Oil Wealth Stimulus Bash in Norway Nearing Tipping Point

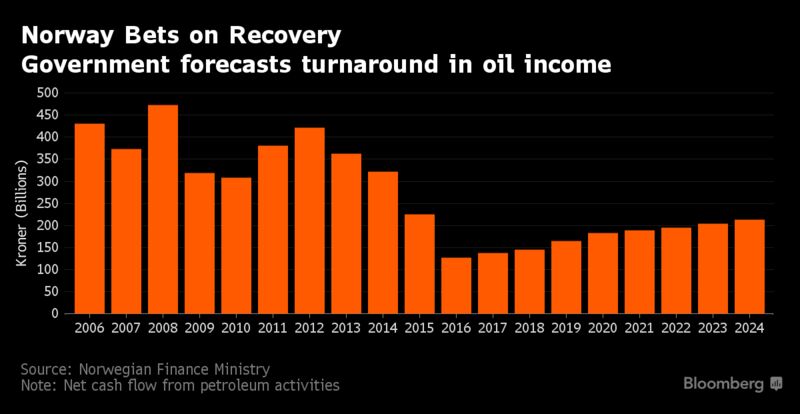

EghtesadOnline: The great Norwegian stimulus engine is gearing down. The growth of Norway’s $910 billion sovereign wealth fund and oil income won’t be enough to keep up with the economy to match previous years’ record stimulus, meaning the mechanism for phasing in oil income will struggle to stay expansionary.

That’s the analysis of the head of research at Statistics Norway, Torbjorn Eika, who’s more than acquainted with the nuts and bolts of the fiscal framework after spending 30 years at the agency. All else equal, a “back-of-the-envelope” calculation shows that the economy of western Europe’s largest oil producer needs petroleum revenue to increase to about 150 billion kroner next year from an estimated 138 billion kroner this year, and increase by 2 percent each year thereafter, just to keep fiscal policy neutral, Bloomberg reported.

“The trend has until now been expansionary and it was a question of how expansionary,” Eika said in an interview at his Oslo office. “Now this turns, but according to our calculations cash flow from petroleum activities will be about the size to keep it going with a neutral fiscal policy.”

How to adjust to a diminished stimulus impulse will be one of the main challenges for the next government after elections in September. The current coalition of Conservatives and the right-wing Progress Party has unleashed record oil cash spending equal to almost 8 percent of mainland gross domestic product this year to keep the economy afloat amid a plunge in oil prices.

But even politicians have realized that this can’t continue, in particular since the plunge in interest rates over the past decade has diminished returns for Norway’s wealth fund. The government, which last year made its first withdrawals from the fund, recently proposed tightening the fiscal spending rule that governs how much oil money should be used, capping the the amount to 3 percent of the fund’s value from 4 percent.

‘Oil Adventure’

While “oil adventure” isn’t over we can’t depend the sector being the main driving force for the economy, Finance Minister Siv Jensen said in a speech in Oslo Thursday.

“Lower oil income will depress inflows to the fund in coming years and give us less room to increase withdrawals,” she said.

But even if oil prices rise more than forecast, the government’s infrastructure and education spending plans then risk being squeezed by a rising krone. That’s because a stronger krone reduces the size of the wealth fund, which is invested abroad.

While the krone has weakened this year, it’s still up about 3 percent from low last year. The price of oil has also rallied 37 percent from an April 2016 low, even though it has recently sold off to about $51 from $57 at the start of the year.

Eika and his colleagues at the statistics agency have drawn up a scenario where the price of oil reaches $70 by the end of this year and stays there until the end of 2020. The outcome of the economic modeling came as a surprise to the economists.

The currency effect will be the strongest at first, shrinking the size of the sovereign wealth fund by 197 billion kroner ($23 billion) in 2018. The effect from higher oil prices won’t compensate for the losses until 2021, according to the economists.

The exercise demonstrate that the government will need to rely on a continued weak currency to avoid breaching its newly proposed 3 percent spending rule.

"Breaching the fiscal spending rule now, after it recently has been proposed amended, it would be very strange when the GDP-gap is closing," Eika said.