Economic Expert Surveys Fiscal 2022-23 Budget

EghtesadOnline: Except from a few key aspects, the fiscal 2022-23 budget bill submitted by President Ebrahim Raisi to the Iranian Parliament on Sunday is not different from the budget proposed by previous governments.

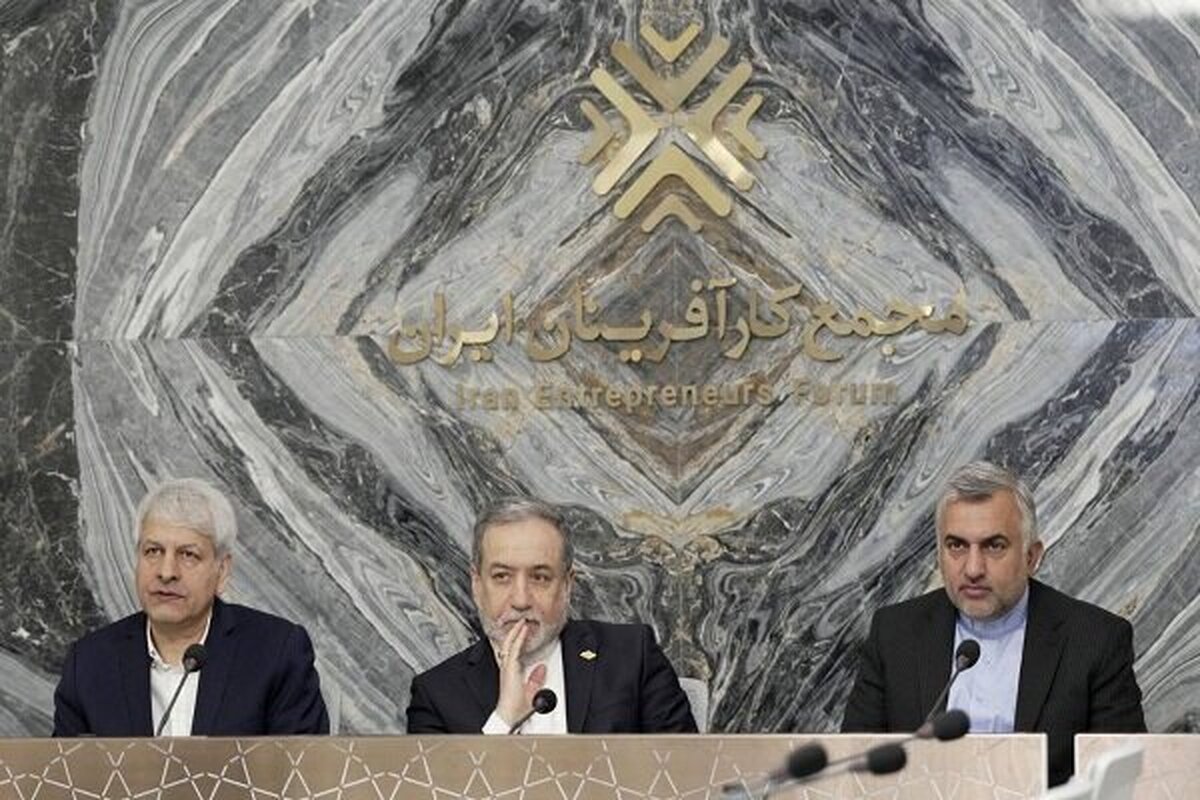

The statement was made by Hadi Haqshenas, an economic expert, in an article published by the Persian daily Arman-e Melli, who stressed that the bill lacks the needed structural reforms. A translation of the article follows:

This budget is the same as those of previous years; you don’t see any structural reforms in it. The new government’s budget is similar to all those of previous governments: resources and expenditures have been specified, tax exemptions or any increase in tax break ceilings have been set and a part of the budget has been allocated to provincial planning councils.

The budgeting process seems to be the same as in the past years. I do not seek to prove or disprove anything; I just want to say that the budgeting process is the same as it was before.

Normally, the budgetary figures increase every year compared with the previous year. The total budget has increased from 28,820 trillion rials [$96 billion at exchange rate of 300,000 rials per dollar] to 36,310 trillion rials [$121 billion], indicating a 26% growth. The budget of governmental companies and for-profit institutions has increased by 42% and the country’s public budget has risen by 9.2%.

Compared with the first ceiling of the current fiscal budget, public resources have increased by 46%, while public resources have grown by 7.4% compared to both the ceilings of the current fiscal budget.

[Projected] customs revenues have risen by 300 trillion rials [$1 billion], suggesting that imports or customs tax and duties will increase next year. Despite criticisms leveled at the previous government for ignoring sanctions and counting on oil revenues, the new government has also envisioned an increase of 300 trillion rials in oil revenues for the next year.

In general, the next year’s budgeting decisions look like the current year’s, except for a couple of key points.

The first point is that the government has seemingly predicted that sanctions will be lifted next [Iranian] year and therefore unlike the current year it will not run a budget deficit in the year ahead [starting March 21]. If the economic climate of the country normalizes, naturally the budgetary figures will materialize. But if, for whatever reason, the revival of the Joint Comprehensive Plan of Action fails, due to this simple reason, the government will have to wrestle with a budget deficit next year just like in the current year.

The second point is that the budget set for government companies and for-profit institutions has grown significantly. In other words, the 40% increase in the budget of these companies is indicative of the fact that their ownership transfer to the private sector or say the enactment of Article 44 of the Iranian Constitution [which calls for privatization of major state-owned companies] will slow down.

Another key point is that the budget of government companies, banks and for-profit institutions exceeds 22,310 trillion rials [$74.36 billion]. This figure indicates both income and expenses [22,310 trillion rials each]. The profit that these companies generate for the government is less than 5%, which is convincing enough to prove that they should be privatized under Article 44 of the Iranian Constitution.

One of the most important developments in next year’s budget bill is an increase of 2,000 trillion rials [$6.6 billion] in tax revenues compared with the current year’s budget. Governments usually collect tax with a delay of one year; businesses did not perform well in the current year, so it is unlikely that such an income will materialize, unless the government removes tax exemptions or increases the tax ceiling and prevents evasion, otherwise a 70% increase in tax revenues will definitely require a more serious mechanism.

Among the new developments in the budget bill is the creation of the so-called “Provincial Fund”; less than a quarter of the 2,510-trillion-rial [$8.36 billion] from the asset ownership budget will be put at the disposal of provincial planning councils. These councils will decide on the allocation of the budget based on the priorities of each province’s projects.