Member of Parliament Discusses Tax Evasion and Targeted Tax Exemptions in 2024 Budget

In an interview with Eghtesad Online, Abolfazl Abutorabi, a member of the Parliamentary Committee on Internal Affairs and Councils, expressed hope for a reduction in the tax burden on vulnerable groups and small businesses in the 2024 budget. He emphasized that one of the key decisions in the 2024 budget proposal is the increased focus on identifying tax evaders while easing the tax pressure on the lower-income groups and small businesses, particularly by doubling the tax exemption for salaried workers and small enterprises.

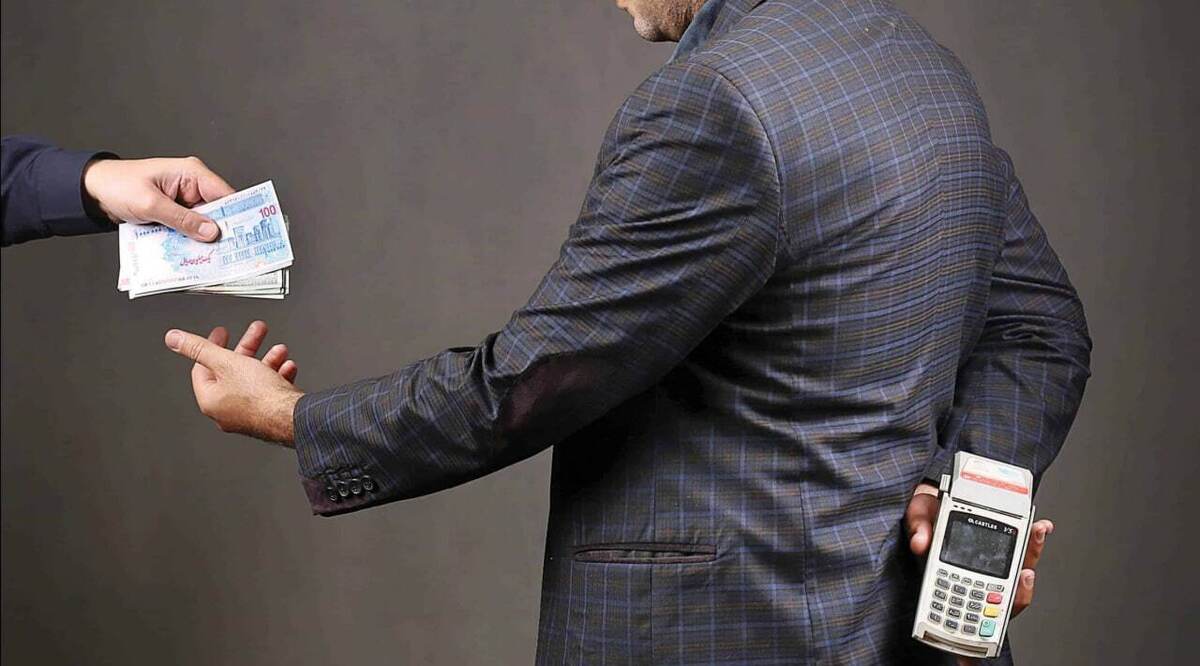

EghtesadOnline: Abutorabi explained that tax evasion remains one of the biggest challenges in the country’s taxation system. "Unfortunately, statistics show that nearly 50% of potential tax revenues are lost due to tax evasion," he said. "This issue prevents the government from making necessary investments in infrastructure and public services, which ultimately impacts the quality of services provided to citizens." He added, "Therefore, we need to focus on combating tax evasion, while providing targeted exemptions for small businesses and ordinary wage earners."

The representative for Najafabad in the Iranian parliament noted the recent positive steps taken by the government to address tax evasion. "Fortunately, the government has recently made decisions that could have a positive impact on the taxation system. One of the key measures in the 2024 budget proposal is a stronger focus on identifying tax evaders and reducing the tax burden on vulnerable groups and small businesses by increasing the tax exemption for salaried individuals and small enterprises by 100%." Abutorabi stressed that this approach would allow for more focus on large individuals and companies, those most likely to engage in tax evasion.

Abutorabi, who also serves on the Committee for Internal Affairs and Councils, emphasized the need for a fair and transparent tax system, where all citizens feel a sense of responsibility in paying taxes. "This responsibility is not just towards the government, but also towards society and future generations. Public participation in the tax system is crucial, as it ensures that people understand their taxes contribute to projects that improve their quality of life. This understanding increases their willingness to pay taxes," he explained.

He continued: "When citizens participate in the process of how their tax revenue is spent, they become more aware of their contribution and how it benefits society. Taxes, in this sense, become an investment in the country’s future. Every citizen can contribute to improving infrastructure and public services by paying taxes. Our efforts in the government and the tax system should focus on maintaining this public involvement by ensuring transparency, providing sufficient information, and gaining the trust of the people. This will show citizens that their taxes are being used properly, which can lead to sustainable national development."

Abutorabi also pointed out that reducing production taxes by 5% in the 2024 budget could bring significant benefits to the productive sector of the economy. "This reduction will increase investment in various industries and allow producers to allocate more resources to research and development. As a result, this will enhance competitiveness and improve the quality of products," he concluded.