Stocks Fall, Bonds Rally Amid Korea, Irma Threats

EghtesadOnline: U.S. stocks slipped while Treasuries rallied the most in 10 months as tensions with North Korea mounted and another Atlantic hurricane threatened to make landfall.

According to Bloomberg, the Dow Jones Industrial Average fell 234 points at the start of a week packed with central-bank decisions, Federal Reserve speakers and economic data that will help illuminate the path of the global economy. The S&P 500 Index dropped the most since Aug. 17, ending a six-day rally. Ten-year Treasuries climbed amid lingering unease over North Korean plans for a ballistic missile launch, while Hurricane Irma threatened a region already dealing with the devastation from Harvey.

Big economic news still awaits. Mario Draghi may give more clarity on paring the European Central Bank’s bond-buying program when he speaks after a rates decision on Thursday. U.S. durable-goods figures, the trade balance, unemployment claims, and the release of the Fed’s Beige Book will add to the global data mix after a purchasing managers’ index Tuesday indicated the euro area is poised for the fastest economic expansion in a decade.

Meanwhile, U.S. President Donald Trump agreed to support billions of dollars in new weapons sales to South Korea after North Korea’s largest nuclear test, while his ambassador to the United Nations said America would seek the strongest possible sanctions against Kim Jong Un’s regime. Tensions escalated after Asia Business Daily reported North Korea was preparing to fire an ICBM.

The key events coming this week:

- Among other economic numbers out of China, trade figures are anticipated to show another month of solid export growth, while FX reserves probably continued to rise on stricter capital controls, robust growth and a stronger yuan, according to Bloomberg Intelligence.

- Other Fed speakers this week include New York Fed President Bill Dudley and Dallas Fed President Robert Kaplan.

- The European Central Bank meets on Thursday. Draghi will express concern over the euro’s strength, but won’t say much about his asset-purchase program’s future, according to a survey.

And here are the main moves in markets:

Stocks

- The S&P 500 Index sank 0.76 percent to 2,457.85 as of 4:12 p.m. in New York. The Dow lost 1.1 percent.

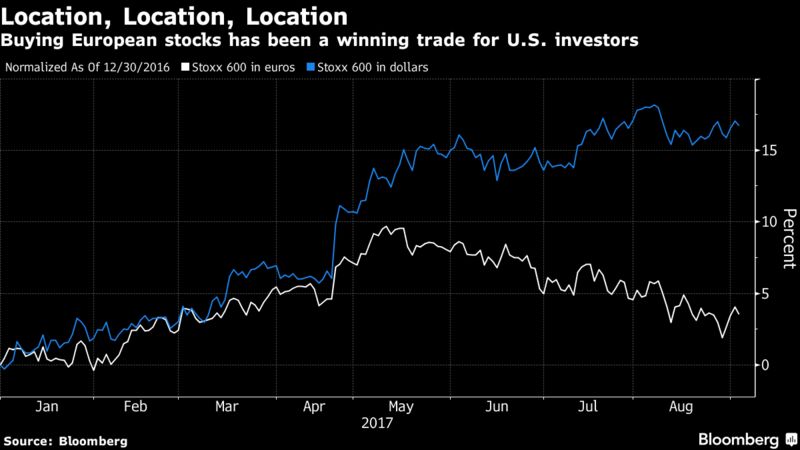

- The Stoxx Europe 600 Index dipped 0.1 percent.

- The U.K.’s FTSE 100 Index declined 0.5 percent.

- Germany’s DAX Index climbed 0.2 percent.

Currencies

- The Bloomberg Dollar Spot Index declined 0.3 percent to 1,147.87, the lowest in more than two years.

- The euro increased 0.2 percent to $1.1914.

- The British pound gained 0.8 percent to $1.303, the biggest jump in over seven weeks.

- The Japanese yen climbed 0.8 percent to 108.87 per dollar, the strongest in almost 20 weeks.

Bonds

- The yield on 10-year Treasuries fell 10 basis points to 2.07 percent.

- Germany’s 10-year yield declined three basis points to 0.34 percent.

- Britain’s 10-year yield fell three basis points to 1.026 percent.

Commodities

- Gold increased 0.4 percent to $1,338.97 an ounce, the highest in a year.

- West Texas Intermediate crude rose 2.7 percent to $48.57 a barrel.

- Copper increased 0.3 percent to $3.13 a pound.

Asia

- Japan’s Topix index fell 0.8 percent at the close, while South Korea’s Kospi index lost 0.1 percent. Australia’s S&P/ASX 200 Index rose 0.1 percent.

- Hong Kong’s Hang Seng Index fluctuated with indexes higher in China and Singapore.

- The MSCI Asia Pacific Index edged higher. It slid 0.6 percent on Monday, the steepest drop since Aug. 11.