Havens Thrive as Storms, North Korea Rattle Markets, Charts Show

EghtesadOnline: Threats from fatal Hurricanes and North Korea’s missile program are unnerving investors, prompting them to seek shelter in haven assets.

Buyers have poured into gold, Treasuries and the Japanese yen, even as central banks talk of reducing accommodation and are optimistic on economic growth. These charts track the flight, according to Bloomberg.

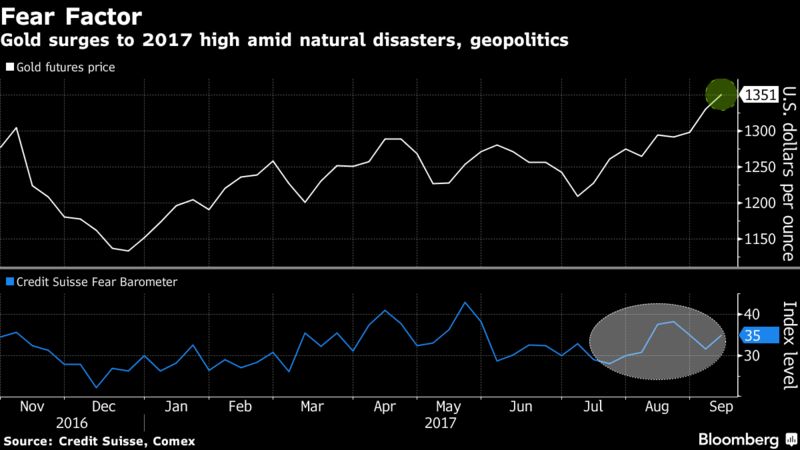

1. Gold’s Ascent

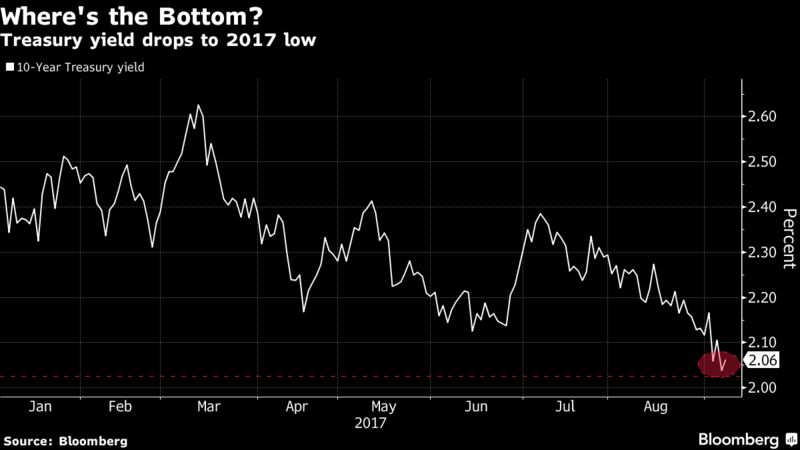

2. Yields Nosedive

Investors have pushed U.S. 10-year Treasury yields to the lowest this year. The drop comes amid uncertainty on whether the damage from Hurricanes Harvey and Irma will slow economic growth and prevent the Federal Reserve from raising interest rates. Traders are pricing in a 25 percent chance of a rate hike this year, down from more than 50 percent in early July. “We’ll have several weeks/months of data distorted by the recent storms,” Ian Lyngen, head of U.S. rates strategy at BMO Capital Markets, said in an email.

3. Saber-Rattling

The Japanese yen strengthened Friday to 107.74 per dollar, the most in almost 10 months, as investors cast a wary eye on U.S.-North Korea tensions. North Korea detonated its sixth and most powerful nuclear bomb on Sunday, and South Korea has said Kim Jong Un’s regime may be planning to launch another intercontinental ballistic missile on Saturday. Markets are vulnerable to a move toward the psychologically important level of 105, according to Nomura Securities.

4. ETFs Rebound

Assets in exchanged-traded funds backed by bullion climbed this week to the highest since June, according to data compiled by Bloomberg. Holdings have risen for five straight weeks, the longest run since April.