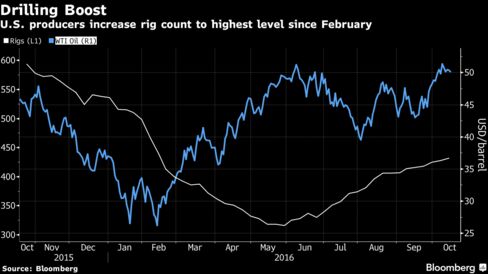

According to Bloomberg, futures lost as much as 0.7 percent in New York after slipping 0.2 percent Friday. Rigs targeting crude rose for a seventh week to the highest since February, Baker Hughes Inc. said on its website. That followed the first gain in U.S. inventories in six weeks. Output from OPEC’s Libya expanded to 560,000 barrels a day, according to a National Oil Corp. official, compared with a reported production rate of 540,000 a barrels a day last week.

Oil has fluctuated near $50 a barrel amid speculation over the ability of the Organization of Petroleum Exporting Countries to implement an agreement to reduce supply. An OPEC committee will meet later this month to try and resolve differencesover how much individual members should pump and Libya is among countries exempt from the output cut.

“Oil looks vulnerable to the downside and a slide under $50 a barrel is quite likely,” said Michael McCarthy, chief market strategist in Sydney at CMC Markets. “There is some support for West Texas around $48, but if we breach that level, we’re looking for a pullback toward $45.”

West Texas Intermediate for November delivery fell as much as 36 cents to $49.99 a barrel on the New York Mercantile Exchange and was at $50.06 at 7:45 a.m. in London. The contract dropped 9 cents to $50.35 on Friday. Total volume traded was about 66 percent above the 100-day average.

Rig Count

Brent for December settlement was 22 cents lower at $51.73 a barrel on the London-based ICE Futures Europe exchange. The contract lost 0.2 percent to $51.95 on Friday. The global benchmark crude traded at a premium of $1.25 to WTI for December.

U.S. producers added four rigs to 432 last week, Baker Hughes said Friday. Explorers have now added more than a hundred rigs since a steady expansion began in June. The nation’s crude inventories rose to 474 million barrels through Oct. 7, according to data from the Energy Information Administration. That’s the highest for that time of year since the EIA began publishing weekly data in 1982

Oil-market news:

- Iran is seeking to pump 4 million barrels a day within two weeks, Ali Kardor, the managing director of National Iranian Oil Co., said at an energy conference. That compares with 3.89 million barrels a day now.

- India’s billionaire Ruia brothers agreed to sell a 98 percent stake in their refinery unit to Russia’s Rosneft PJSC and a consortium of Trafigura Group and United Capital Partners for about $13 billion.

- Iran is boosting efforts to woo foreign investment in its energy industry, with a request for companies to submit documents to pre-qualify as bidders to develop the country’s oil and natural gas fields.