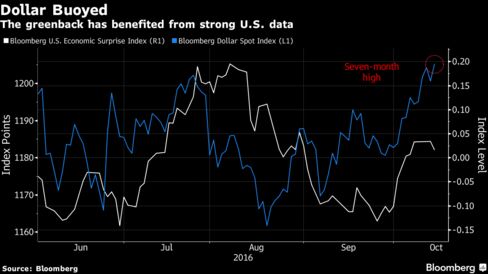

Benchmark bond yields in Australia, Germany and the U.S. climbed to their highest levels since June after Yellen on Friday put forward an argument for Fed policy to be kept loose. The Bloomberg Dollar Spot Index held near a seven-month high following the pickup in Treasury yields, while South Korea’s won led losses among Asian currencies. The Stoxx Europe 600 Index fell toward a two-month low and benchmark shares gauges declined across most of Asia as oil neared $50 a barrel, reports Bloomberg.

Investor sentiment continues to be dominated by shifts in expectations for the scale and timing of U.S. interest-rate increases, while American companies’ earnings are also being watched closely. Fed Vice Chair Stanley Fischer is due to speak Monday, when American industrial output data are also scheduled. Yellen said there are “plausible ways” that running the economy hot for a while could repair some damage caused to growth during the recession, indicating a willingness to keep policy loose even as inflation quickens.

“U.S. economic data like inflation for September and home construction, home sales and industrial output figures will be eagerly anticipated for clues about the Fed’s interest rate policy,” said Vasu Menon, vice president for wealth management research at Oversea-Chinese Banking Corp. in Singapore. "Earnings are especially critical at this juncture as U.S. stocks are trading at near-record highs and susceptible to earnings disappointments as valuations look stretched.”

The euro area is due to report last month’s change in its consumer price index on Monday, while similar figures for the U.S. are scheduled for Tuesday. China may issue data on money supply and lending, ahead of Wednesday’s release of gross domestic product figures for the third quarter. Bank of America Corp. has quarterly results coming, after Citigroup Inc. and JPMorgan Chase & Co. reported better-than-expected earnings on Friday.

Bonds

The yield on Australia’s 10-year sovereign bonds rose by four basis points to 2.31 percent as of 8:16 a.m. London time, while that on similar-maturity notes in Germany increased by three basis points to 0.09 percent.

The rate on U.S. Treasuries due in a decade was little changed at 1.80 percent, after climbing six basis points on Friday. The two-year yield was little changed for a second day after futures prices indicated the chance of a Fed rate hike in 2016 held steady at 66 percent in the last session.

Currencies

The Bloomberg Dollar Spot Index, a gauge of the greenback against 10 major peers, was steady following a 0.4 percent advance on Friday. Australia’s dollar slipped 0.3 percent and the won slid as much as 0.9 percent to its weakest level since July. The yuan fell to a fresh six-year low in Shanghai, while Taiwan’s dollar dropped to levels last seen in August.

The yen advanced 0.1 percent to 104.03 per dollar, following declines in each of the last three weeks. Hedge funds and other large speculators cut bullish bets on the currency by the most since May in the week ended Oct. 11.

Stocks

The Stoxx Europe 600 Index fell 0.3 percent, after gaining by the most in three weeks on Friday. Futures on the S&P 500 Index declined 0.3 percent.

The MSCI Asia Pacific excluding Japan Index slipped to a one-month low. Australia’s S&P/ASX 200 Index lost 0.8 percent and Hong Kong’s Hang Seng Index dropped 1 percent, while Japan’s Topix index gained 0.4 percent as the yen’s recent retreat buoyed exporters.

China’s foreign-currency shares plunged in afternoon trading, with the Shanghai B-Share Index sliding more than 6 percent in its biggest loss since January. The Shanghai A-Share Index of yuan-denominated stocks declined 0.7 percent. Overseas investors are free to trade B shares, while their participation in the A-share market is restricted.

Crown Resorts Ltd. tumbled 14 percent in Sydney after Chinese authorities detained 18 of its employees, including the head of its international high-roller operations. Gaming stocks elsewhere were also impacted, with Sands China Ltd. and Galaxy Entertainment Group Ltd. both dropping at least 3 percent in Hong Kong. Tokyo Electric Power Co. Holdings Inc. fell 7.9 percent after a candidate opposed to the restart of its Kashiwazaki Kariwa nuclear plant, the world’s biggest, won a gubernatorial election in the Niigata prefecture.

Commodities

Crude oil fell 0.6 percent to $50.03 a barrel in New York after a report showed the number of U.S. rigs increased to the highest level since February. Output from OPEC member Libya has expanded to 560,000 barrels a day, according to an official at National Oil Corp. This compares with a reported production rate of 540,000 a barrels a day last week.

Gold gained 0.3 percent, buoyed by Yellen’s remarks on Friday and data showing investment in exchange-traded funds backed by gold is at the highest level since June 2013. Bullion declined in each of the last three weeks as speculation mounted that the Fed will raise interest rates in 2016.

“A hike is being considered -- that is clear -- but the Fed is certainly not about to remove stimulus aggressively anytime soon,” Australia & New Zealand Banking Group Ltd. said in a note. “Investor appetite remains strong” in gold, it said.

Corn futures in Chicago climbed as much as 1 percent to trade near the highest since July after the U.S. Department of Agriculture cut its grain crop forecast for the European Union.