Brexit and Politics Cast Shadow Over U.K. After Tumultuous 2016

EghtesadOnline: The U.K.’s long-predicted Brexit slump may finally arrive. With the negotiations to exit from the European Union set to begin early next year, the political back-and-forth that slammed the pound this year will continue through 2017.

Bank of England policy maker Ian McCafferty foresees a “slow-motion slowdown” as consumers face faster inflation, importers cope with higher costs and companies become more reluctant to invest, Bloomberg reported.

While prophecies of doom have so far proved inaccurate, a BOE report on Wednesday showed companies are hoarding cash as they become more cautious. That’s partly because households and businesses remain in the dark about the country’s future ties with the EU. Further muddying the outlook is the U.S. administration under Donald Trump and elections that could alter the political makeup in some of Europe’s biggest nations.

“Forecasting is hard at the best of times and these are not the best of times,” said Rob Wood, a former BOE economist now at Bank of America-Merrill Lynch. “Ultimately the economic forecasts for next year and the years beyond depend heavily on the choices that politicians make.”

Some details of the new EU-U.K. relationship may emerge shortly if Prime Minister Theresa May fulfills a promise to publish a plan before formal exit talks, scheduled to start by the end of March with the triggering of Article 50. That’s the same month Chancellor of the Exchequer Philip Hammond will unveil his new budget, which may contain some fiscal sweeteners to smooth the economy’s progress.

The BOE will update its projections in early February, meaning they may have a very short shelf life. Governor Mark Carney has already come under fire for his forecasting. Along with the IMF and OECD, the BOE was lambasted this year by pro-Brexit campaigners who said they exaggerated the potential adverse effects of withdrawal.

Growth Slows

The U.K. recorded a solid performance this year, with consumers helping to sustain momentum after the EU referendum. Growth is likely to be 2 percent, above the 1.6 percent forecast for both the euro area and the U.S.

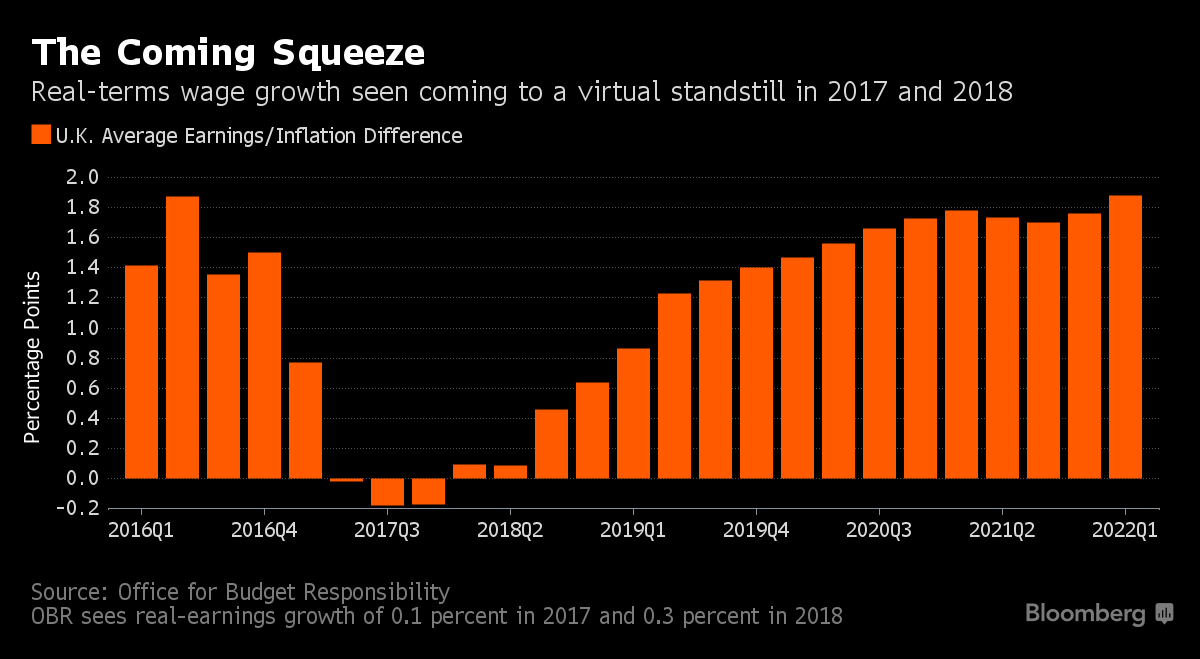

While GDP will continue expanding in 2017, economists surveyed by Bloomberg see the pace slowing almost by half, to 1.1 percent. After sterling’s plunge this year, the BOE forecasts a sharp inflation pickup that will eat into real-income growth.

“There’s every reason to think that the end of this year will be the high point for the consumer,” said Simon Wells, an economist at HSBC Holdings who previously worked at the BOE. “With the publication of the Brexit plan and the triggering of Article 50 the size of challenges may come to the fore.”

May’s success in negotiating a new deal with the bloc also rests on elections in Germany, France and the Netherlands that could see populist parties with anti-EU stances increase their standing in 2017. Rupert Harrison, chief macro strategist at BlackRock Multi-Asset Strategies and a former government adviser, said the U.K. is still in a “phony war,” and real negotiations may not start until after these votes.

“We don’t know just how distracted the main players in Europe will be next year,” HSBC’s Wells said. “One surprise might be that Brexit isn’t the top priority.”

BOE Ready

Ready to step in again if there’s a sharp slowdown is the BOE. It cut interest rates in August to a record low, though it’s now more constrained by the inflation outlook. Movements in the pound -- dictated largely by political events in recent months -- could be crucial in determining its next move.

As the clock ticks down to the start of the two-year exit process, companies are demanding clarity, and some have even set up special teams to assess the impact of the EU vote. Electronics retailer Dixons Carphone said this month it hasn’t seen any effect on consumer demand yet, but it’s “planning for the possibility of more uncertain times ahead.”

A transition deal with EU leaders could give businesses time to adapt to a new relationship, though a key part of that would be an early agreement. Otherwise companies will start making their contingency plans, changing investment strategies, even potentially relocating.

The Confederation of British Industry said this week that easy access to European labor and markets are the key demands of U.K. firms in any new deal. That could prove difficult to reconcile for May, whose government has put capping immigration at the forefront of its negotiating position.

“The more likely a hard Brexit becomes, the bigger I think the business response will be in terms of reducing investment and firms relocating activity out of the U.K.,” said Thomas Sampson, a professor at the London School of Economics. “It’ll be a slower effect gradually emerging over time rather than anything dramatic.”