Dollar Halts Fed-Driven Rally as Asian Stocks Rise With Gold

EghtesadOnline: The dollar halted its weekly climb as investors weighed whether the currency’s surge amid the fallout from Wednesday’s Federal Reserve meeting had gone too far. Asian stocks advanced with gold.

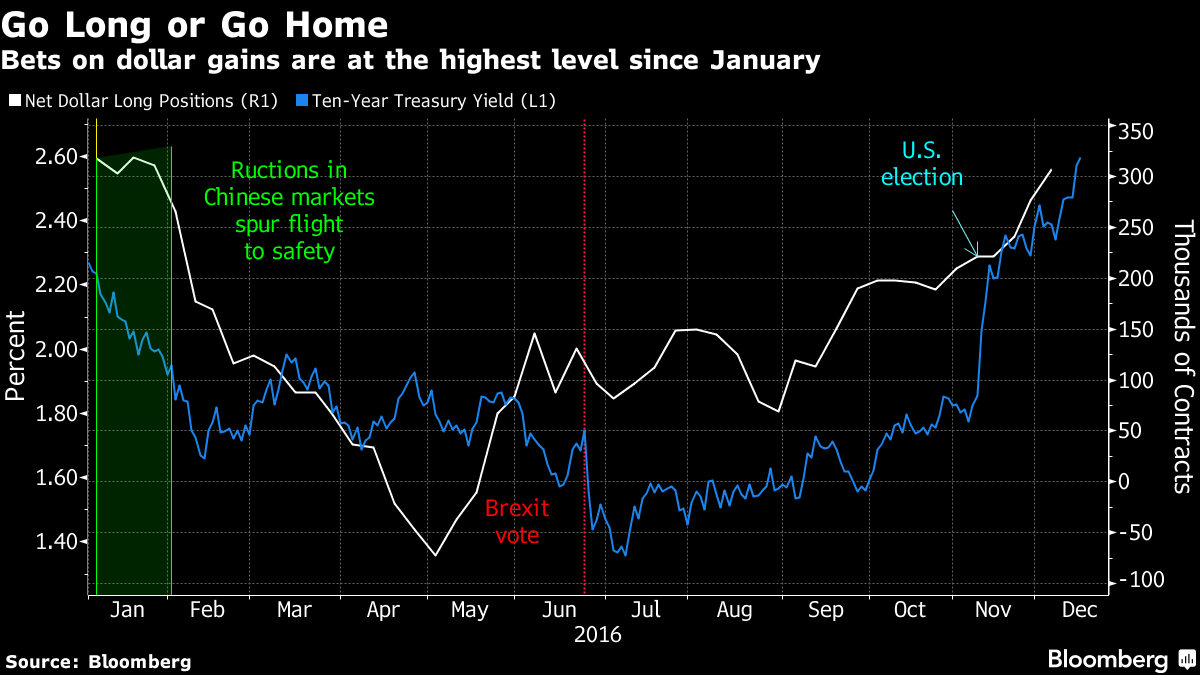

The greenback fell against most major peers, slipping 0.3 percent against the euro after jumping to the strongest since 2003. Asian equities pared some of their weekly drop while European stocks were little changed in early trading. The yield on Treasuries due in a decade fell from a two-year high, snapping a six-day rising streak underpinned by the Fed’s more hawkish outlook for interest-rate increases next year. Gold trimmed its sixth weekly decline, according to Bloomberg.

The Fed’s pivot toward hawkishness marks a shift away from central-bank policy dominating market sentiment, with the potential for an increase in fiscal stimulus now in focus. While stocks have rallied and debt has tumbled since Donald Trump’s election as U.S. president fueled bets on an uptick in spending, the Fed stands largely alone in actively tightening policy, fueling the dollar’s surge. The Bank of England kept its key rate at a record low Thursday, a week after the European Central Bank extended quantitative easing.

“The dollar weakness is just temporary in an otherwise very eventful week for the greenback,” said Qi Gao, a Singapore-based foreign-exchange strategist at Scotiabank. “It’s not a turnaround in the trend and we still expect the dollar to continue to strengthen.”

Stocks

- The Stoxx Europe 600 Index were little changed as of 8:24 a.m. in London, up 0.9 percent for the week.

- The MSCI Asia Pacific Index rose 0.2 percent, reducing its decline in the week to 1.8 percent, the worst weekly performance since September.

- The Topix gained 0.5 percent, bringing its sixth straight weekly advance to 1.7 percent and erasing its loss for 2016.

- China’s Shanghai Composite Index rose 0.2 percent, trimming its biggest weekly drop in eight months.

- New Zealand’s S&P/NZX 50 Index added 0.2 percent, snapping a five-day retreat and trimming its weekly decline to 1.9 percent.

- The S&P 500 Index ended last session up 0.4 percent after sinking the most since October after the Fed’s statement on Wednesday.

Currencies

- The dollar slipped 0.3 percent to $1.044 per euro after climbing to as high as $1.0367 Thursday, its strongest level since January 2003.

- The yen traded at 118.27 yen per dollar, set for a slump in the week of 2.6 percent, its sixth straight weekly drop.

- The Korean won fell for a third day, losing 0.5 percent.

Bonds

- Rates on Japanese bonds due in a decade advanced as much as 1 1/2 basis points to 0.10 percent. The benchmark’s yields gave up the earlier increase to trade at 0.08 percent.

- Yields on Treasury notes due in a decade were down two basis points at 2.58 percent, set for their steepest weekly advance in a month after touching their highest level since September 2014.

Commodities

- West Texas Intermediate crude was little changed at $50.91 a barrel, on track for a 1.2 percent weekly decline

- Gold for immediate delivery gained 0.5 percent to $1,133.58 an ounce