The Oil Trade Showing Where OPEC’s Cuts Are Starting to Bite

EghtesadOnline: As OPEC starts to make its production cuts work, the true impact of its actions is perhaps most in evidence in an obscure part of the physical oil market.

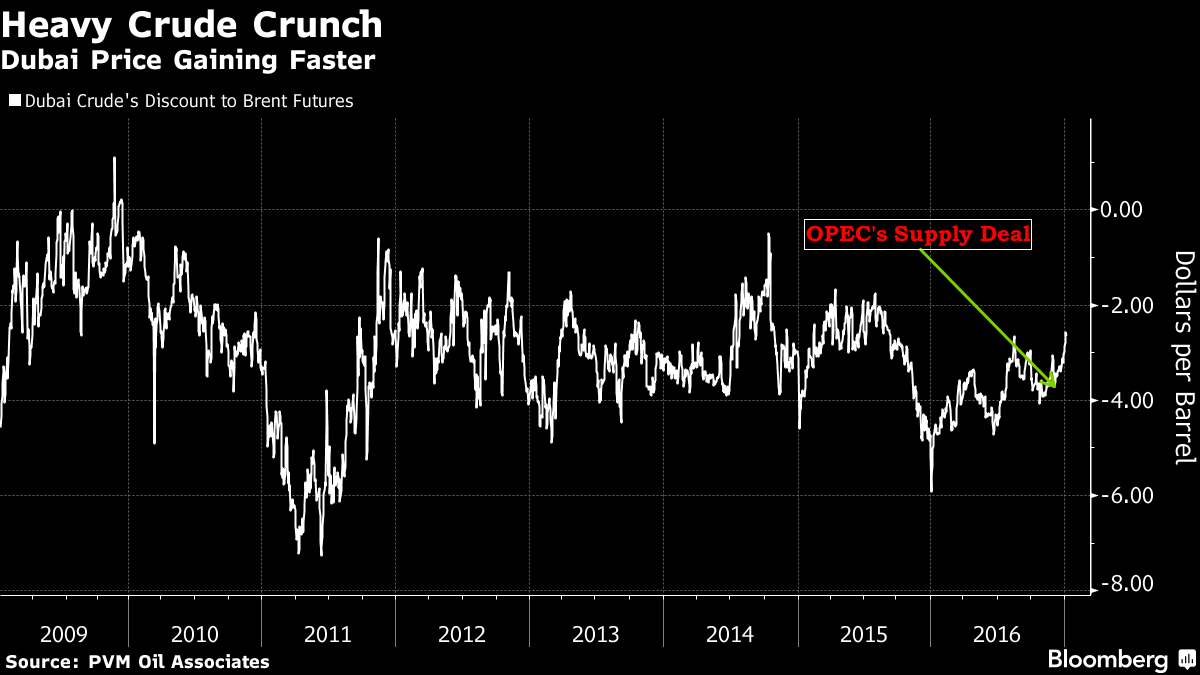

While Brent futures, a benchmark based on North Sea supply, are trading about $4 a barrel higher than their peak in June, the price of cheaper Middle East crude is rising faster still. The gap between the two varieties -- now the smallest in 15 months -- reveals where buyers are experiencing the greatest supply restrictions. It also has the potential to influence where oil flows.

According to Bloomberg, Saudi Arabia and its neighboring countries mostly pump lower quality oil, known in the industry as heavy crude. So when production from Organization of Petroleum Exporting Countries drops, the price difference -- or spread -- between those grades and higher quality light crude such as Brent and West Texas Intermediate typically gets smaller.

“Heavier crudes have always been the first to get cut so that looks like the spread to watch,” said Warren Patterson, a commodity strategist at ING Bank NV.

The best sign of how prices are converging is in the so-called Brent-Dubai exchange of futures for swaps, which lets refiners better manage their exposure to the relatively illiquid heavy crude market by allowing them to use the larger liquidity of the Brent market for hedging. The Brent-Dubai EFS spread fell to a 15-month low of $1.68 a barrel this week, down from $3.71 a barrel in June, according to data from brokerage PVM Oil Associates. It traded at $1.80 at 11:26 a.m. in New York.

Out of Sight

Although oil traders such as Vitol Group and some specialized hedge funds actively trade light-heavy crude spreads, the market is relatively out of sight for mainstream oil investors, who focus on Brent and WTI. As such, the light-heavy spread usually reflects demand from refiners and physical buyers and sellers affected by OPEC cuts, rather than speculative trades.

“The physical market pricing in OPEC cuts is probably the main driver at the moment,” Giovanni Staunovo, commodity analyst at UBS Group AG in Zurich, said. “If OPEC target the higher cost barrels, that will remove heavier crude from the market.”

Prior Cuts

In 2009, the previous time OPEC cut output, Dubai traded intermittently at a premium to Brent, despite the fact the Middle East crude is normally viewed as being lower quality. At its peak, Dubai traded at a premium of 71 cents to Brent. In 2011, it traded at a discount of almost $8 a barrel.

OPEC pumped 33.1 million barrels a day last month, down 310,000 barrels a day from November, according to a Bloomberg News survey of analysts, oil companies and monitoring of ship-tracking data.

The decline comes as OPEC, which controls around 40 percent of global oil supply, is planning to curb output in a bid to boost prices. The organization reached a historicdeal last month with Russia and other non-members to cut global production by about 1.8 million barrels a day for six months starting January.

Saudi Arabia, Kuwait and the United Arab Emirates, whose supplies are dominated by heavy grades, will shoulder the bulk of the cuts. Saudi Arabia has informed some Asian customers that volumes of its medium and heavy crudes could be reduced more than lighter grades next month.

Supply of lighter grades, such as those produced in Libya, is increasing as that country was exempted from the OPEC deal. North Sea and U.S. output, which traditionally tends to be lighter than OPEC’s, is also rising.

Cargo Flows

The global nature of the oil market means that refiners often source crude depending on prices of individual grades. Relatively cheap Brent or West Texas Intermediate crude could potentially serve as an incentive to buy more of the grades and others produced in the Atlantic Basin.

Oil traders and analysts anticipate that heavy-light crude differentials are likely to narrow further this year, although the full extent of the tightening wouldn’t occur until late spring in the Northern Hemisphere, when refinery processing picks up after seasonal maintenance.

“Clearly, light-heavy differentials will have to do a lot of work to entice refiners to buy light grades, although there are limits to how much of this can be done,” said Amrita Sen, chief oil analyst at consultant Energy Aspects Ltd.