Oil Heads for Biggest Monthly Gain Since April Before OPEC Talks

EghtesadOnline: Oil is poised for the biggest monthly advance since April amid speculation informal talks among OPEC members in Algeria next month may result in action to stabilize the market.

According to Bloomberg, futures slid 0.1 percent in New York, trimming the monthly gain to 11 percent. Iraq would support a proposal for the Organization of Petroleum Exporting Countries and other major producers to freeze output, Prime Minister Haidar Al-Abadi said in Baghdad. U.S. crude stockpiles increased by 942,000 barrels last week, the industry-funded American Petroleum Institute was said to report. Government data due Wednesday is forecast to show a 1.3 million build.

Oil entered a bull market Aug. 18, less than three weeks after tumbling into a bear market. A cap on production would bepositive for the market, Saudi Arabia’s Energy Minister Khalid Al-Falih said in an interview last week, while ruling out a cut to output. A deal to freeze supply was proposed in February but a meeting in April ended with no final accord.

“A freeze based on current maximum production levels, or somewhere near that, may not have too much practical impact on the market,” said Ric Spooner, chief analyst at CMC Markets in Sydney. “We are moving into the maintenance season for refineries and we could see some inventory builds starting to happen. There is the possibility that prices could drift lower.”

West Texas Intermediate for October delivery was at $46.31 a barrel on the New York Mercantile Exchange, down 4 cents, at 8:05 a.m. in London. The contract declined 63 cents to settle at $46.35 a barrel on Tuesday. Total volume traded was about 46 percent below the 100-day average.

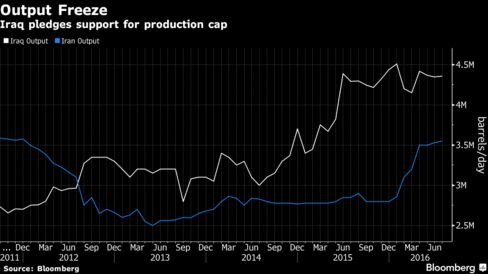

Output Freeze

Brent for October settlement, which expires Wednesday, was 3 cents lower at $48.34 a barrel on the London-based ICE Futures Europe exchange. Prices dropped 1.8 percent to $48.37 on Tuesday. The global benchmark was at a $2.04 premium to WTI. The more-active November contract fell 6 cents to $48.67 a barrel.

The drop in prices is hurting Iraq, Al-Abadi said, pledging to support a potential output freeze deal. The nation is the second-biggest member of OPEC, pumping 4.36 million barrels a day in July, according to data compiled by Bloomberg. Saudi Arabia is the largest, producing 10.43 million a day.

Oil-market news:

- Schlumberger Ltd. is expecting the situation to get worse for its drilling business in the third quarter thanks to further deterioration in deepwater work around the world.

- U.S. gasoline inventories probably declined by 1 million barrels last week, according to a Bloomberg survey before Energy Information Administration data Wednesday.

- Japan’s JX Holdings Inc. and TonenGeneral Sekiyu KK finalized an agreement to form the county’s biggest oil refiner starting in April.