Some of the Biggest Hedge Funds Are Bleeding Cash

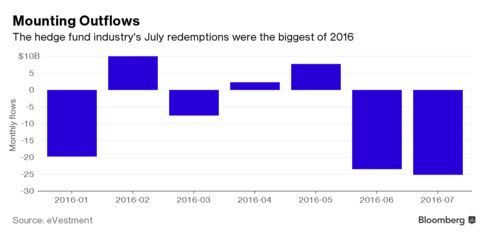

EghtesadOnline: Some of the biggest and best-known hedge funds can’t hang on to client capital.

Richard Perry, who started his hedge fund 28 years ago, has seen assets in his Perry Capital shrink to $4 billion, from $10 billion lastSeptember. That 60 percent drop comes as the firm’s main fund fell 18 percent from the end of 2013 through July, reports Bloomberg.

Perry isn’t the only manager struggling. John Paulson’s assets, on the decline since 2011, are down an additional 15 percent this year. And Dan Och, who like Perry cut his teeth at Goldman Sachs Group Inc., is now managing $39.2 billion at his Och-Ziff Capital Management Group, compared with $44.6 billion at the start of the 2016.

Perry, 61, wagers on corporate actions such as takeovers and bankruptcies. He’d never had a losing year until 2008, when his main fund slumped 28 percent. Since then, the Pop Art collector has posted only four winning years. Last September, David Russekoff, the chief investment officer, left the firm after almost 14 years. He was replaced by an investment committee that includes money managers Todd Westhus, Maulin Shah and Todd Gjervold.

Pedigreed Network

Before going out on his own, Perry worked under Robert Rubin on Goldman’s risk-arbitrage desk, the team that spawned a group of big-name managers including Eric Mindich of Eton Park Capital Management and Och.

Assets at Och-Ziff have dropped 12 percent this year. The firm has been under investigation over whether it knowingly paid bribes to government officials in Africa. Och, 55, has also struggled with performance. The firm’s main fund has made just 0.4 percent in 2016.

Och said on a conference call in August that the firm’s ability to attract money was hindered in part by the investigation.

Paulson, 60, has had mixed results since his windfall wager against U.S. housing in 2007. Assets at his Paulson & Co. have declined by more than two-thirds from a peak of $38 billion five years ago. The firm is managing $2.2 billion less than it was at the start of the year.

Spokesmen for the firms either declined to comment or didn’t return calls seeking comment.