Oil stocks weighed on benchmark equity indexes in the U.S. Bonds rose across the euro-area before a policy meeting Thursday expected to extend bond-buying beyond March. Crude fell for the first time since OPEC confounded skeptics on Wednesday by agreeing to cut production, a pact that may be challenged by rising output from non-member countries. The dollar was little changed, according to Bloomberg.

U.S. stocks slipped, halting a rally on speculation that Donald Trump’s planned policies will spur growth in the world’s largest economy at the same time that European monetary policy remains accommodative. Italian bond investors have moved on from the resignation of Italy’s prime minister in a sign that concerns the nation will move to leave the euro have faded. Questions about how successful OPEC will be in its attempt to bolster prices pared a gain in crude that had kept a barrel of oil above $51.

Stocks

- The S&P 500 Index was within 0.4 percent of an all-time high as of 9:41 a.m. in New York, while the Dow Jones Industrial Average was little changed after closing at a record.

- The Stoxx Europe 600 Index gained 0.5 percent, adding to its 0.6 percent advance from Monday. German utilities RWE AG and EON SE advanced at least 2 percent after a court ruled the two must be compensated for the government’s shift away from nuclear energy.

- Italy’s FTSE MIB Index jumped 2 percent, helped by gains of at least 3.9 percent by UniCredit SpA and Mediobanca SpA.

- The MSCI Emerging Markets Index added 0.8 percent.

Commodities

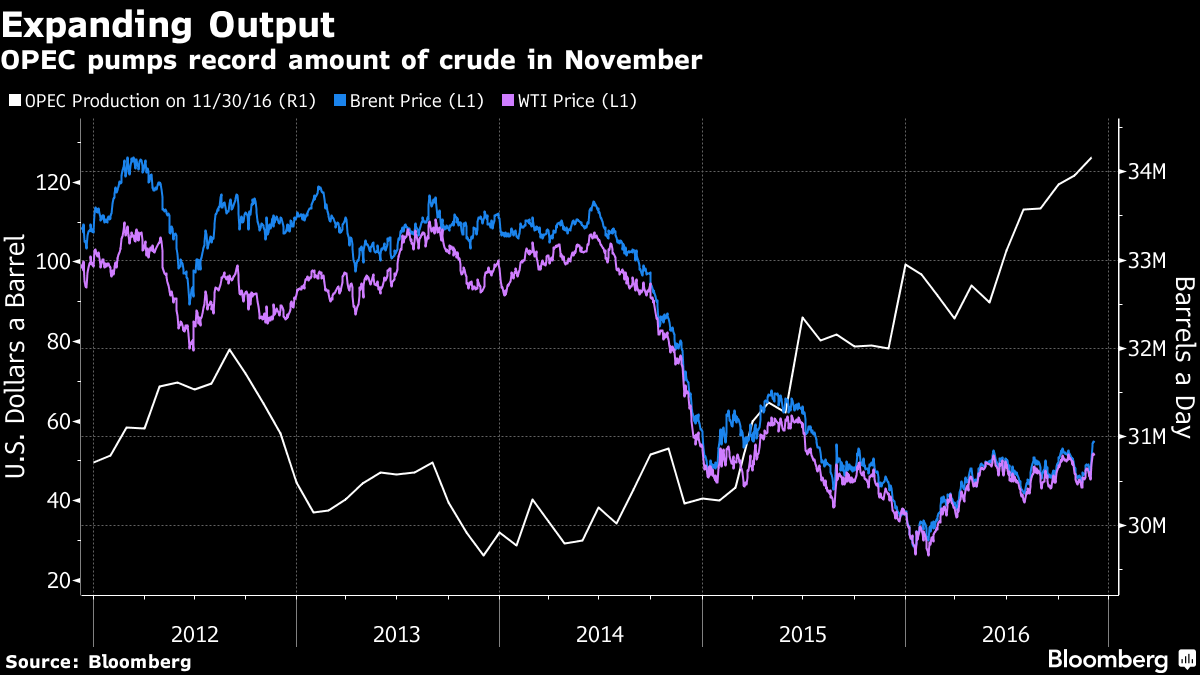

- West Texas Intermediate crude fell 2.5 percent to $50.49 a barrel, while Brent dropped 1.7 percent to $54.03, ending a four-day winning streak that was the longest since August.

- Aluminum fell 1.6 percent to $1,706.50 a metric ton, the biggest drop in a week. The metal will probably tumble next month as an “irrational” increase in prices prompts companies to restart plants, while new capacity also ramps up in the world’s largest supplier, according to China’s top metals industry group. Copper lost 1.3 percent.

Currencies

- The Bloomberg Dollar Spot Index, which tracks the greenback against 10 major peers, was little changed after falling 0.4 percent Monday.

- The euro fell 0.2 percent to $1.0745 after ending Monday up 0.9 percent, erasing an earlier slide of as much as 1.5 percent in the wake of the Italian vote.

- The pound reached a two-month high as the U.K.’s top court heard a second day of arguments in a court case over who has the right to trigger Britain’s exit from the European Union, climbing as much as 0.3 percent to $1.2775.

- The Australian dollar fell 0.2 percent to 74.60 U.S. cents, after the nation’s central bank kept interest rates unchanged and Governor Philip Lowe said “some slowing in the year-ended growth rate is likely.”

Bonds

- Italy’s 10-year bond yield declined one basis point to 1.98 percent, after Monday’s increase of eight basis points.

- Yields on Portugal’s bonds with a similar due date decreased four basis points to 3.66 percent, while Germany’s rose two basis points to 0.35 percent.

- Almost all economists surveyed by Bloomberg expect the ECB to announce on Thursday that its bond-buying program will be extended after March, and most foresee an extension of about six months at the current 80 billion euros ($86 billion) a month.

- Treasury 10-year yields were little changed at 2.40 percent.