Brexit Flashbacks Haunt Traders Bracing for Election Night Chaos

EghtesadOnline: Less than five months after the U.K.’s surprise Brexit vote shook up global markets, traders are scouting the best locations to once again assume the fetal position.

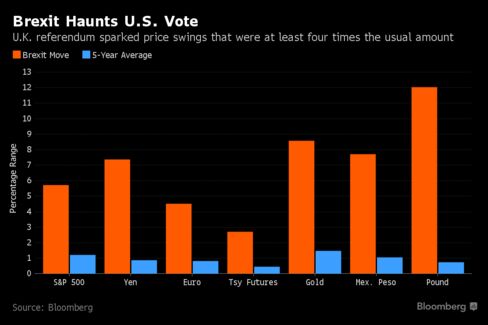

The Nov. 8 presidential election between Hillary Clinton and Donald Trump has trading firms preparing for potential upheaval -- financial, political and personal. They’re boosting staffing, carrying out stress tests and hedging bets in the event of Brexit-style turbulence on Tuesday, reports Bloomberg.

“I’m getting night sweats and flashbacks of Brexit,” said Brian Frank, portfolio manager at Key Biscayne, Florida-based Frank Capital Partners LLC. “I’ve got my bomb shelter ready with battle helmets and water supply.”

All the talk about curling up and hoarding supplies is only a little facetious. From currencies to bonds to equities, volatility is surging. The measure of stock-market fluctuations, known as the VIX, climbed for eight-straight days through Thursday, matching the longest streak on record, while currency and U.S. Treasury volatility were near three-month and seven-week highs, respectively. With polls showing a close race, investors are taking no chances. They’re gearing up for rocky trading.

“Clients demand a lot out of us at times like this, but that’s why we have a game plan,” said Julian Emanuel, executive director of U.S. equity and derivatives strategy at UBS Securities LLC in New York. “We know that customers want to trade, whether picking up the phone or electronically, so we need to be ready.” In the night after the June 23 Brexit vote, Emanuel said he slept for about an hour. For this vote, he said doesn’t expect to turn in until the outcome is clear.

Less Predictable

According to polling, Clinton’s lead over Trump has shrunk in the past week, sparking an attack of nerves among many investors, who view him less favorably. Trump has promised to tear up existing U.S. trade agreements and, partly due to his lack of policy clarity and in some degree because of his temperament, investors perceive him to be less predictable than his Democratic rival.

ICAP Plc plans to double staffing on the customer-support desk for its electronic currency trading platform on election night, according to Darryl Hooker, co-head of ICAP’s EBS BrokerTec Markets unit. The company carries out regular checks of its systems’ capacity, and Hooker said he expects regulators and central bankers will ask for a review of market operations after the election, as they typically do after big events.

In the $5.1-trillion-a-day currency market, the importance of preparing for the unexpected was made plain four weeks ago when the pound crashed 6 percent in a matter of minutes during early Asia trading hours. The plunge in the world’s fourth-most-traded currency followed at least three other bouts of puzzling foreign-exchange turbulence in the past two years, including in South Africa’s rand and New Zealand’s dollar.

Central bankers are also monitoring currency swings closely, with the collapse in the pound after the U.K. referendum still a fresh memory.

It is “not unusual to have volatility ahead of tight presidential elections,” Bundesbank board member Andreas Dombret said in a interview with Bloomberg Television’s Anna Edwards and Yousef Gamal El-Din. He said volatility bouts would not compare in size to the ones seen after the Brexit vote in June.

Fastmatch Inc., a New York-based foreign-exchange-trading venue, said its key staff will toil on election night and hotel rooms will be ready in case personnel are needed back at work early Wednesday. Anticipating greater volatility, the company has widened trading bands on its system to allow for a bigger range of bids or offers around a midpoint price.

Bloomberg LP, the parent company of Bloomberg News, also runs currency-trading platforms.

Bigger Deposits

Retail brokers FXCM Inc., London Capital Group and Saxo Bank A/S are temporarily increasing margin requirements on major currency pairs, asking customers to set aside bigger deposits in order to trade in markets that are likely to be more volatile.

Traders are also monitoring and adjusting positions. Sinead Colton, San Francisco-based head of investment strategy at Mellon Capital Management Corp., has stress-tested her portfolios and is using options to hedge against abnormally large price moves. Andy Maack, head of foreign-exchange trading at Vanguard Group Inc. in Malvern, Pennsylvania, uses limits on algorithmic orders to protect against runaway price moves.

“Our counterparties are concerned about potential thinness of liquidity,” said Paul Lonsdale, a partner at Lucid Markets LLP, a currency market maker in London. “We expect turbulent markets given that the election is in play.”

Kevin Giddis, head of fixed income at Raymond James & Associates, said he isn’t taking big positions before the vote and will stay at a hotel near his office in Memphis, Tennessee, ready to return to work at a moment’s notice.

“We’re not going to bet anything on election night,” Giddis said. “I’ll be in the fetal position in a corner somewhere hoping it’s going to be over soon.”