Glencore Dealmaking King Returns With Wager on Oil and Putin

EghtesadOnline: A year ago Ivan Glasenberg was fighting to save his company from short sellers. Today, the CEO of Glencore Plc is back to doing what made his reputation: cutting deals that shake up global commodity markets.

Making a big bet on both the battered oil industry and Vladimir Putin’s Russia, Glencore and Qatar’s sovereign wealth fund joined forces to buy an $11 billion stake in Rosneft PJSC, the Kremlin-run oil producer that pumps more crude than Exxon Mobil Corp, according to Bloomberg.

Although Glasenberg is only committing 300 million euros ($324 million) of Glencore’s money to the proposed deal -- the rest will come from banks and Qatar -- his company will be closely entwined with Rosneft, built and run by Putin’s longtime ally Igor Sechin. As part of the deal, Glencore will get to sell 220,000 barrels a day of Rosneft oil for five years and it’s unlikely to end there.

Glencore expects “additional opportunities, through a strategic partnership for further cooperation, including infrastructure, logistics and global trading,” the Baar, Switzerland-based company said in a statement Wednesday.

The deal "was shock and awe", said Craig Pirrong, a professor of finance and energy markets at the University of Houston. "Given the experience of the last two years, one could have understood if he had been risk averse. This shows that his legendary appetite for risk remains.”

Surprise Deal

The surprise deal gives the buyers a 19.5 percent stake in Rosneft PJSC, which the U.S. and European Union have targeted with punitive measures, and is the biggest foreign investment in Russia since the crisis in Ukraine.

The U.S. is reviewing the deal to determine if it violates Western sanctions, according to Amos Hochstein, U.S. special envoy for international energy affairs.

“Clearly this is not what we were hoping for when we implemented sanctions,” he said in an interview on Bloomberg Television. “They are selling this partly because of the cash crunch, so you can look at it as the sanctions are actually working.”

Glencore said the deal was still in “final-stage negotiations” and would likely close in mid-December.

Intesa Sanpaolo SpA agreed to provide financing for consortium of Glencore, Qatar Investment Authority to purchase the stake in Rosneft, according to two people familiar with deal who asked not to be identified because they’re not authorized to discuss matter. Glencore’s equity contribution isn’t part of financing arrangement.

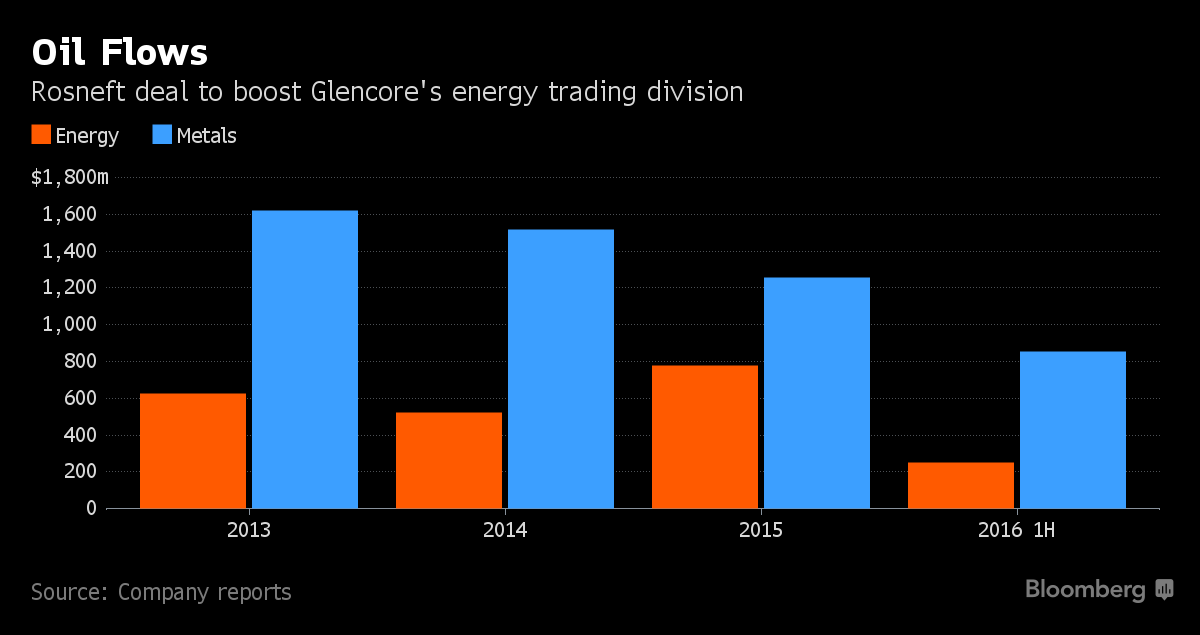

While Glencore is the world’s second-largest independent oil trader, behind Vitol Group, it doesn’t produce much crude. Its oil trading unit has been less high profile than the metals and coal business, where Glasenberg made the company a huge producer through the $43 billion acquisition of Xstrata in 2013.

It hasn’t made investments of a similar scale in the oil and gas industry. Until Wednesday, the biggest was the acquisition of Chad-focused Caracal Energy for $1.4 billion in 2014. That ended badly when collapsing oil prices forced Glencore to write down the value of the purchase. Glencore also owns several oil assets in Equatorial Guinea.

The Rosneft announcement signals the ascendance of oil chief Alex Beard. Until now Beard, a 49-year-old biochemistry graduate who joined in 1995 from BP Plc, has been largely overshadowed by metal traders like Telis Mistakidis and Daniel Mate. Beard cut his teeth trading Russian crude oil and has sought to expand the trader’s operations in the country, including a deal to finance some of the oil exports of Rosneft two years ago.

“Rosneft will be able to expand its access to global oil markets through this deal with a major oil-trading company,” said Michael Moynihan, research director for Russia at Wood Mackenzie Ltd.

Huge Bet

As well as shifting Glencore toward oil, the deal is also a huge bet on Russia and its leader. The company has long had ties with the natural resources world in Russia. The trading house was instrumental in the creation of what became United Co. Rusal, the Russian aluminum giant, by providing its alumina assets in a three-way merger in 2007. Today, it owns an 8.75 percent stake.

The commodities trader also owns a 25 percent stake in Russneft, the country’s seventh-largest oil producer by output. And Glencore already trades significant volumes of Russian crude and fuel-oil. The company is also one of the largest shippers of wheat and other agricultural products out of Russia, owning several terminals in the Black Sea and silos across southern Russia.

Glasenberg’s Confidence

Glasenberg himself has kept close to Russian leaders, attending the St. Petersburg annual business forum and traveling regularly to Moscow.

The latest move also shows Glasenberg’s confidence in Glencore’s recovery. In 2015, the company’s share price collapsed as investors challenged the ability to service its debt in a weak commodities market. After raising cash from investors, selling assets and idling mines, Glencore was able to reinstate dividend payments last month.

Glencore shares advanced 2.9 percent to 305.30 pence by 1:29 p.m. in London trading, the highest since May 2015. Rosneft shares jumped 5 percent to a record 375.15 rubles.

Peter Grauer, the chairman of Bloomberg LP, the parent of Bloomberg News, is a senior independent non-executive director at Glencore.