An OPEC Oil Price Surge May Not Last, IEA Says

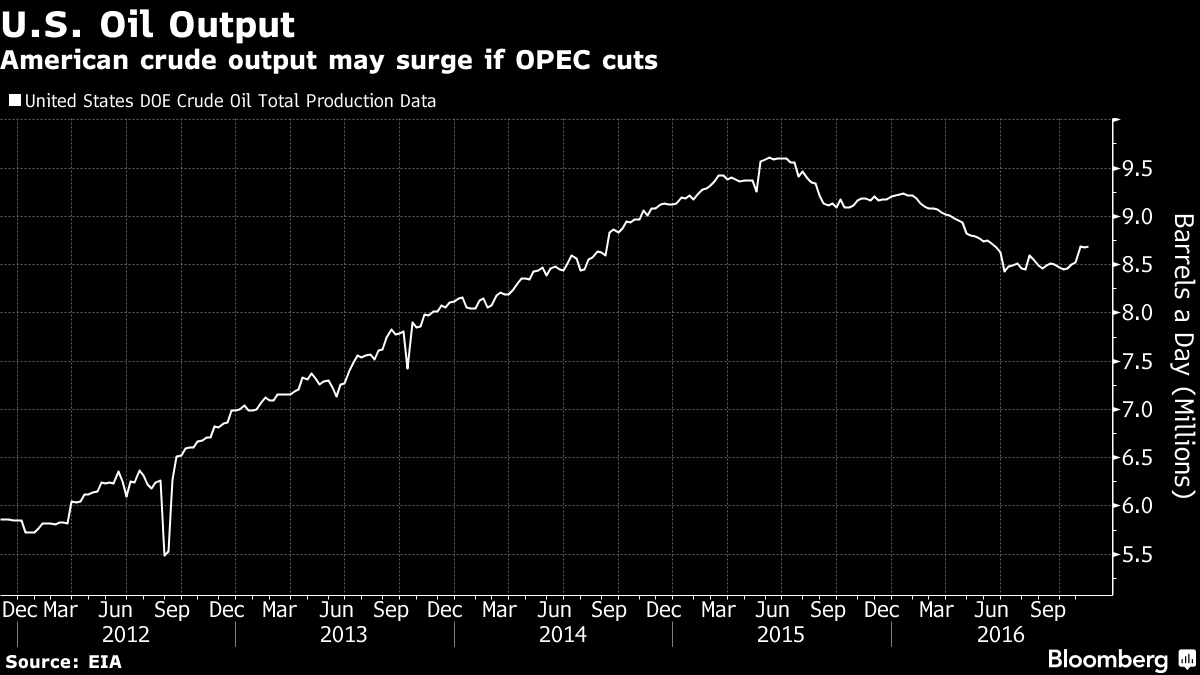

EghtesadOnline: An oil price surge triggered by a successful OPEC agreement to cut production could be snuffed out as supply surges back, according to the head of International Energy Agency.

If OPEC members agree to limit supplies at their meeting next week, prices could rise to $60 a barrel and trigger a jump in global output, particularly from U.S. shale producers, Fatih Birol, executive director of the Paris-based IEA, said during an interview with Bloomberg Television. The output boom could put downward pressure on prices again within nine months to a year, he said.

Brent crude, the global benchmark, has rebounded about 10 percent from a three-month low earlier this month to trade near $50 a barrel in the run up to the Nov. 30 meeting by Organization of Petroleum Exporting Countries in Vienna, where ministers will try to implement supply curbs first outlined in late September. Futures traded at $49.02 a barrel at 7:18 a.m. in London, according to Bloomberg.

“Many people expect a freeze or a cut from the Vienna meeting,” Birol said in Tokyo. “But we should also think about the next steps after the possible cut or freeze.”

Brent prices have averaged about $44 a barrel this year, almost 50 percent less than the five year average, amid a global glut that has forced producers to slash spending. Energy markets have entered a period of greater volatility as investments in new production are declining for a third year, Birol said.

“This is the first time in the history of oil that investments are declining for three years in a row,” he said. “As a result, we may see bigger difficulties in a few years time.”

U.S. crude output peaked in June last year, when the country produced an average of 9.61 million barrels a day. It’s fallen about 10 percent to 8.69 million barrels since then.

OPEC Agreement

OPEC reached a preliminary agreement in Algiers on Sept. 28 to reduce collective output to 32.5 million to 33 million barrels a day, compared with the group’s estimate of 33.6 million in October. Iraq will shoulder part of the burden of oil-output cuts, Prime Minister Haider Al-Abadi said Wednesday, reversing the nation’s previous insistence for an exemption.

The IEA warned earlier this month that prices may retreat if OPEC fails to enact “significant” cuts as producers outside the group will raise supply next year. OPEC’s own estimates of supply and demand also show that the Algiers agreement would barely drain a record oil surplus next year without the cooperation of non-members such as Russia, the world’s largest energy exporter.