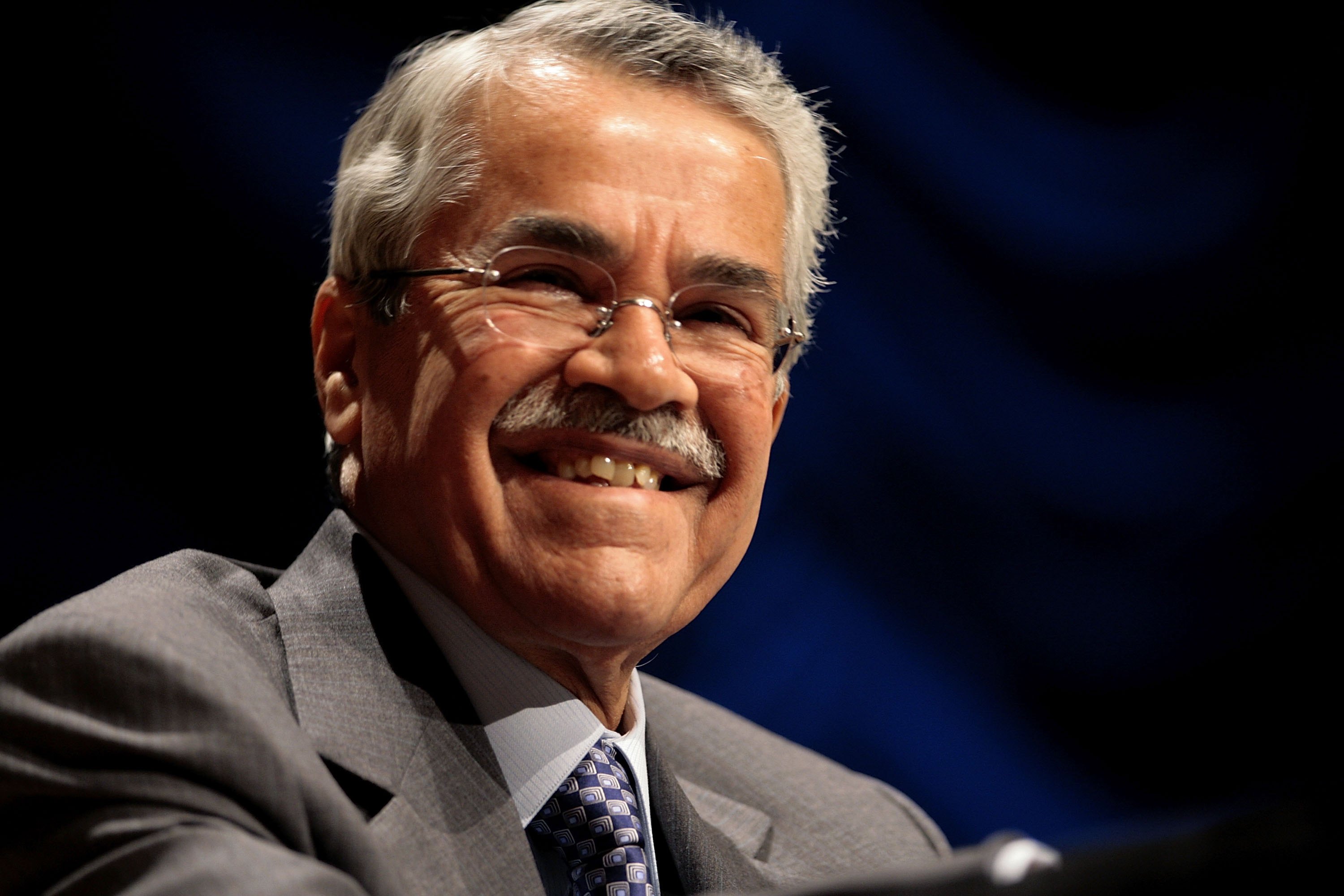

The comments, made in his forthcoming autobiography ‘Out of the Desert: My Journey from Nomadic Bedouin to the Heart of Global Oil,’ provide a cautionary history as OPEC waits on a pledge this month by Russian President Vladimir Putin to freeze or cut production.

According to Bloomberg, Al-Naimi writes in the book that one of his aides asked him in November 2014 what was the chance of leading non-OPEC countries Russia, Mexico, Kazakhstan and Norway cutting oil production.

"I held up my right hand and made the sign for zero," he writes.

Although the former Saudi minister doesn’t write about the current negotiations, he strongly defends the no-limits approach he convinced OPEC to adopt two years ago. He writes the best way to re-balance the market is still to let supply, demand and prices work.

"The oil market is much bigger than just OPEC. We tried hard to bring everyone together, OPEC and non-OPEC, to seek consensus. But there was no appetite for sharing the burden," he writes in the 317-page book, published next month by Portfolio Penguin. "So we left it to the market as the most efficient way to re-balance supply and demand. It was -- it is -- a simple case of letting the market work".

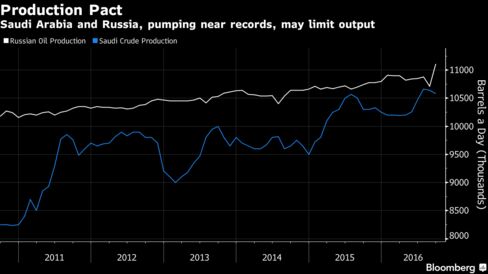

Khalid Al-Falih, who replaced Al-Naimi as energy minister in May, is taking a different path. Saudi Arabia has agreed to cut production, despite its regional rival Iran’s reluctance to join the effort, and is trying to convince Russia and other non-OPEC countries to cut too.

Al-Falih is betting that a small production cut will pay for itself, even if others don’t join the effort, by raising prices enough to increase revenues. So far, it seems to be working -- Brent, the global crude benchmark has risen a to one-year high above $50 a barrel since OPEC agreed an outline deal in Algiers last month.

Al-Naimi, writing about OPEC’s decision in 2014, sees it a different way.

"If we, Saudi Arabia, or OPEC as a whole, cut production without the participation of major non-OPEC members, we would be sacrificing revenues as well as market share," he writes.

Financial Crisis

The former Saudi minister recalls how Igor Sechin, the powerful head of state-controlled Rosneft PJSC, "didn’t follow through" on his promise to cut output in 2008-09 during the global financial crisis.

He also offers the first on-the-record account of a meeting between himself, Sechin and Venezuelan and Mexican officials in Vienna in November 2014, when both Russia and Mexico declined to cut production.

"It looks like nobody can cut, so I think the meeting is over," the former Saudi minister recalls saying, adding that even his own team was "clearly as unprepared for my response as the other ministers."

For all his complaints about Russia, Al-Naimi doesn’t mention a meeting earlier this year in Doha where Saudi Arabia walked away from an informal pledge to Moscow to freeze production. At the last minute, Al-Naimi sunk the deal by demanding that Tehran joined in, leaving the Russian oil minister, Alexander Novak, empty handed.

The books offers an insight into 35 years of Saudi Arabian oil policy as Naimi served first as chief executive officer of the country’s state-owned giant Saudi Aramco and then as petroleum minister. The autobiography recounts the response to the invasion of Kuwait in 1990 by Saddam Hussein and how Al-Naimi battled other ministers and princes in the late 1990s to keep international oil companies away from the kingdom’s oil riches.

Admits Mistake

Al-Naimi, who for several years defended oil prices at around $100 a barrel as fair to consumers and producers, admits that was a mistake.

"It was very high," he writes. "That price unleashed a wave of investment around the world into what had previously been uneconomic oilfields," including U.S. shale, the Arctic and ultra deep water.

"We are in a temporary state during which the world’s most important commodity is being repriced for the future," he writes. “New supplies will find new demand at the right price.”

Al-Naimi draws some parallels from the current situation to that of the early 1980s, when Saudi Arabia first agreed to increase or decrease output to balance the market.

In May 1983, at an OPEC meeting, Riyadh accepted for the first time the role of "swing producer," something Naimi says "would prove to be a momentous and, in many ways, unfortunate decision."

Decades later, he still believes that Saudi Arabia should not play the role of swing producer, despite the financial pain of lower prices today. "I will let history be the judge as to the success of our market-based policy," he writes in the epilogue of the book. "This commodity, like all commodities, is inevitably cyclical."