Most Asian Stocks Rebound as Korean Fears Abate

EghtesadOnline: Most Asian stocks advanced after President Donald Trump’s measured response to North Korean missile launches and comments from Kim Jong Un suggested geopolitical tensions will ease off. The yen fell for a second day.

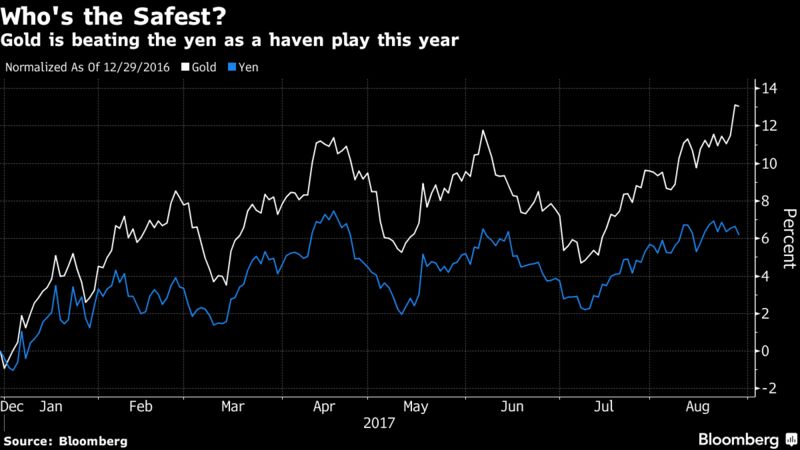

Equity indexes in Japan, South Korea and Hong Kong gained after U.S. stocks rebounded from losses initially sparked when Kim’s regime fired a missile over Japan. The yen rallied on Tuesday as safe havens advanced, only to more than give up those gains as investors speculated the event won’t flare up. The Australian dollar outperformed its developed-market peers after construction and building approvals data beat estimates and copper approached a three-year high. Bond yields rose as risk assets came back in favor and gold held at the highest level this year, Bloomberg reported.

Asian markets were roiled on Tuesday after North Korea fired a ballistic missile over Japan in an act the latter called an “unprecedented, grave and serious threat.” Trump said the U.S. will consider “all options” in its response. Kim said Wednesday the missile was in protest at annual military exercises between the U.S. and South Korea. That suggests the standoff is unlikely to intensify and, coupled with Trump’s tempered remarks, helped underpin risk assets.

“We’ve seen the typical reaction that you would expect yesterday, with the safe haven assets like the yen gaining and the Korean won obviously weakening and equity markets in this region selling off,” Khoon Goh, Australia & New Zealand Banking Group Ltd.’s head of Asia research, said in a Bloomberg Television interview. “What’s interesting is that the reaction has been fairly muted and a lot of the moves have largely reversed and I think it’s a case now where what’s happening with North Korea is not necessarily new.”

Among other key events looming this week:

- Inflation data from the euro zone’s largest economies this week may show prices nudged up in August.

- The U.S. updates second-quarter GDP and core price data on Wednesday, and reports on August payrolls on Friday.

And here are the main moves in markets:

Stocks

- The Topix index rose 0.5 percent as of 12:30 p.m. Tokyo time and the Kospi index edged higher. Australia’s S&P/ASX 200 Index swung between gains and losses. Read here why the Aussie equity market can’t catch a break.

- The Hang Seng Index in Hong Kong rose 0.8 percent, while the Shanghai Composite Index was little changed.

- Contracts on the S&P 500 Index climbed 0.1 percent. The cash gauge finished Tuesday 0.1 percent higher.

Currencies

- The yen was down 0.1 percent at 109.77 per dollar after dropping 0.4 percent.

- The Bloomberg Dollar Spot Index fell 0.1 percent, close to its lowest in more than two years.

- The Aussie dollar jumped 0.5 percent to 79.96 U.S. cents.

- The euro was steady at $1.1979, after touching the strongest in almost three years.

Bonds

- The yield on 10-year Treasuries rose two basis point to 2.15 percent. It dropped as low as 2.08 percent on Tuesday, the least in 10 months.

- Australian 10-year note yields advanced five basis points to 2.68 percent.

Commodities

- West Texas Intermediate crude fell 0.3 percent to $46.31 a barrel.

- Gold was at $1,312.93 an ounce after reaching the strongest level in 11 months.

- Gasoline for September delivery rose 3.2 percent to $1.8405 a gallon and is up more than 9 percent this week.