In the age of globalization, diversity is harder to come by. That poses a challenge for an emerging markets investor, reports Bloomberg.

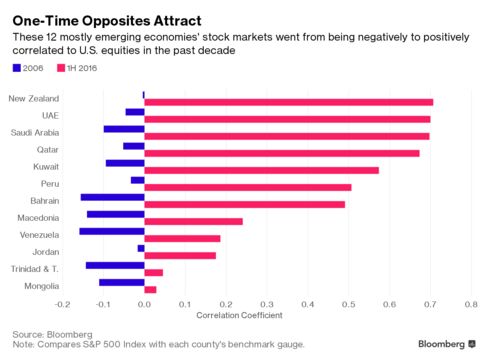

Bloomberg's Stock Correlation Tracker compares the benchmark equity indices in 84 countries with the S&P 500 index over a 10-year period and found that 88 percent of them were positively correlated with the U.S. market index in the first half of this year. That's up from 82 percent a decade ago. Much of this convergence is happening in emerging or frontier markets, where economic growth has slowed dramatically -- moderating closer toward the U.S. pace -- including several Middle Eastern indices that used to move in the opposite direction to the S&P.

"Emerging markets were once seen as the Wild West of investing, the markets that are hard to understand and impossible to predict," said Timothy Ghriskey, who helps manage $1.5 billion as chief investment officer at Solaris Asset Management LLC in New York.

That's no longer the case. The most striking examples are oil-dependent economies like Saudi Arabia, United Arab Emirates, Qatar, Kuwait and Bahrain.

"We see more and more often that the forces that impact the developed markets influence the emerging markets as well," he said. In short, "emerging markets are no longer the markets that exist in isolation to the U.S market."

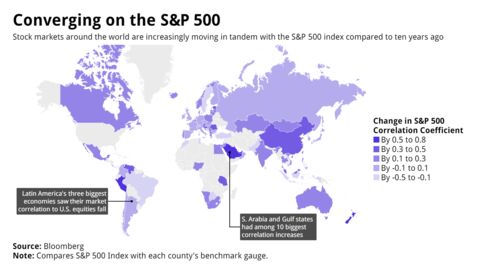

For a global overview here is a map that shows the changes in the correlation coefficient. Europe is highly correlated to the U.S., especially Germany. Correlation has risen the most in the Middle East and Asia, but here is a surprise, it is falling in Latin America's largest economies particularly hard hit by the commodity crash.

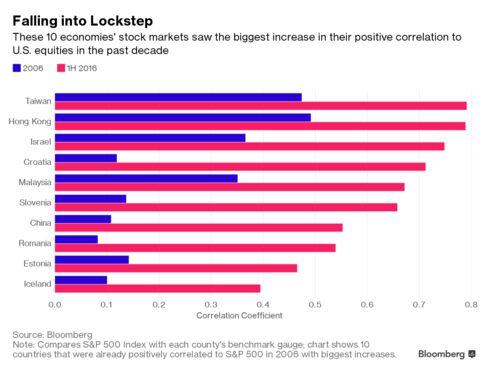

Among the 10 positively-correlated markets that have moved closest to the S&P 500 in 10 years, none is more important than China, which has seen its correlation coefficient increase from 0.11 in 2006 to 0.55 so far this year.

How can one account for the Latin America outlier? Well, it comes down to diversity and how the indices are constructed. Taiwan, which is highly correlated to the S&P, may be a small island but it has 856 listed companies. In the cases of Brazil and Chile, their benchmark indices have actually become less representative of their economies since 2006, shedding more than 30 percent of gross domestic product from their respective market capitalizations.

For traders looking to hedge their U.S. equity bets, there are but 10 markets left this year that are negatively correlated to the S&P 500, according to the Bloomberg Stock Correlation Tracker: Morocco, Tanzania, and Malta to name a few. Instead, they may want to take a closer look at those larger economies whose markets are now less correlated than a decade ago: Indonesia and Turkey, teetering on the edge of losing its investment-grade rating after a failed coup.