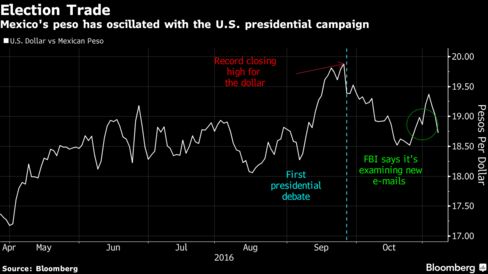

As Tuesday’s election approaches, financial markets have become more polarized on the candidates’ respective chances, with news favoring Republican candidate Donald Trump tending to weigh on stocks and boost demand for havens. U.S. equities fell every day since FBI director James Comey’s announcement on Oct. 28 that the bureau was looking into more Clinton e-mails. The peso, an election bellwether, has been among assets tending to strengthen when Trump loses momentum as he has pledged to renegotiate the North American Free Trade Agreement and build a wall along the U.S. border with Mexico.

“The market reacted to the message that they started the investigation and now they have to do the opposite,” said Piet Lammens, head of research at KBC Bank NV in Brussels. “However we are just one day before the election and it would be imprudent to take big positions and think everything is OK.”

Stocks

The MSCI All Country World Index rose 0.3 percent as of 10:54 a.m. London time, and the Stoxx Europe 600 Index jumped 1.1 percent. HSBC climbed 5 percent after posting a surprise jump in adjusted profit and a regulatory decision boosted its key capital ratio. Banks and miners were the biggest winners, as BHP Billiton Ltd. posted gains.

Ryanair Holdings Plc rose 5.2 percent after saying it will transport more passengers than previously expected in the years ahead, as lower fares help Europe’s biggest discount airline draw customers and boost profit.

S&P 500 Index futures surged 1.4 percent, after U.S. equities last week extended their longest losing streak in more than three decades. Berkshire Hathaway Inc. climbed 1.3 percent in premarket New York trading after late Friday reporting a record $85 billion in cash on its books as of Sept. 30, even as third-quarter earnings fell short of estimates.

The MSCI Emerging Markets Index rose 1 percent, rebounding from a three-month low, as benchmark gauges in Hong Kong, Taiwan, Turkey and Poland climbing at least 1.2 percent.

Egyptian stocks gained for an eighth day, sending the EGX 30 Index up the 4.7 percent to the highest since February 2015, on speculation an unprecedented decision to float the pound will help the country get a $12 billion loan from the International Monetary Fund.

Currencies

The peso climbed 2 percent. The currency posted declines in the past two weeks as Clinton’s lead over Trump narrowed in opinion polls amid the FBI’s renewed probe.

The Bloomberg Dollar Spot Index was set for its biggest gain in more than two weeks, rising 0.4 percent. The U.S. currency’s rally against the euro and the yen leaves it close to levels where it’s likely to trade 24 hours after a Clinton victory, based on the estimates of the top 10 currency forecasters as ranked by Bloomberg.

The greenback is being boosted by speculation that a Clinton presidency is now more likely, and that will pave the way for the Federal Reserve to raise interest rates in December.

“A Clinton win would clear the decks for the Fed to raise rates in December and for markets to price in a more aggressive profile for tightening over 2017,” said Sean Callow, a senior strategist at Westpac Banking Corp. in Sydney. “The surge in U.S. equity futures and slide in the gold price reinforces the evidence that a Trump win is seen as negative for global growth and profits.”

The yen and the franc had the biggest declines among major currencies, slipping at least 0.8 percent. They’re considered haven assets and posted gains of more than 1.5 percent last week.

China’s yuan fell by 0.3 percent, the biggest loss in four weeks, after the central bank lowered its daily reference rate ahead of an update on the nation’s foreign-exchange reserves. The holdings decreased $45.7 billion to $3.12 trillion in October, the People’s Bank of China said in a statement Monday. That compares with the median forecast of $3.13 trillion in a Bloomberg survey of economists.

The rand gained 0.8 percent. Data showed the South African central bank’s gold and foreign-currency reserves increased more than economists’ expectations in October.

Commodities

The Bloomberg Commodity Index, which tracks returns on raw materials, rose 0.8 percent, the most since Oct. 10.

Nickel led an advance in industrial metals, climbing 4.7 percent to $10,950 a metric ton, the highest in more than a year. Violent protests in Jakarta against the city’s governor prompted concern about the supply of metal from the country. Copper gained 1.4 percent to $5,064 a ton.

Oil rebounded as an earthquake struck Oklahoma Sunday near the nation’s largest crude-storage hub, prompting some pipeline companies to shut down operations as a precaution. West Texas Intermediate gained 1.6 percent to $44.77 a barrel.

Gold sank the most in a month, joining a slide in other haven assets after the FBI statement was seen boosting Clinton in the final stretch of the election campaign. Bullion for immediate delivery fell 1.3 percent to $1,288.53 an ounce. Silver lost 0.8 percent and platinum slid 0.4 percent.