High-Risk Investments Make a Comeback in Japan

EghtesadOnline: Yield-starved Japanese investors are taking out the cash stashed under the futon and plowing it into potentially risky securities.

Faced with domestic bond yields below zero and a rally in global equities that only recently had some wobbles, Japanese retail investors drove sales of bonds tied to the Nikkei 225 Stock Average to the highest in at least three years in January, according to Societe Generale SA.

This marks a comeback for the so-called uridashi notes, offerings of which tumbled 24 percent back in mid-2015, when weak energy prices and worries about China triggered a risk-off mood in markets. The securities pay off if the stock index rises above a preset level on designated days. The Nikkei 225 stock average climbed to 17-year highs in dollar terms after Donald Trump’s election, prompting early redemption of the notes linked to the gauge and a rollover of the money into new offerings for the figurative Mrs. Watanabe.

According to Bloomberg, the increase "could be a result of the knock-out of a significant portion of outstanding structured products by December, given a 16 percent rise in the Nikkei spot level in the fourth quarter of 2016,” Vincent Cassot, Societe Generale’s head of equity derivatives research, and his colleagues wrote in a March 23 note.

A pick-up in the proportion of worst-of baskets in issuance, to 35 percent in the past year from 17 percent in the first half of 2014, also fueled the increase in sales of uridashi notes, the analysts said. Worst-of securities, which base their payout on the lowest returning of typically two or three stock indexes, are becoming popular as issuers look to construct securities with higher yields.

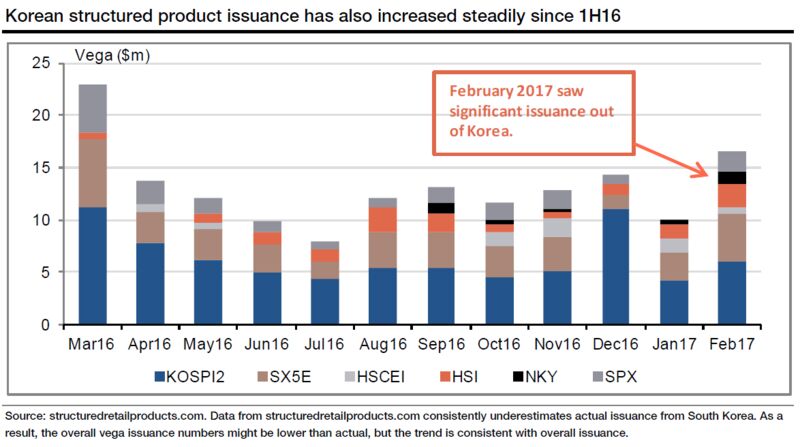

With their risky nature, structured securities have sometimes drawn the scrutiny of regulators. In South Korea, which vies with Japan as the region’s biggest market for the notes, rules were tightened after a 2015 rout in Chinese equities, when investors lost a chunk of their principal on notes tied to Chinese stocks. Volatility in the broader market worsened at the time, with dealers rushing to hedge the securities they’d issued.

Sales of notes linked to the Hang Seng China Enterprises Index have declined as a result of the tighter oversight, according to Societe Generale analysis. Securities tied to the Euro Stoxx 50 continue to dominate, making up 50 to 60 percent of the total equity-linked notes, Societe Generale analysis shows.

In the chart above, vega measures the change in the option’s price for a 1 percent change in volatility of the underlying asset.

With South Korean investors joining their Japanese counterparts in snapping up notes linked to the Nikkei, their biggest area of vulnerability may be to any resurgence in the yen along the lines of Monday’s trading, which sent Japanese shares down with it. Losses on such structured products can impact banks, which may need to re-balance related hedges.

Still, the worries over the U.S. fiscal-stimulus narrative that stoked the risk-off trade at the start of this week were waning by Tuesday, when the yen halted its gains and Japanese shares climbed the most in two weeks.

“Given the globally bullish stance, especially on emerging markets, we could reasonably expect to see substantial knock-outs and subsequent issuance in the coming months,” the Societe Generale analysts wrote.