Russia Inc. Finds Currency to Believe In to Rouse Investment

EghtesadOnline: From President Vladimir Putin all the way down to makers of insulation and power generators, Russia believes it may have the antidote to years of slumping investment.

While a stronger ruble raised the risk of robbing the economy of momentum and prompted the Finance Ministry to start purchases of foreign currency last month, companies and some of Russia’s top decision makers have come around to embrace gains in the exchange rate. By making imports of technology and equipment more affordable, it’s emerging as a spark plug for an economy retooling after crisis and desperate to snap out of an investment torpor, according to Bloomberg.

“The current exchange rate is optimal,” said Nikolay Dunaev, head of Dalgakiran, a firm based in the Moscow region that manufactures and services compressor units and power-generation equipment. “A weak ruble does nothing good for our company.”

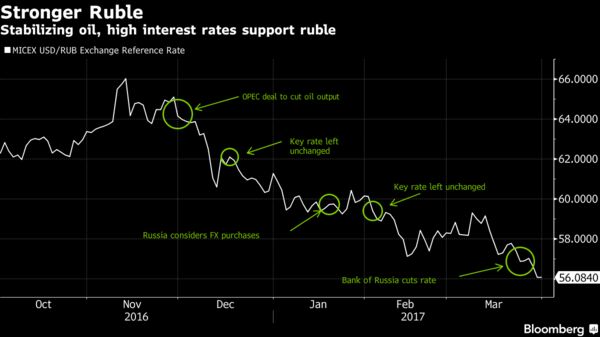

It’s a view that increasingly resonates in a Russia trying to refashion itself for an era of cheap oil, moving past a growth model based on funneling income from energy exports into domestic demand. The central bank has pursued what HSBC Holdings Plc calls a “strong ruble policy” by keeping interest rates elevated even as the outlook for inflation continues to improve.

Gross domestic product eked out annual growth of 0.3 percent last quarter after a drop of 0.4 percent in the previous three months, the Federal Statistics Service said on Friday. GDP’s first expansion in two years matched the median of 11 estimates in a Bloomberg survey.

The ruble is among the top two performers in emerging markets in 2017, adding to its best-ever year in 2016, as the central bank maintains its carry-trade appeal and allows it to trade freely. That’s hurt the competitiveness of Russian exporters and set off alarms among some officials.

By decoupling from oil, which is down about 7 percent this year, a stronger exchange rate is rankling the Finance Ministry because it cuts into Russia’s local-currency revenue from energy sales that are denominated in dollars. The share of oil and gas was at 36 percent of budget income in 2016.

But after three years of declining investment, encouraging companies to restart capital spending is among the few options available to the government as it steers the economy after a recession. To keep up the appeal of a technological makeover and keep down its cost, the currency is key.

“If the ruble weakens, then your investment opportunities will decline with it,” Putin said this month at a meeting with the nation’s big-business lobby. “Buying new equipment, which raises labor productivity, would become more expensive.”

In Favor

Most Russian companies favor a strong and stable exchange rate because that would help reduce output costs and pave the way for modernizing production with imported equipment, according to results of a survey of 372 firms in industry and agriculture published by the central bank’s research department last year.

“Today’s exchange rate is comfortable enough for all players,” said Sergey Kolesnikov, the billionaire co-founder of Technonicol, Russia’s biggest producer for insulation and roofing materials that exports its products to dozens of countries. “Everyone has already fine-tuned their companies to that level.”

A stronger currency is feeding appetite for foreign goods, with the value of equipment and machines imported from beyond the former Soviet Union jumping 5.4 percent last year as the ruble strengthened, while overall imports declined slightly.

For Dalgakiran to roll out investment projects, it needs to be able to forecast and run a profit, however small, which requires a stable ruble in the range of “plus or minus” 55-62 against the dollar, according to Dunaev. A sweet spot for Technonicol is 55-65, according to Kolesnikov. In 2017, the Russian currency has traded between 56 and 60.

The ruble was 0.4 percent weaker at 56.3 against the dollar as of 4:27 p.m. in Moscow on Friday after trading at the strongest in almost two years. It’s set for a fifth straight quarterly gain, the longest winning streak since the second quarter of 2008.

‘Pause’ Over

The Bank of Russia says the “lengthy investment pause” is already over and expectscapital spending to shift to annual growth of 1 percent to 3 percent in the first quarter of 2017.

While the right exchange rate may still be the missing ingredient for some, the stage is already set for domestic investment to take off, according to Bank of America Corp. That’s because companies are flush with cash after net corporate profits reached a historic high in 2016.

“High corporate profits remain the main driver of the potential economic recovery,” said Vladimir Osakovskiy, an economist at BofA in Moscow. “With a more benign macro environment in late 2016 and into 2017, we think that investment might have already resumed growing year-on-year in the fourth quarter, which should continue in 2017.”