European Debt Crisis Memories Rattle Markets, Defy Confidence

EghtesadOnline: Europeans are more confident about their economy than they’ve been in nearly six years, but you wouldn’t know it by looking at the markets.

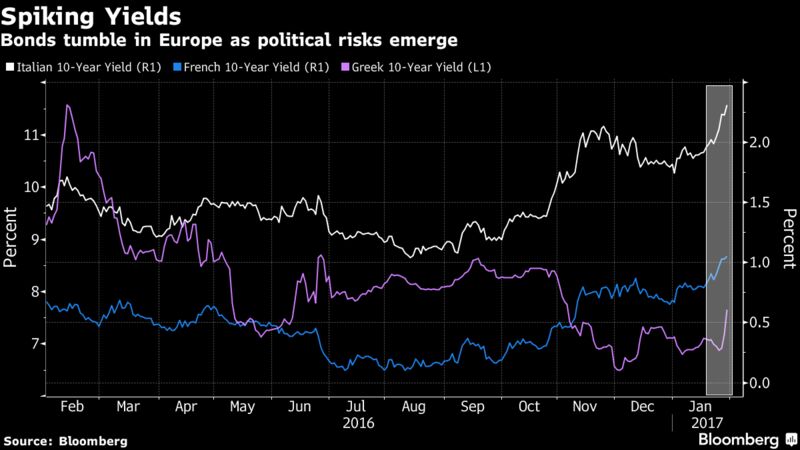

According to Bloomberg, investors dumped bonds and stocks across the region on Monday, spurred by a confluence of risks that echoed the euro-zone debt crisis. French and Italian election campaigns stoked concerns over the rise of anti-euro political powers, while inflation in Germany signaled European Central Bank stimulus may not last much longer. Meantime, Greece, the catalyst for the original crisis, reached another crossroads with its creditors.

“Investors are becoming increasingly concerned that the safety net -- in the form of ECB QE -- is not as strong as perhaps it was previously believed to be,” said Richard McGuire, the head of rates strategy at Rabobank International in London. The "anesthetic" that monetary stimulus used to provide is wearing off as populism emerges as a "far greater threat than anyone had believed it to be," he said.

The domestic factors behind the selloff are a reminder that turbulence in European markets didn’t just begin with the election of U.S. President Donald Trump, whose immigration policies have also rattled markets this week.

Yields on French and Italian bonds climbed to their highest level relative to German debt since 2014 on Monday, while Portuguese securities tumbled. The Swiss franc, a haven currency, headed for its strongest level versus the euro in almost 18 months. Stocks were also infected by concerns over bad loans, while the cost of insuring high-yield debt spiked, and Greek markets retreated.

The rout defied data on Monday that showed an index of executive and consumer sentiment rose to 107.9 in January, surpassing the median estimate in a survey of economists. It’s the highest reading since March 2011.

Inflation Pick-Up

Investors ignored those signs of optimism in part because German inflation neared 2 percent in January, adding credence to the argument that ECB bond purchases, which have largely insulated markets from geopolitical risks since their inception in 2015, may not be a permanent feature. With the pace of stimulus already due to be scaled back this year, a sustained move higher in inflation may make it politically difficult for the central bank to delay.

Monday’s selloff in French bonds was largely triggered by a scandal involving presidential front-runner Francois Fillon, who’s facing accusations that he may have broken the law by employing his wife as a parliamentary assistant. Any retreat in Fillon’s popularity may pave the way for anti-euro nationalist Marine Le Pen.

Italian securities, meanwhile, retreated as a constitutional court opened the way for snap elections that may also herald the rise of populist leadership. UniCredit SpA fell 5.5 percent in Rome after the ECB demanded an improved plan for dealing with bad loans by the end of February.

In Athens, stocks declined to their lowest since Dec. 15 as the government admitted that two-thirds of the actions creditors have demanded for the disbursement of the next tranche of emergency loans have yet to be completed.

Equity markets headed lower in the U.S. as well, with the S&P 500 index on pace for its biggest decline since October as concerns over Trump’s isolationist policies also knocked global risk sentiment.

While the drop in Europe’s riskier assets is redolent of moves during the debt crisis, it also served as a reminder of how far markets have come under the influence of ECB support. Italian 10-year yields at 2.35 percent are at an 18-month high, yet they’re still less than one-third of levels in 2011. Equivalent rates in Portugal and Greece are even smaller fractions of levels since during the crisis.