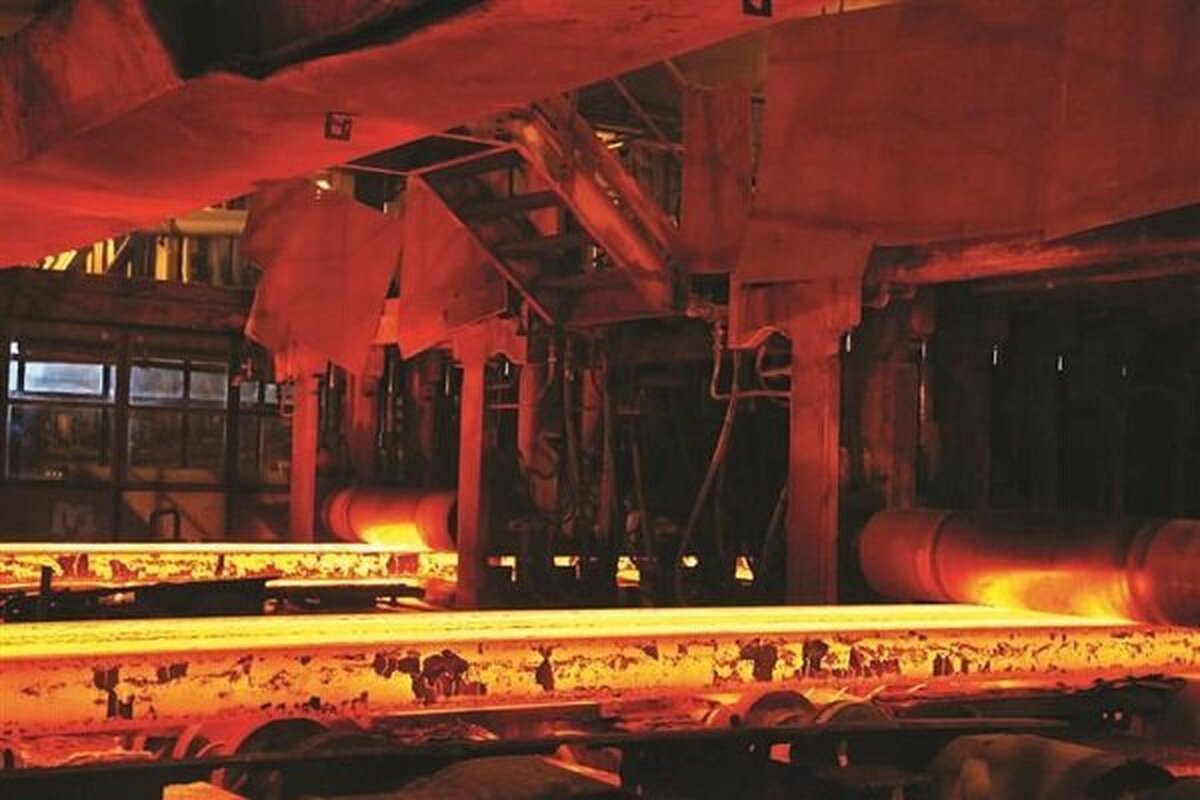

Iran's Steel Output Declines by 10%

EghtesadOnline: A new report by the Iranian Steel Producers Association shows Iranian steelmakers produced a total of 18.53 million tons of semi-finished products during the first eight months of the current fiscal year (March 21-Nov. 21), down 10% year-on-year.

According to ISPA, billet and bloom made up 10.96 million tons of total semi-finished production, down 15% YOY.

Slab output reached 7.57 million tons to register a 2% decline year-on-year.

The output of finished steel decreased by 8% YOY to 12.82 million tons.

Long steel products had a 7.39-million-ton share in the output of finished steel products, posting a 3% decline compared with the similar period of last year.

Rebar production stood at 6.04 million tons (down 3% YOY). It was followed by beams with 808,000 tons (down 6% YOY) and L-beam, T-beam and other types with 542,000 tons (unchanged from the corresponding period of last year).

Production of flat steel with 5.44 million tons registered a 13% YOY decline.

Hot-rolled coil comprised 5.44 million tons in this category, showing a 10% YOY decline, followed by cold-rolled coil with 1.63 million tons, down 10% YOY; and coated coil with 975,000 down 7% compared with last year’s corresponding period.

The output of direct reduced iron stood at 20.07 million tons during the period under review, down 3% YOY.

Power Restrictions

The decline in steel output is mainly due to the power outages and restrictions imposed on steelmakers in the past few months.

The Ministry of Oil and National Iranian Gas Company are putting pressure on steelmakers and mining firms to drastically cut their gas consumption, according to a report by the Persian daily Jahan-e-Sanat.

Specifically, Chadormalu Mining and Industrial Company has been asked to keep its gas consumption to below 30,000 cubic meters per day until further notice. Since the quota is less than 1% of the heavyweight mining firm’s gas consumption under normal conditions, the restriction practically means cessation of production in Chadormalu, inflicting huge losses in lost production.

The report also noted that certain companies have been restricted for longer periods, while others will be less affected.

It went on to say that producers of direct-reduced iron are the prime target of new restrictions due to their energy-intensive nature, adding that since DRI is considered a strategic and key product in the steel industry, the measure will impact the entire steel production chain and lead to a massive decline in output of steel products and rising prices.

With the decline in temperature across Iran, gas consumption in households has set a record high.

According to Oil Minister Javad Owji, daily household gas demand has surpassed 650 million cubic meters, showing a 40% or 140 mcm rise compared with the same period of last year.

The Oil Ministry’s proposal to hike natural gas tariffs in the household sector was recently ratified by the Cabinet, based on which the vital commodity’ price will rise by an average 40%.

The Oil Ministry reportedly compensates the cement producers’ financial loss through discounts in their mazut bills.

This is not the first time that industries, especially steelmakers, are facing power restrictions. In the summer of current fiscal year (June 22-Sept. 22), steel production declined by 40% compared with the previous quarter (March 21-June 22) due to electricity cuts amid record high domestic consumption.

In a letter to the Supreme National Security Council, ISPA has put steel mills’ losses due to power outages at $6 billion from the beginning of the current Iranian year (March 21) to Sept. 12.

According to ISPA, 82 days of production were lost during the period due to power outages and 300,000 direct and indirect jobs were lost or restricted, the news portal of the association reported.

Summer demand led to a severe power and water shortage in summer in most regions, resulting in blackouts and dry taps.

Electricity consumption on June 20 surpassed 62,000 MW.

The new record came as high temperatures nationwide drove general electricity consumption to new heights, prompting authorities to prioritize domestic users over industries in supplying power.

As the manufacture of steel and cement are an energy-intensive process, their factories were restricted by the Iran Power Generation, Distribution and Transmission Company (locally known as Tavanir) and have been only allowed to work at a fraction of their demand during specific hours of the day.

The abrupt ban on the two key sectors created shortages of steel and cement in the local market and prices increased overnight, creating new problems for most construction sectors.

According to Tavanir Spokesman Mostafa Rajabi Mashhadi, electricity restrictions on industries were removed as of Sept. 23.

Noting that Iran is the world’s 10th biggest steelmaker, Vahid Yaqoubi, the vice president of Iranian Steel Association, says due to such power restrictions, the country risks losing its position.

Latest data released by the World Steel Association show Iran’s steel output has declined, yet the country’s world standing remains unchanged.

Iranian steel mills produced a total of 22.4 million tons of crude steel in the first 10 months of 2021, to register a 5.7% decline compared with the corresponding period of 2020.

As per the latest report of the World Steel Association, Iran's October output hit 2.2 million tons, down 15.3% year-on-year.

Despite the decline in output, Iran maintained its global status as the world’s 10th biggest crude steel producer. China was the world’s largest crude steel producer in the 10-month period with 877.1 million tons of steel output, down 0.7% YOY.

It was followed by India with 96.9 million tons (up 20.6%), Japan with 80.4 million tons (up 17.5%), the United States with 71.7 million tons (up 19.6%), Russia with 62.5 million tons (up 5.7%), South Korea with 58.7 million tons (up 5.9%), Germany with 33.6 million tons (up 15.1%) and Turkey with 33.3 million tons (up 14.2%).

Iran is placed after Brazil (ninth) with 30.3 million tons (up 19.1% YOY).

Iranian steel mills produced a total of 29.02 million tons of crude steel in 2020 to register a 13.35% rise compared with 2019, the highest growth in output on the list of the world's top 10 producers.

Yaqoubi also pointed to steelmakers’ export obligations and said producers are often pre-ordered for the next three months and if they cannot supply the required DRI and produce steel, they will suffer massive losses in addition to the loss of their reputation internationally.

According to the official, currently one or two steel production units have encountered gas outages, while other units have been warned and some units have reduced consumption to 50% of their usual demand and some to 3% of their demand, which practically means business closure.

Crude Steel Production Capacity Tops 40m tons

The installed capacity of crude steel production in Iran has exceeded 40 million tons per year, according to a deputy minister of industries, mining and trade.

“Annual production of steel ingots has exceeded 30 million tons,” Vajiollah Jafari was also quoted as saying by IRNA during the 8th Steelprice Conference held recently.

“There are about 36 million tons of direct reduced iron, 66.7 million tons of pellets and 62.7 million tons of [iron ore] concentrate installed capacity in the domestic steel industry, but at the same time we are facing problems in supplying raw materials.”

The official noted that the target capacity of 55 million tons of steel ingots’ goal is expected to be achieved in the fiscal 2025-26, of which 40 million tons have been realized so far and 7 million tons will be added in the fiscal 2021-22.

He also noted that $21.5 billion have been invested in the steel industry, of which $19 billion have been installed.

The required electricity for steel industry is at 8,000-9,000 megawatts, of which 6,000 megawatts are currently in use and a further 12,500 megawatts are required for the development projects, adding that gas is also required to feed steel companies.