A production cap would mean Russia pumping 200,000 to 300,000 barrels a day less than planned in 2017, Energy Minister Alexander Novak told reporters in Moscow on Thursday. That means a freeze would be “quite a difficult and harsh situation for us as our plans envisioned an output growth next year,” he said.

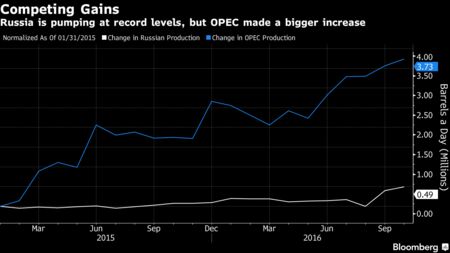

The Organization of Petroleum Exporting Countries, which is seeking to finalize its own supply cuts of as much as 1.1 million barrels a day next week, asked non-members to contribute by cutting daily production by about 500,000 barrels, Novak said.

According to Bloomberg, OPEC reached a preliminary deal in September to reduce collective output to 32.5 million to 33 million barrels a day, compared with the group’s estimate of 33.6 million in October. Talks on individual production quotas continued this week with the aim of securing a final pact by the ministerial meeting in Vienna on Nov. 30.

The group will meet lower-level OPEC officials to discuss cooperation on Nov. 28, followed by a Nov. 30 breakfast meeting between ministers and non-members, including Russia, before the ministerial summit, according to people familiar with the matter.

The role of Russia is going be critical in shaping a deal, Emmanuel Kachikwu, Nigeria’s minister of state for petroleum, said in an interview with Bloomberg Television. “Russia is as interested in firming up the price as we are,” he said.

While Russia, the largest crude supplier outside OPEC, has reiterated its preference for a freeze over a cut for several months, members of the group including Saudi Arabia had been expecting the nation would eventually join a reduction, according to people briefed on the matter. If Russia and other non-OPEC producers balk at the idea of cutting output, the exporters’ group could reconsider pushing ahead, the people said.

Russia’s position “has remained unchanged and consistent,” Novak said Thursday. “As our president said earlier, we are ready to freeze production at the current levels.” President Vladimir Putin on Monday reaffirmed the country is willing to freeze, adding he sees no obstacles to an OPEC agreement this month after the group made major progress in overcoming differences.

Russia drafts its 2017 budget using an oil-production estimate at about 11 million barrels a day compared to an average 10.9 million expected this year. Output increased to a record 11.205 million barrels a day in November, near a post-Soviet record. The country has raised its production forecasts several times a year since 2015.

“While there’s actually nothing new from Russia today, Moscow is changing its rhetoric to show its commitment to a deal,” said Alexander Kornilov, an analyst at Aton LLC in Moscow. “The new wording shows Russia is trying to convince OPEC partners.”