China Stock Shakeout Creates Most Divided Market in 15 Years

EghtesadOnline: All Chinese stock indexes are not equal. As Beijing intensifies a campaign to clean up markets and reduce leverage, state-owned enterprises that dominate old growth industries, such as banks and commodity producers, have been among the worst hit, while new-economy shares remain in favor among overseas investors.

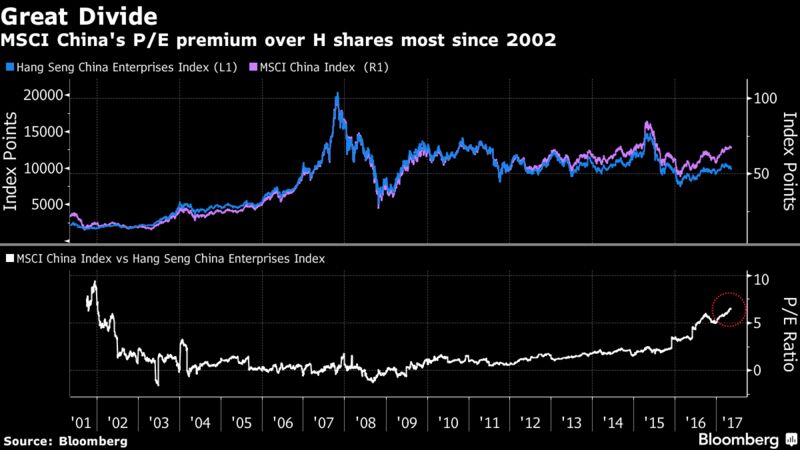

That’s led to a yawning gap between the nation’s two main offshore gauges -- the Hang Seng China Enterprises Index and the MSCI China Index.

The 40-member Hang Seng measure has fallen 2.5 percent over the past month, as the MSCI China advanced 1.4 percent. That’s caused the index of so-called H shares to trade at its biggest discount against its MSCI rival in 15 years -- a split that investors see diverging further, Bloomberg reported.

“The stocks that are listed in the H-share market are typically the more mature, less high growth companies which you would expect to trade at low multiples,” said Richard Titherington, chief investment officer for emerging markets and Asia-Pacific equities at JPMorgan Asset Management in Hong Kong. “I would expect that gap to widen.”

While a lot of the crackdown-motivated selling has hit China’s mainland stock markets, Hong Kong-listed shares succumbed last week, with the H-share measure sliding the most this year.

The declines further exacerbated the split between the H-share index and the MSCI China, a gap that developed as China re-engineered its economy away from heavy industry toward higher-end technologies and the creation of a sustainable domestic consumer base.

Over the past five years, the differentiation in performance between the two indexes has been stark: The Hang Seng China Enterprises Index -- which is almost 90 percent weighted toward financial, energy and industrial shares -- has declined 3.3 percent, while the MSCI China is up 19 percent. Both gauges advanced on Tuesday.

Less Representative

Both indexes were introduced in the mid 1990s, but the 149-stock measure run by MSCI Inc. has diversified its membership beyond Hong Kong listings to include U.S.-traded Chinese shares and is looking at ways to bring mainland-listed stocks into its ranks. Tech has the highest weighting in the MSCI China, at 35 percent.

The divergence is rattling Hang Seng Indexes Co., Hong Kong’s index compiler, which said in March that the H-share gauge had become less representative of China’s market. They proposed widening the scope of member companies, and are consulting market players ahead of an announcement expected in August, said Daniel Wong, head of research at Hang Seng Indexes.

Even if the index changes its constituents, the move still excludes U.S.-listed shares, which has been a large driver for MSCI China, said Philip Li, Hong Kong-based senior fund manager at Value Partners Ltd. Unless the valuation of technology shares start decreasing substantially, it’s unlikely the gap will close between the H share index, he said.

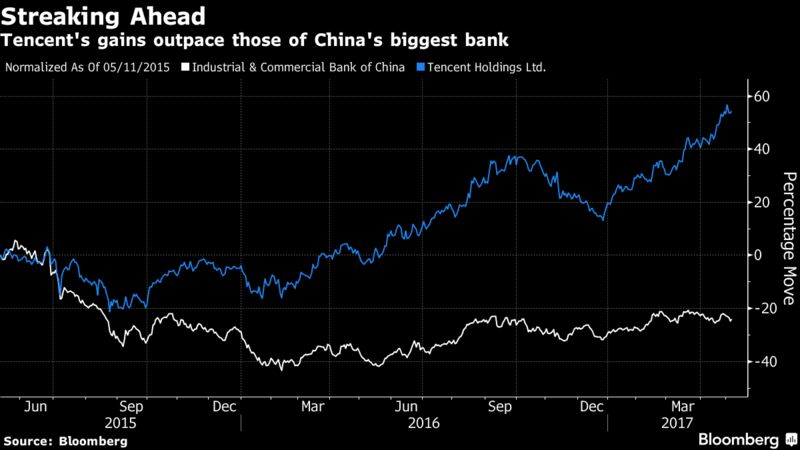

Amid gains of more than 28 percent, consumer-discretionary shares and tech companies have driven the MSCI China’s 16 percent jump in 2017. Internet giant Tencent Holdings Ltd. -- owner of the ubiquitous WeChat mobile messaging and payment app -- rose to a record on May 2, just as last week’s decline in H shares and mainland stocks was getting under way.

Alibaba Group Holding Ltd. is another big gainer that is included in the MSCI China but not in the H-share gauge because it is U.S. listed. China’s top e-commerce company has jumped 33 percent this year, while Hong Kong-traded shares of Industrial & Commercial Bank of China Ltd., the biggest bank and the H-share gauge’s largest weighting, are up just 7.5 percent.

The MSCI China gauge is “heavily geared towards the service and high-tech industry which is fast growing in China,” said Jing Ulrich, vice chairman of Asia Pacific at JPMorgan Chase & Co. in Hong Kong. “Investors have a very strong preference for large new-economy companies which are in the MSCI China Index. The valuation gap will likely remain.”

First-quarter data pointed to further re-balancing away from the old industrial drivers, with the share of economic growth coming from consumption on the increase.

Also, while China’s regulators boost restrictions on lenders to curb debt and rein in shadow banking, the country’s tech companies enjoy the backing of government policy, with the development of artificial intelligence to cloud computing prioritized in Premier Li Keqiang’s work report earlier this year.

Though the run-up in tech shares has some investors -- including Templeton Emerging Markets Group’s Mark Mobius -- calling the MSCI China too expensive, some say the Hang Seng model has had its day.

“How many people really focus predominantly on H shares?” said Ken Wong, a Hong Kong-based fund manager as Eastspring Investments, the Asian asset-management arm of Prudential Plc, the U.K.’s largest insurer. “Maybe five, 10 years ago when all these companies started to list in Hong Kong -- that was a useful time to have an H-share composite index, but now people are going above and beyond.”