Risk-On Trade Lifts Oil, Rand at Dollar Detriment

EghtesadOnline: The dollar fell against higher-yielding peers while U.S. stock futures rose with commodities, as an optimistic start to 2017 spread to emerging-market currencies.

South Africa’s rand and Brazil’s real were among the biggest beneficiaries of returning appetite for risk. S&P 500 Index futures suggested a second day of gains in the benchmark guage. Oil recouped some of the previous day’s slump while aluminum and nickel climbed. Perceived investment-grade credit risk slid to the lowest in almost four months, Bloomberg reported.

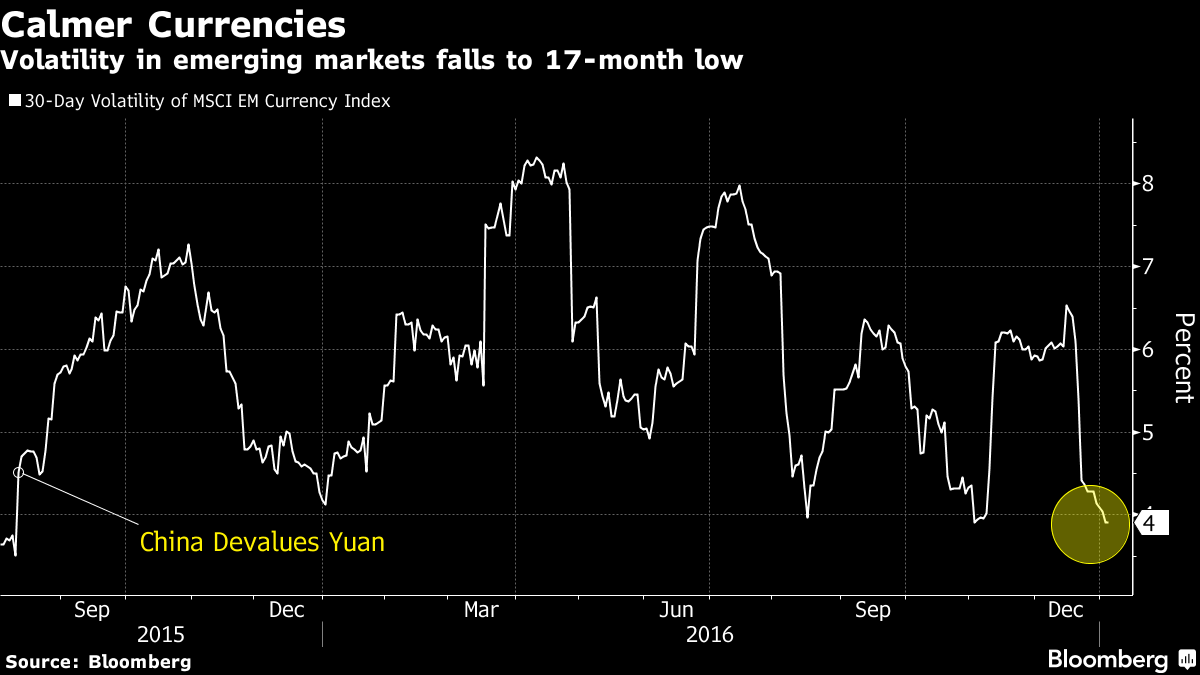

With near-zero rates stifling returns in much of the developed world, emerging markets are a buy for BlackRock Inc. Price swings on the MSCI gauge of developing nations are at their narrowest since August 2015. The optimistic mood could be upset should minutes of the Federal Reserve’s last meeting signal an accelerated path to higher rates when they are released later.

“The year has started with a stream of good macro stories which has justified a risk on position with investors,” said Andrew Milligan, head of global strategy at Standard Life Investments Ltd. in Edinburgh. He favors stocks and bonds of developed countries poised to benefit from a reflating U.S. economy that will boost the dollar over emerging markets.

Currencies

- The rand strengthened 1.5 percent as of 8:37 a.m. in New York, the most among 24 emerging market currencies tracked by Bloomberg. The real gained almost 1 percent.

- China’s yuan rose 0.8 percent in offshore trading on speculation of contingency plans by the government to support the yuan and curb capital outflows.

- The U.S. Dollar Index was 0.4 percent lower after touching its highest level since at least 2005.

- The euro rose 0.3 percent in its first gain against the dollar this year after the region’s inflation accelerated in December at the fastest pace since 2013.

- Citigroup Inc. strategists said in a Jan. 3 note to clients that “Russia and South Africa could be outperformers” in developing Europe, “but it might still be a bumpy ride for EMFX as the relatively hawkish FOMC signal from mid-December permeates.”

Commodities

-

Crude oil futures climbed as much as 1.2 percent in New York after tumbling 2.6 percent Tuesday.

- Gold was up 0.5 percent after jumping 1 percent in New York Tuesday while copperjumped 1.5 percent.

Stocks

- S&P 500 futures added 0.1 percent, as did contracts on the Dow Jones Industrial Average.

- The Stoxx Europe 600 Index fell, dragged down by declines on retailers. Next Plc tumbled 11.9 percent after cutting its annual profit forecast and forecasting a difficult year ahead.

Bonds

- U.S. Treasury notes due in 2026 edged lower, with the yield up two basis points to 2.46 percent.

- European bonds were mixed after the inflation data, with 10-year bund yields at 0.25 percent.

- The cost of insuring highly rated corporate debt against default dropped to the lowest since Sept. 9. The Markit iTraxx Europe Index of credit-default swaps on investment-grade companies declined one basis point to 69 basis points. A gauge of swaps on high-yield companies fell two basis points to 280 basis points, the lowest since July 2015.