Turkey's Lira Strengthens as Erdogan Victory Sparks Relief Rally

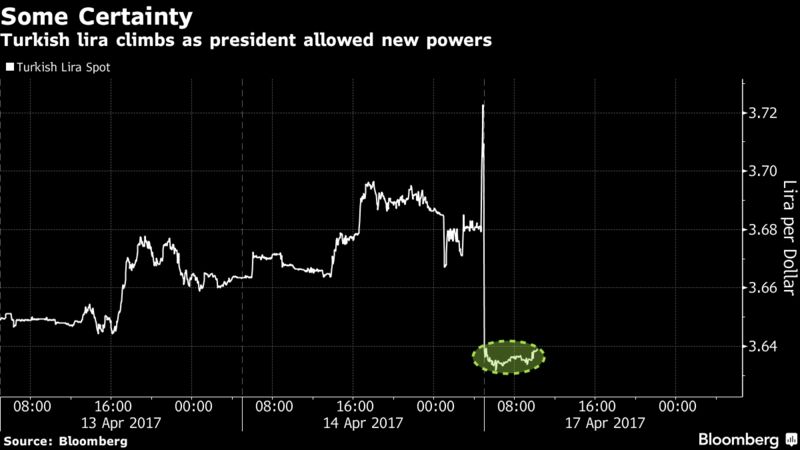

EghtesadOnline: The lira jumped as Turkey voted to endow President Recep Tayyip Erdogan with vast new executive powers, in a narrow referendum victory that may rekindle interest in 2017’s worst-performing emerging-market currency.

The lira surged as much as 2.5 percent to 3.6188 per dollar in the first minutes of Monday trading in Istanbul, its biggest intraday gain since Jan. 30. Voters approved a set of constitutional amendments that give Erdogan greater sway over policy, including the authority to appoint ministers and top judges at his discretion, according to Bloomberg.

Many investors see the victory as removing one source of uncertainty they have to juggle, after a failed coup attempt last summer, credit-rating downgrades and the lira’s slump to a record hurt appetite for the nation’s assets. Pollsters had forecast a victory margin as slim as the final tally, which according to state-run Anadolu Agency indicated a 51.4 percent share for the “Yes” camp.

“I expect Turkish markets to rally as the knee-jerk reaction, then to try and appraise what this now means for policy, economic policy and also relations with key allies, including the EU and U.S.,” said Tim Ash, a senior emerging-market strategist at Bluebay Asset Management LLP in London.

The president urged foreign countries to respect the decision, even while his opponents inside the country voiced complaints about the fairness of the poll. In his victory speech, Erdogan appeared to rule out the early elections that some observers had feared, but said he’d consider holding a second referendum to reinstate the death penalty, which was abolished in 2004 as a precondition to European Union accession. On the campaign trail he had vowed to “reassess” the country’s relationship with Europe when the vote was over.

Accession Talks

After the result, Kati Piri, the European Parliament’s Turkey rapporteur, said accession talks would be suspended if the referendum package is implemented in its current form. “It is clear that the country cannot join the EU with a constitution that doesn’t respect the separation of powers and has no checks and balances,” she said in a statement on her website.

The two main opposition parties voiced their objections to the count, which was reported exclusively by state-owned news after the other agency that used to report on Turkey’s elections was closed down in the post-coup crackdown. The deputy head of the largest opposition bloc said the news agency was “manipulating” results as it announced them, and promised -- along with other opposition parties -- that it would contest the vote at the election board.

Responding to the allegations of wrongdoing, the head of that authority said official results would be announced within 12 days but that “Yes” was conclusively ahead with a margin above a million votes.

Rebound Predicted

The dispute appeared to matter little to foreign investors, who are predicting a rebound for Turkish assets after a poor start to the year that saw the lira weaken more than any emerging-market counterpart. The currency is still down 3.2 percent in 2017. In the run-up to the vote, traders had been hedging against the prospect of wide price swings, especially while the closure of European markets on Monday drains liquidity.

While investor positioning was already skewed toward a “Yes” vote, the lira could appreciate by up to 2-3 percent over the next month, and outperform peers such as the South African rand or even the Indian rupee, UBS analysts including Manik Narain wrote in a report before the vote.

Still, the focus is likely to quickly turn to the central bank’s next meeting, scheduled for April 26, “especially if depreciation pressure on the currency eases after the referendum,” Turk Ekonomi Bankasi’s Erkin Isik wrote this month. The lira has been one of the most volatile currencies in emerging markets. With inflation running at more than double the central bank’s target, investors will be looking for signs that the monetary authority will keep funding constrained.

Under Fire

Policy makers came under fire from investors earlier this year for not raising borrowing costs fast enough in the face of political pressure from Erdogan, even as markets priced in higher U.S. rates immediately after Donald Trump’s victory. In a bid to stem a run on the currency the central bank ended up raising borrowing costs by over 300 basis points, making the lira the highest-yielding currency among emerging markets after the Argentine peso.

Those higher rates have since stabilized the currency and helped lure foreign investors back into the nation’s debt markets. Offshore funds bought a net $487 million of lira-denominated bonds in the week ended April 7, according to central bank data published last week. That was a fifth week of inflows from non-resident funds, as their share in the bond market rebounds from a five-year low.