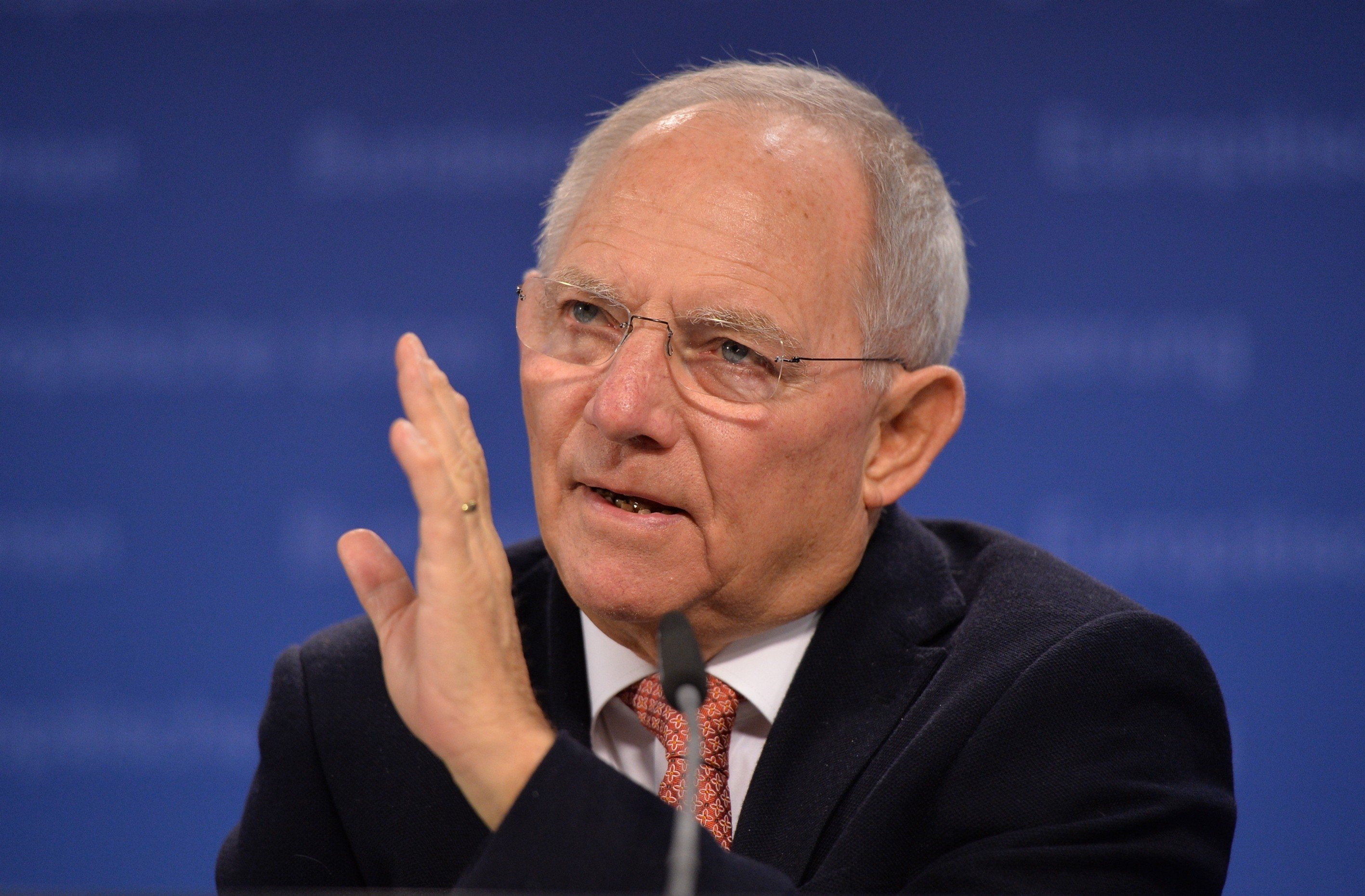

“The rules mustn’t have particularly negative consequences for specific regions because banks’ balance sheets and the financial markets are structured quite differently around the world,” Schaeuble told reporters in Bratislava on Saturday. “This is a crucial, common European concern. In Europe, companies are mostly financed via banks, whereas in the U.S. this is mostly done in the capital markets.”

According to Bloomberg, that message has found support outside Europe. Leaders of the Group of 20 nations said earlier this month that as work on the capital framework known as Basel III is wrapped up, the Basel Committee on Banking Supervision should promote a “level playing field” while honoring its commitment to avoid “further significantly increasing overall capital requirements across the banking sector.”

The Basel Committee promised in January not to boost “overall capital requirements” significantly as it completes work on bank-leverage limits and a revision of the way credit, market and operational risks are measured. That left open the possibility that individual countries or banks could face a marked increase.

‘Drastic’ Reduction

The Basel Committee is racing to wrap up the post-crisis capital framework. The regulator’s oversight body is set to meet on Sunday, followed by a two-day meeting Sept. 14-15 of the committee, whose members include the U.S. Federal Reserve, the European Central Bank and the Bank of England.

Banks warn that proposed changes in how they assess risk would send capital requirements spiraling. Credit Agricole SA Chief Executive Officer Philippe Brassac said the Basel Committee should freeze plans to overhaul capital rules to avoid a “drastic” reduction in lending by European banks.

“The planned revision of the capital framework must be suspended for five years to give time to the current reforms to bear fruits and assess whether further revisions are needed,” Brassac said in an article prepared for a conference in Bratislava.

EU finance ministers in July urged the Basel Committee to avoid “differences for specific regions of the world” in the impact of the new rules.

‘Apples and Pears’

Schaeuble took up that call on after Saturday’s meeting with his EU counterparts. He pointed to accounting standards and the treatment of mortgages in Europe and the U.S. as evidence of the divergence the Basel Committee needs to take into consideration.

“You can’t compare apples and pears and have the same rules” for everyone, he said. “I talked about this intensively with Mark Carney, chairman of the Financial Stability Board, last week, and we’re also underlining this point in the Basel Committee.”