Bank Stocks Propel Global Equity Gains as Yen Slides With Crude

EghtesadOnline: Stocks climbed, boosted by a rally in financial shares, amid optimism that the European Central Bank will this week commit to prolonging its bond-buying program. Crude and the yen extended losses, while Australia’s dollar fell after a report showed the economy shrank by the most since 2008.

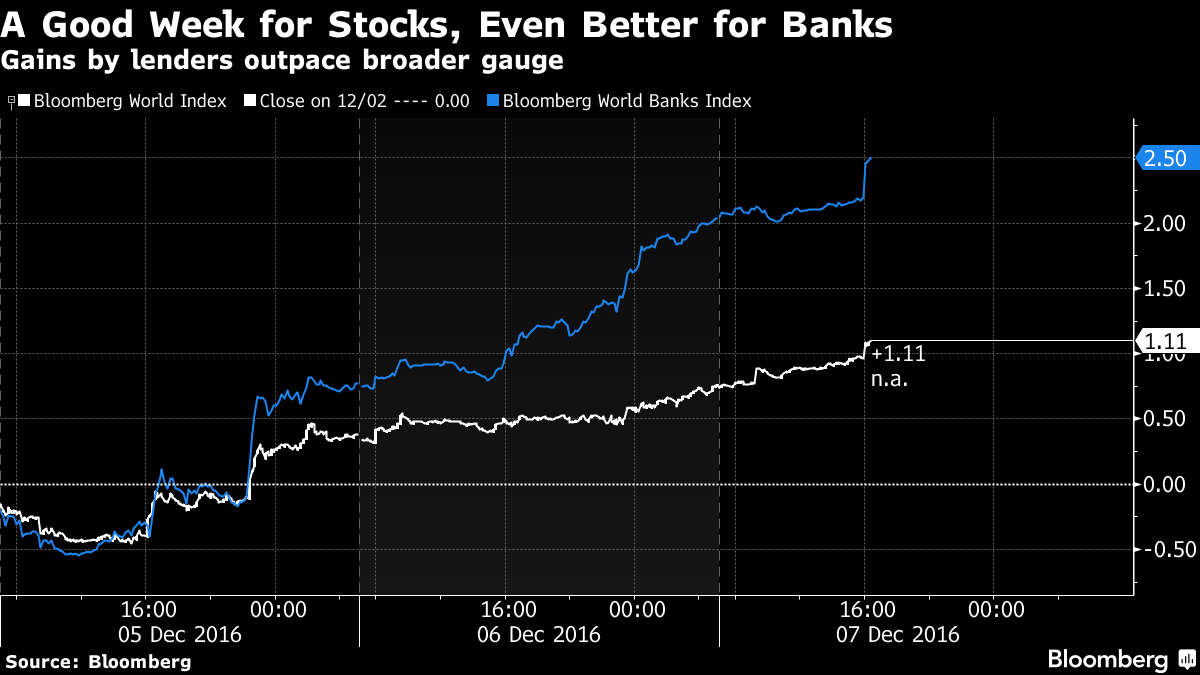

European equities advanced for a third day, with the Bloomberg World Banks Index trading at the highest level in more than a year. The Topix index rose in Tokyo as Japan’s currency weakened past 114 per dollar. Crude continued its slide below $51 a barrel after retreating Tuesday to end gains spurred by OPEC’s output deal. The Aussie declined after the statistics bureau said third-quarter gross domestic product decreased 0.5 percent from the prior quarter, the first contraction since 2011. Copper and zinc swung to gains as sentiment on metals was boosted by a surge in China’s steel futures market, Bloomberg reported.

More than $1.5 trillion has been added to the value of global equities in the past month amid speculation U.S. President-elect Donald Trump will stoke inflation, driving the Dow Jones Industrial Average to a record and sending bond yields surging as money poured out of fixed-income assets. Investors are also betting European monetary policy will remain accommodative, with most economists in a Bloomberg survey predicting the ECB’s two-day session will culminate in a decision to prolong asset purchases after March at the current monthly pace of 80 billion euros ($86 billion) for about six months.

“This stabilization story in Europe and further stimulus from the ECB will be bullish for equities,” said James Woods, Sydney-based analyst at Rivkin Securities, a brokerage. “The minimum we’re expecting is for the ECB to announce a six-month extension.”

Analysts forecast the Reserve Bank of India will cut its key interest rate on Wednesday. China reported foreign reserves of $3.05 trillion at the end of November, the steepest monthly decline since January.

Stocks

- The Stoxx Europe 600 Index added 0.5% as of 8:18 a.m. in London as mining companies and banks rallied, with Credit Suisse Group AG climbing 3.8% after announcing cost cuts

- Japan’s Topix index gained 0.9% in Tokyo. Softbank Group Corp. jumped 6.2% after Chief Executive Officer Masayoshi Son told Trump he would create 50,000 new jobs in the U.S. through a $50 billion investment in startups and new companies

- The MSCI Asia Pacific Index added 0.4%

- Futures on the S&P 500 Index were little changed after the measure posted a 0.3% advance on Tuesday. The Dow Jones Industrial Average rose 0.2 percent to close at another record

Commodities

- West Texas Intermediate crude dropped 0.7% to $50.55 a barrel, after falling 1.7 percent the previous session

- Copper gained 0.5%, swinging from an 0.6% decline. Steel rebar in China climbed with iron ore to the highest in more than two years, as reports of a crackdown on illegal plants spurred speculation that the government is stepping up supply-side reforms

- Spot gold was little changed at $1,169.77 an ounce

Currencies

- The Australian dollar traded as low as 74.17 U.S. cents before paring its drop to 0.3%. The GDP report, which showed government spending fell and imports rose, spans a period when Australia’s election returned Prime Minister Malcolm Turnbull with a razor-thin majority and government spending and resource exports failed to lift growth. The Reserve Bank of Australia on Tuesday kept interest rates unchanged and Governor Philip Lowe said “some slowing in the year-ended growth rate is likely.”

- The Bloomberg Dollar Spot Index, which tracks the greenback against 10 major peers, added 0.1%

- The yen weakened 0.2% to 114.25 per dollar

- The pound dropped 0.5%, after touching a two-month high on Tuesday, as a case in Britain’s highest court over the triggering of Brexit continues.