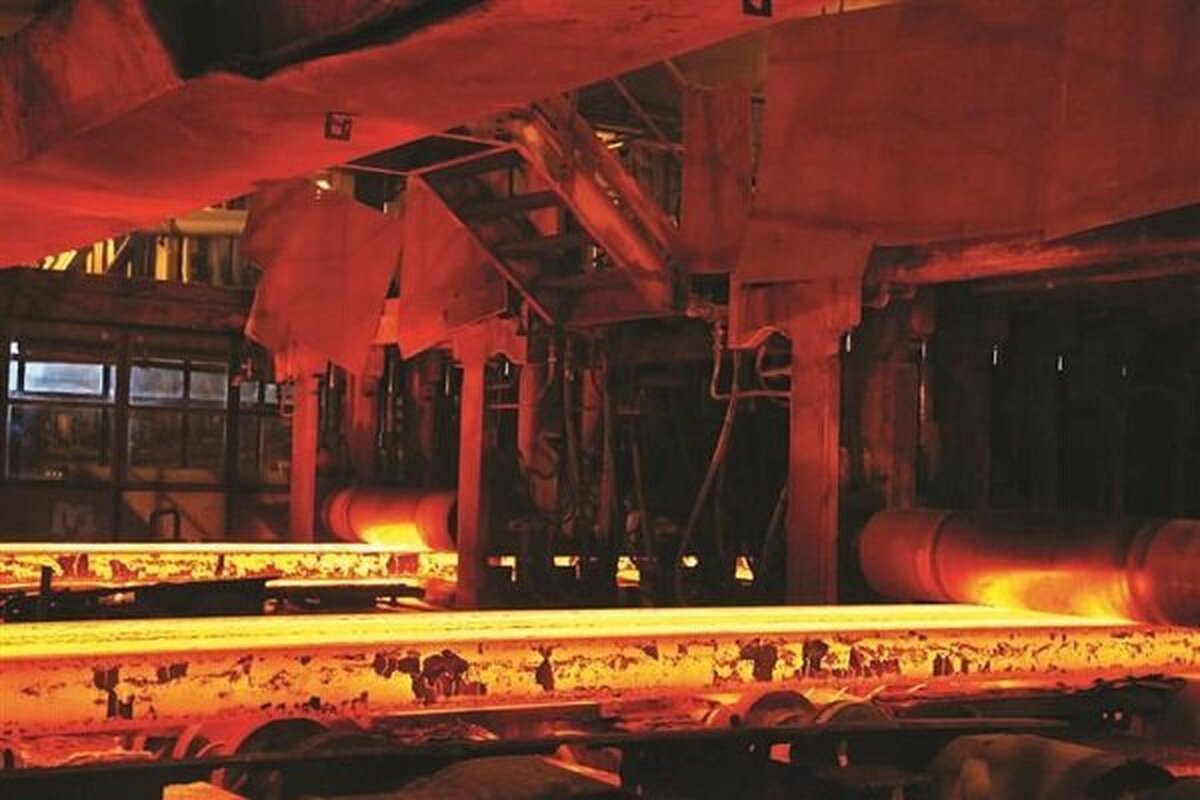

Iran's Steel Exports Increase as Output, Imports Decline

EghtesadOnline: During the first four months of the current fiscal year (March 21-July 22), steel exports saw significant growth as imports and production declined compared with last year’s corresponding period.

Exports of semi-finished products stood at 2.53 million tons during the period, up 52% year-on-year.

Billet and bloom had the lion’s share of semis exports with an aggregate of 1.69 million tons, 26% higher than the previous corresponding period.

Slab amounted to 841,000 tons during the period, up 161% YOY.

Exports of finished steel products jumped by 104% YOY to 1.16 tons.

Rebar accounted for the largest portion of finished steel products exported from Iran during the period, with 873,000 tons. The total volume of Iran’s rebar exports experienced a 114% growth compared with the same period of last year.

Beam exports amounted to 47,000 tons during the period under review, up 24% YOY.

Nearly 65,000 tons of L-beam, T-beam and other types were also exported from Iran during the period, recording a 41% rise YOY.

Hot-rolled coil amounted to 135,000 tons, registering a 193% growth compared with the year before.

Cold-rolled coil with 2,000 tons registered an 83% decline year-on-year.

Coated coil with 41,000 tons, up 86% YOY, was the other finished steel products exported from Iran.

Exports of direct-reduced iron increased by 569% YOY to 415,000 tons, ISPA figures show.

Imports of finished steel decreased by 4% YOY to 268,000 tons. The imports mostly included HRC with 48,000 tons, down 59%; CRC with 121,000 tons, up 68%; coated coil with 75,000, up 9%; L-beam, T-beam and other types with 11,000 tons, down 8%; rebar with 9,000 tons, up 13% and beams with 4,000 tons, up 100%.

Imports of semi-finished steel stood at 1,000 tons, unchanged YOY. Iran did not import billet and bloom during the period, as the volume stood at 1,000 tons in the same period of last year. Slab imports stood at 1,000 tons, while Iran did not import slab in last year's same period.

Production of semis stood at 9.58 million tons, down 4% YOY.

Billet and bloom made up 5.78 million tons of semi-finished production, down 5% YOY.

Slab output reached 3.79 million tons to register a 3% decline year-on-year.

The output of finished steel decreased by 6% YOY to 6.47 million tons.

Long steel products had a 3.66 million-ton share in the output of finished steel products, posting a 1% decline compared with the similar period of last year.

Rebar production stood at 3 million tons (down 8% YOY). It was followed by beams with 374,000 tons (down 9% YOY) and L-beam, T-beam and other types with 283,000 tons (up 8% YOY).

The production of flat steel with 2.8 million tons registered a 11% decline in the four-month period.

Hot-rolled coil made up 2.76 million tons of the production in this category, showing a 10% decline compared with the similar period of last year, followed by cold-rolled coil with 826,000 tons, down 9% year-on-year, and coated coil with 493,000 (up 5%).

Iran's output of direct reduced iron stood at 10.06 million tons unchanged from last year, ISPA data show.

Power Supply Restrictions

The decline in production comes, as steel mills were made to lower electricity consumption amid record high temperatures and widespread blackouts.

The Iran Power Generation, Distribution and Transmission Company (locally known as Tavanir) has warned that it will have to cut down on its electricity supply to steel mills if public consumers fail to cooperate and lower their power consumption.

Due to extreme heat and people’s failure to lower consumption, electricity supply to the steel industry faced problems, Mohammad-Hossein Motevalli-Zadeh, CEO of Tavanir, said.

“We have gone through the last few weeks without any restrictions [in supplying electricity to steel mills] since the media succeeded in raising awareness [about the need to save energy] and the industries cooperated,” he was quoted as saying by Mehr News Agency.

But the official insisted that if people do not cooperate, “we may have to limit the consumption of some steel industries”.

According to the official, some of the steel producers in Iran have engaged in supplying oxygen for Covid-19 patents.

Summer demand led to severe power and water shortages in the past weeks in most regions, resulting in blackouts and dry taps.

Steel and cement factories were only allowed to work at 50% of their capacity from 12-8 a.m. during this period.

The abrupt ban on the two key sectors created shortages of steel and cement in local markets and prices increased overnight, creating new problems for most construction sectors.

Rasoul Khalifeh-Soltani, the head of Iranian Steel Producers Association, said at the time power outages shut down 85% of steel industry’s production.

Heavyweight Iranian mining firms saw 100 trillion rials ($378 million) in lost sales during the first four months of the current fiscal year (March 21-July 22), a new report released by the Iranian Mines and Mining Industries Development and Renovation Organization shows.

Mobarakeh Steel Company, the biggest steelmaker in Iran and the North Africa and the Middle East region, saw the highest volume of sales during the period with 450 trillion rials ($1.7 billion), up 157% YOY.

World’s 10th Biggest Steelmaker

Iranian steel mills produced a total of 15 million tons of crude steel in the first six months of 2021, which indicate an 8% rise compared with the corresponding period of 2020.

The World Steel Association’s latest report shows Iran's June output stood at 2.5 million tons, up 1.9% year-on-year.

The report ranks Iran the world’s 10th biggest crude steel producer. China was the world’s largest crude steel producer in H1 with 563.3 million tons of steel output, up 11.8% YOY.

It was followed by India with 57.9 million tons (up 31.3%), Japan with 48.1 million tons (up 13.8%), the United States with 42 million tons (up 15.5%), Russia with 38.2 million tons (up 8.5%), South Korea with 35.2 million tons (up 8.3%), Germany with 20.6 million tons (up 18.1%) and Turkey with 19.7 million tons (up 20.6%).

Iran is placed after Brazil (ninth) with 18.1 million tons, 24% higher than the corresponding period of 2020.

The world’s 64 steelmakers produced a total of 1 billion tons of steel over the six months under review, up 14.4% YOY. States located in Asia and Oceania collectively produced 737 million tons of the total.

The Middle East produced 24.1 million tons of crude steel in the six months under review, posting an increase of 8.7% compared with the same period of last year.

Global steel output also experienced a 11.6% growth in June to 167.9 million tons.

World's major steel producers seem to have recovered their output in 2021, after the global closure of businesses and disruption in industrial operations, as Covid-19 spread in early 2019.

Crude steel is defined as steel in its first solid (or usable) form: ingots and semi-finished products (billets, blooms and slabs). This is not to be confused with liquid steel, which is steel poured.

The World Steel Association is one of the largest and most dynamic industry associations in the world, with members in every major steel-producing country. Worldsteel represents steel producers, national and regional steel industry associations and steel research institutes. Members represent around 85% of global steel production.

The 64 countries included in this table represent 85% of global steel production.

Iranian steel mills produced a total of 29.02 million tons of crude steel in 2020, which indicate a 13.35% rise compared with 2019, the highest growth in output in the list of the world's top 10 producers.