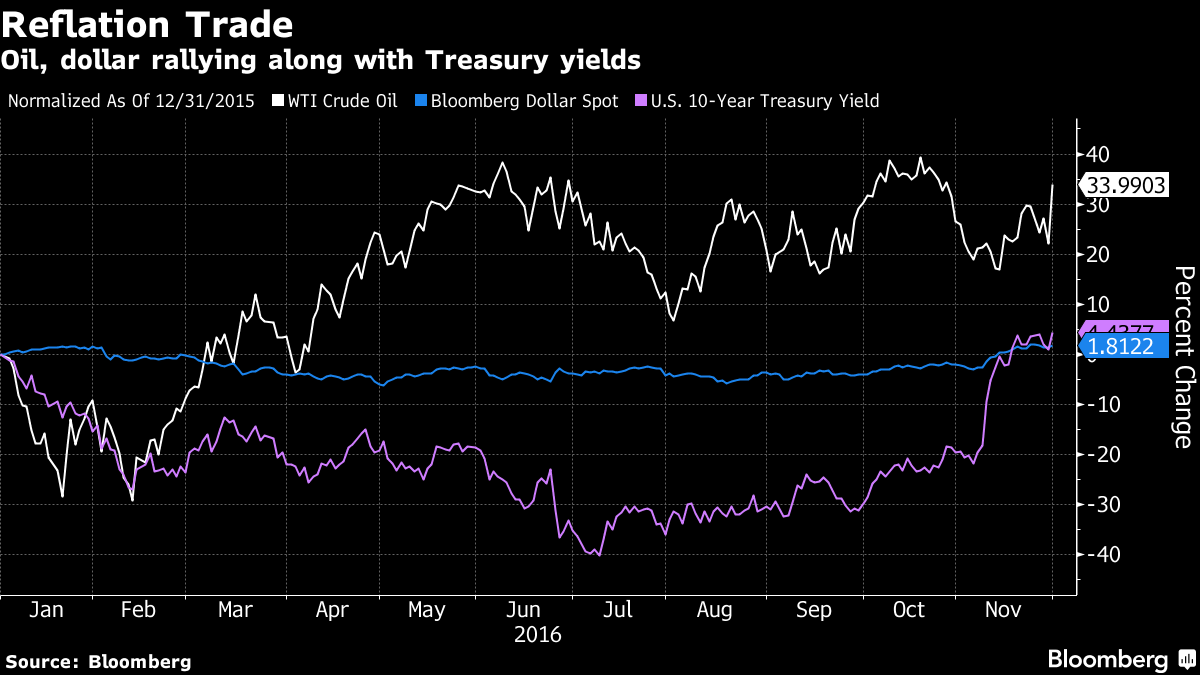

According to Bloomberg, oil prices rallied the most in nine months as major producers agreed to cut output for the first time in eight years. Exxon Mobil Corp. and Chevron Corp. climbed as a measure of energy stocks globally jumped the most since January. Goldman Sachs Group Inc. also advanced, while losses in utilities and technology shares weighed on the S&P 500 Index. The dollar rebounded, reaching an eight-month high versus the yen as gold slid and 10-year Treasury yields gained nine basis points. Industrial metals resumed their rally.

The OPEC deal, which until Wednesday’s meeting had looked to be in peril, removed an element of uncertainty in markets, leaving investors to revert to speculating over the fate of U.S. monetary policy and President-elect Donald Trump’s spending plans. Raising expectations for Friday’s government payrolls data, the ADP Research Institute said companies added the most workers since June, 46,000 more than economists had forecast. Bets on a December interest-rate hike from the Federal Reserve have been ratcheted up since Trump’s victory, amid increased confidence in the U.S. economic outlook.

“Today is a continuation of what we’ve been seeing - higher inflation expectations,” said James Gaul, a portfolio manager at Boston Advisors LLC, which oversees $4.5 billion. Friday’s “payrolls data is going to be watched through the lens of the Fed,” he added. “So long as there are no massive surprises to the downside, then the expectation the Fed is going to raise rates in December will remain in place.”

Commodities

- West Texas Intermediate crude futures surged 9.3 percent to $49.44 a barrel as of 4 p.m. in New York, the biggest one-day gain since Feb. 12.

- The OPEC-led deal was broader than many people had expected, given that it extended beyond the bloc with Russia agreeing to unprecedented cuts to its own output.

- The gain erased oil’s monthly loss, leaving futures up 4.8 percent in November.

- Base metals rebounded in London, paced by copper, after the London Metal Exchange Index tumbled 3.4 percent on Tuesday, its biggest one-day retreat in more than a year.

- Gold sank 1.3 percent to $1,172.84 an ounce in the spot market, its lowest level since February.

Stocks

- Energy shares in the MSCI All Country Index jumped 4 percent, the most since Jan. 22.

- The Dow Jones Industrial Average pared gains in the last minutes of U.S. trading, ending little changed at 19,123.38.

- The S&P 500 slipped 0.3 percent, trimming its November gain to 3.4 percent, still the best monthly performance since July.

- Oil and gas producers accounted for all 10 best performers in the S&P 500, while utility shares dropped 2.7 percent, leading declines among defensive equities.

- The Nasdaq Composite Index slipped 1.1 percent.

- Fannie Mae and Freddie Mac surged more than 40 percent after Steven Mnuchin, Donald Trump’s choice for Treasury secretary, says they should exit government’s grip, countering Republicans who’ve said they should be wound down or eliminated.

- Goldman shares jumped 3.6 percent, the most since Nov. 10, on news of the appointment of Mnuchin, a former executive at the bank.

- Asian index futures signaled gains, with Nikkei 225 Stock Average futures up more than 1 percent.

Currencies

- Bloomberg’s Dollar Spot Index, which tracks the greenback against 10 major peers, advanced 0.5 percent, pushing its gain this month to 3.9 percent, the most since September 2014.

- The Mexican peso, Norwegian krone and Brazilian real led the advance among currencies from commodity-export nations amid the oil deal.

- The yen slid 1.8 percent to 114.38 per dollar, touching its weakest point since March 10.

Bonds

- U.S. government bonds fell, pushing the yield on 10-year Treasury notes to 2.38 percent, set for their highest close since July last year.

- Private payrolls in the U.S. climbed by 216,000 this month, after a 119,000 gain in October that was revised lower, data from the Roseland, New Jersey-based ADP showed Wednesday. The median estimate of economists surveyed by Bloomberg was for an increase of 170,000 jobs.

- Economists are predicting an 180,000-worker increase in nonfarm payrolls in Friday’s data, after they climbed by 161,000 in October.