Positive Impact of the Exchange Rate Agreement on Export-Oriented Companies / What are the Goals Ahead for Fasaazan Shares?

The company Ghaltak Sazan Sepahan, known by its ticker symbol Fasaazan, has a market capitalization of 1,800 billion tomans and produces various types of ingots and casting parts.

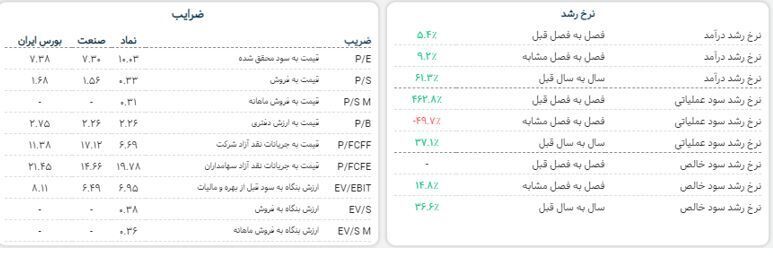

EghtesadOnline: with a portion of Fasaazan's products being exported, the recent news regarding the exchange rate agreement and the increase in the dollar rate, alongside the stability or growth of billet prices, will impact Fasaazan. The company has the potential for significant profit growth, currently holding a P/E ratio of around 10. It is worth noting that the sponge iron used as raw material constitutes about 63% of the ingots. The manufacturing company Chahd Sazan holds a 56.72% stake in Fasaazan, making it the major shareholder. From a technical analysis perspective, Fasaazan appears attractive for further examination within supportive price ranges. The report continues with an introduction and review of the company's performance.

Ghaltak Sazan Sepahan boasts production facilities including heavy casting workshops, melting furnaces, Continuous Casting Machines (CCM), and production halls for ultra-heavy rollers, including support rollers, as well as heat treatment workshops and modeling facilities. Established in 2009 with the aim of casting heavy and ultra-heavy iron and steel components, the company has an annual production capacity of 20,000 tons of various cast iron and steel parts weighing up to 100 tons, along with 150,000 tons of steel ingots via continuous casting. The company operates two separate production lines for casting parts and producing ingots. Fasaazan has enhanced its production capabilities by installing new furnaces, securing electricity supply, and improving power transmission routes from the industrial park to the company, along with two years' worth of imported spare parts and plans to expand its melting and casting facilities. The selling price of ingots is primarily determined by domestic market supply and demand, which typically aligns reasonably with global market prices. Most domestic sales occur through commodity exchanges at competitive pricing. For pricing of the produced casting parts, factors such as complexity, alloy type, and other influencing elements are considered, with production conducted upon agreement.

The export selling price of steel ingots is determined based on global market prices. Fasaazan utilizes sponge iron, melting iron, and various ferroalloys in its production processes. In addition to these direct raw materials, the company requires some indirect raw materials, the most important of which is refractory clay.

The performance report for November indicates favorable sales conditions.

In November 2023, the company achieved sales (revenue) of 575 billion tomans, representing a 27% increase compared to the previous month. The average monthly sales until the end of this month stood at 446 billion tomans, indicating that this month's sales exceeded the average monthly revenue by 29%. The total sales for the fiscal year 2023 reached 3,571 billion tomans. Fasaazan's monthly report shows that in November 2023, it sold 23,741 tons of product, reflecting a 22% increase compared to the previous month. During this period, electricity rates were reported at 2,186,650.131 rials and gas at 25,000 rials.

Share Chart and Future Scenarios:

The share has experienced a decline from its peak price of 590 tomans in May last year to 300 tomans in November this year, forming a WXY combination pattern. It has since experienced a sharp rise from this range. The recent wave is part of an upward C wave in a plausible scenario with significant targets ahead at 570-590 tomans, followed by 750 tomans and then 1,000 tomans. A stop-loss should be set in the range of 390-400 tomans.