It's valued at more than $2 trillion — or about four times the biggest technology giants — though no one really knows what it’s worth because its profits are shrouded in secrecy. The veil could soon be lifted as the Saudi government is planning a partial privatization of Aramco tocreate a war chest and prepare the country for the post-hydrocarbon age.

The Situation

The government intends to sell up to 5 percent of Aramco as soon as 2017,according to the country’s influential Deputy Crown Prince Mohammed bin Salman. The sale’s estimated size of about $100 billion would make it the biggest-ever initial public offering, dwarfing the $25 billion raised by Chinese internet retailer Alibaba in 2014. Bankers are lining up to reap abonanza of fees. Proceeds from the Aramco sale would bulk up a sovereign wealth fund at the center of a drive to diversify the economy, a goal that’s gained urgency since the price of crude tumbled from more than $100 a barrel in 2014 to about half that level. The prince’s drive to create jobs for millions of unemployed Saudis in manufacturing, tourism and other fields isseen as crucial to the kingdom’s political stability. The company will face unprecedented scrutiny: Disclosures needed to trade Aramco shares in London or New York may include the first independent audit of the kingdom’s reserves, details about its production capacity and a window into how much of the nation’s oil wealth goes to the royal family.

SOURCE: BLOOMBERG

The Background

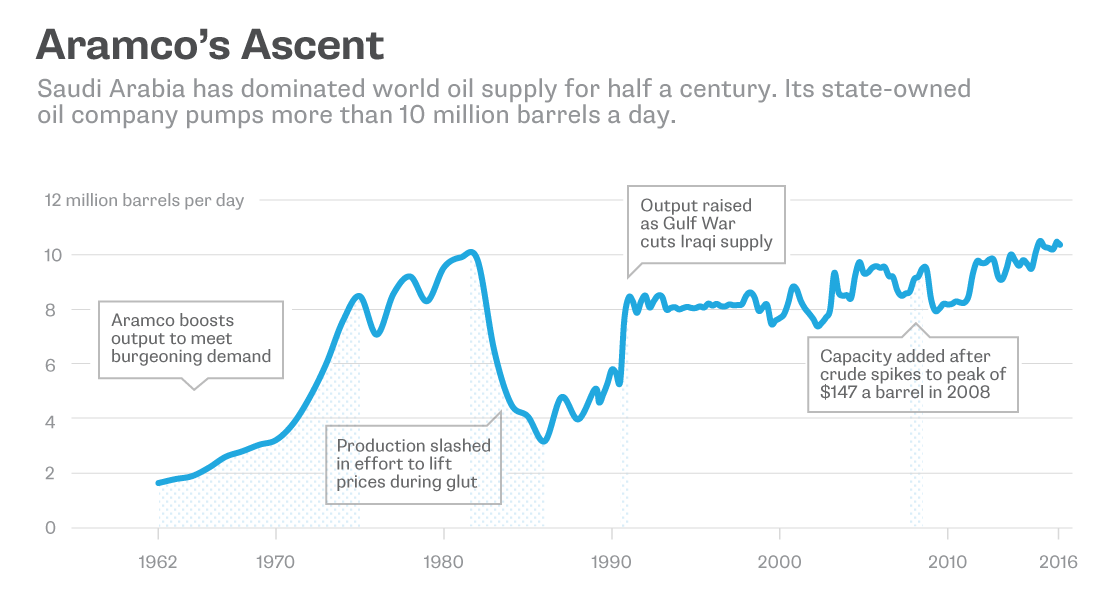

Explorers from the Rockefeller family’s Standard Oil empire first struck oilin Saudi Arabia in 1938. The venture became known as Arabian American Oil and went on to discover Ghawar field, still the world’s largest onshore deposit. In 1980, the Saudi government bought out the original shareholders, all of them forebears of Exxon Mobil or Chevron, and renamed the company. Aramco has fueled decades of prosperity for Saudi Arabia, a conservative Islamic state and one of the world’s last remainingabsolute monarchies. It generates almost 90 percent of government income and built the refineries, petrochemical plants and other infrastructure that form the backbone of the world’s 15th-biggest economy. Saudi Arabia has been the de facto leader of the Organization of Petroleum Exporting Countries, or OPEC, since the cartel was founded in 1960. It’s often called the “swing producer” because decisions to increase or trim Saudi output drive the price of oil. Saudi crude accounts for about 1 out of every 9 barrels of global production and can be extracted for about a third of the cost of reserves in the U.S. Over the decades, Saudi Arabia has had a hand in engineering periods of lower oil prices — including the current slump — in a bid to maintain its share of global energy markets.

SOURCE: BLOOMBERG

The Argument

Prince Mohammed's plan envisions the Aramco IPO as the centerpiece of Saudi Arabia's biggest economic shakeup since the founding of the country in 1932. However, it’s not yet known which parts of Aramco will be put up for sale. And some skeptics suggest the government might scale back the plan to make it palatable to a traditionally closed nation that may be reluctant to relinquish its hold on a national resource. It’s also unclear how the country will preserve its historic role in world oil markets and how much influence the extensive Saudi royal family will continue to exert over its most prized asset. For the biggest oil economy, the clock is ticking. Even with the world's shift to cleaner fuels, oil is expected to continue providingabout a third of world energy for the next two decades. Aramco’s IPO will put a price tag on the future of petroleum just as Saudi Arabia is fixing its sights on the end of its own oil age.