Qatar Sees No Basis Yet for Diplomatic Solution to Crisis

EghtesadOnline: Qatar is still waiting for specific demands from the Saudi-led bloc that has severed ties with the tiny Gulf state, and therefore sees no basis yet for a diplomatic solution, Foreign Minister Mohammed Al Thani said.

Kuwait, the mediator of the dispute, remains in contact with Qatar and the U.S., Al-Jazeera TV cited Al Thani as saying on Monday. Qatar is working on humanitarian issues stemming from the “illegal siege,” he said.

According to Bloomberg, Al Thani’s comments come as Qatar tries to play down the impact of a crisis now entering its second week. Finance Minister Ali Shareef Al Emadi said earlier that the country has enough financial firepower to defend its currency and economy and that the plunge in Qatari assets was a “normal” reaction to moves by Saudi Arabia, the United Arab Emirates, Bahrain and Egypt to cut diplomatic and transport links.

“We’re business as usual and we’re open for business,” he told CNBC in an interview broadcast Monday.

The Saudi-led alliance is demanding that Qatar distance itself from Iran and stop funding Islamist groups. Qatar denies sponsoring terrorism and accuses the Saudis of seeking to dominate smaller neighbors.

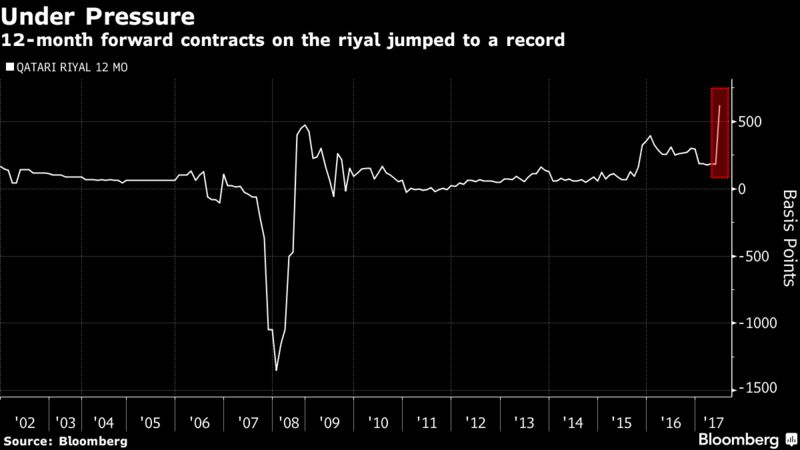

Under Pressure

The unprecedented measures have prompted investors and economists to ponder how long Qatar, the world’s biggest exporter of liquefied natural gas, can weather the pressure without having to devalue its currency or sell any of its global assets. Qatar’s sovereign wealth fund, one of the world’s largest, controls stakes in companies from Glencore Plc to Barclays Plc.

Qatar’s most liquid bonds tumbled last week as its sovereign rating was cut and bets against its currency surged.

“Our reserves and investment funds are more than 250 percent of gross domestic product,” Al Emadi, who sits on the board of the sovereign wealth fund, said. “I don’t think there is any reason that people need to be concerned about what’s happening or any speculation on the Qatari riyal.”

Mohamed Abu-Basha, a Cairo-based economist at the EFG-Hermes investment bank, doesn’t see any major risks to the riyal or Qatar’s growth prospects.

“The Qatari government can continue leading economic activity with little interruption,” he said. The cost of these investments is likely to increase because material can no longer come across the land border with Saudi Arabia, he said. Yet while this might expand the country’s budget deficit, that risk is “by no means life-threatening,” he said.

Ratings companies have been less sanguine about the feud’s effect on the economy of the world’s largest exporter of liquefied natural gas.

Downgrades

The biggest danger Qatar faces would be further credit rating downgrades, said EFG-Hermes’s Abu-Basha. Banks rely on non-resident deposits and foreign borrowing, and additional downgrades could scare away foreign funding and hurt the financial system’s liquidity, he said.

Moody’s Investors Service sees the potential to push up Qatar’s borrowing costs. Qatar’s sovereign credit strength will be hurt primarily on higher funding costs, while a pick-up in foreign investment outflows would drain foreign-exchange reserves, it said.

Al Emadi predicted the countries isolating Qatar will share in the economic pain they’re inflicting on it.

“A lot of people think we’re the only ones to lose in this,” the minister said. “If we’re going to lose a dollar, they will lose a dollar also.”