Wages Shape Up as Key to Abenomics and the Future of Abe Himself

EghtesadOnline: To shore up his ailing premiership, Shinzo Abe is vowing to focus on the economy. But instead of unleashing yet more stimulus, analysts say Abe needs to take a hammer to an old chestnut: moribund wage growth.

Facilitating salary increases would boost household income, and for Abe, help convincean increasingly skeptical electorate that his eponymous economic policies are working for them. The problem is, employers remain reluctant to boost pay despite record-low unemployment and bumper profits, according to Bloomberg.

Facing two days of questioning along with aides over allegations of cronyism, Abe on Monday signaled a renewed focus on the economy and the quest to raise wages. Failure on that front has left the Bank of Japan shouldering the burden with unprecedented stimulus and still years away from meeting its 2 percent inflation target.

"Abe needs to focus on economic policy to win support back," said Akihiko Noda, senior principal researcher of Mizuho Research Institute. "That will definitely help."

The International Monetary Fund says labor market reforms to boost productivity and wages are the "first priority" of Abenomics’ structural reform agenda. The Washington-based fund recommended raising "administratively controlled wages," such as civil servants’ pay, in line with the inflation target and incentivizing profitable companies to boost wages by at least 3 percent per year.

Indeed, conditions in Japan appear to be ripe for higher wages. Companies are sitting on massive stockpiles of cash, and they marked their most profitable quarter on record during the three months ending December 2016. Unemployment is at 3.1 percent, the lowest among G-7 countries, and the jobs-to-applicants ratio is at the highest point in more than a quarter century.

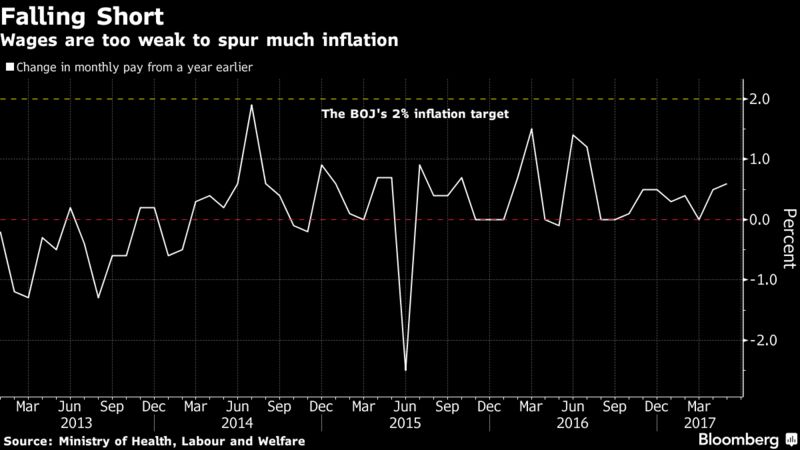

Yet -- just as in other big developed economies including the U.S., U.K. and Germany -- all that labor market tightness is failing to translate into wage inflation. Year-over-year measurements of real wages fell from 2012 to 2015, and grew just 0.7 percent in 2016, according to data from the labor ministry.

Scar Tissue

Part of the problem for Japan is a legacy from the country’s economic crash in the early 1990s. In the years that followed, workers accepted lower salaries to secure their job, weakening their negotiating positions, according to the Annual Report on the Japanese Economy and Public Finance 2017 published last week by the Cabinet Office.

The Abe government’s basic economic policy document for 2017 notes the importance of "equal pay for equal work," and raising Japan’s minimum wage. The former refers to efforts to equalize pay between regular and non-regular workers who perform the same jobs. On the latter, the administration is sticking to a goal of achieving a weighted average minimum pay of 1,000 yen per hour across the country.

And wages have crept upward, rising 0.6 percent in May from a year earlier. But that’s not enough to spur the 2 percent inflation sought by the BOJ, and nor is it enough to make households feel better off. A poll by the Cabinet Office in August 2016 found that 49.6 percent of respondents were dissatisfied with their income.

Politically, that’s adding to the slide in approval for Abe’s cabinet, which sank to 26 percent -- the lowest since he took office in 2012 -- in a poll conducted by the Mainichi newspaper over the weekend. Abe on Monday reiterated denials of accusations of cronyism, which have eaten away at his support.

"With Japanese administrations, scandals accumulate like barnacles, and Abe needs to get ahead of that narrative with new initiatives, most of which will be tangential to the economy," said Douglas Paal, a vice president at the Carnegie Endowment for International Peace. "The Bank of Japan has done and is still doing all it can responsibly to stimulate growth."

The sinking ratings are also a warning that the public remains to be convinced by Abenomics and that a reliance on fiscal and central bank policies isn’t enough, said Martin Schulz, an economist at the Fujitsu Research Institute in Tokyo.

"Japan’s electorate is aware of the lack of economic reforms and realizes the risks of an exhausted monetary policy," he said.

That means cracking the wages conundrum will prove vital if Japan is ever to wean itself off the unprecedented monetary stimulus unleashed by the central bank.

"Without robust wage growth, inflation will remain stuck a long way from the central bank’s 2 percent target and Japan’s debt burden will remain unsustainably high," said Adair Turner, Chairman of the Institute for New Economic Thinking and a former U.K. Financial Services Authority Chairman. "So either we solve the wage puzzle, or we accept that extremely unconventional monetary policy will have to be applied forever."