Oil jumped more than 4 percent in New York and London after Saudi Arabia signaled it will cut output by more than previously agreed amid a weekend deal to tackle oversupply with competitors such as Russia. Longer-dated securities led declines as government bonds around the world tumbled, while climbing energy shares bucked a drop in Europe’s wider benchmark stock gauge. China’s Shanghai Composite Index sank the most since June as a gauge of smaller companies in Shenzhen plunged more than 5 percent, while U.S. stock futures were little changed, Bloomberg reported.

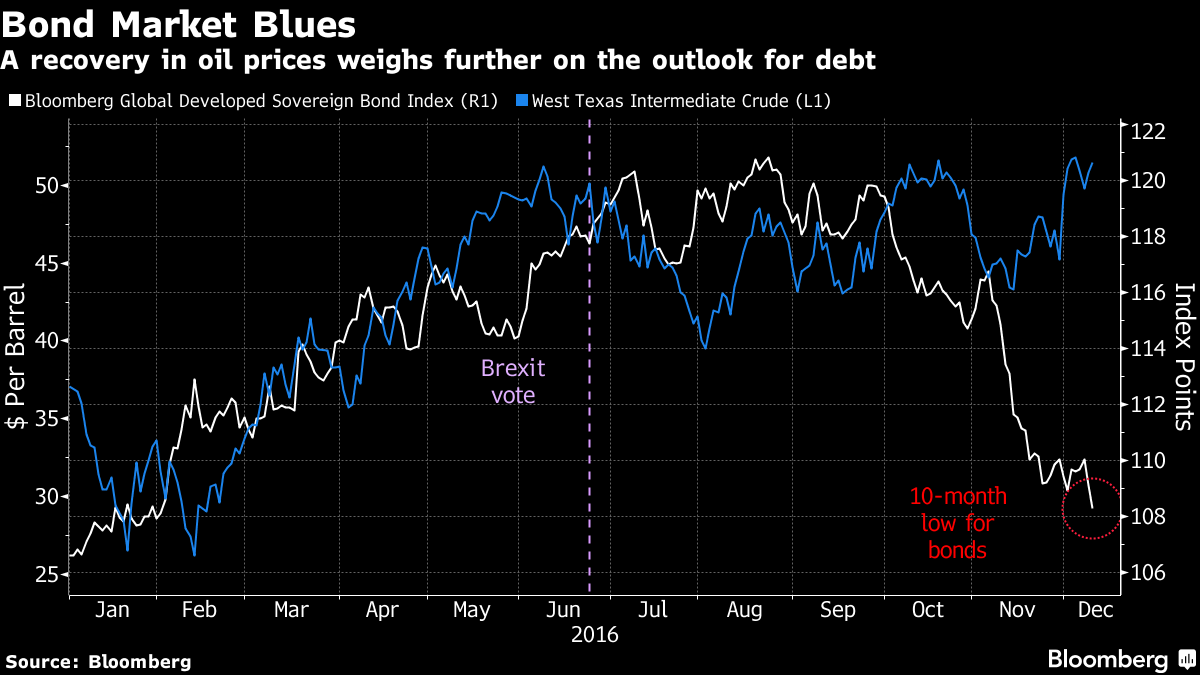

The oil deal has lit a fire under crude prices, fueling an increase in investors’ expectations for global inflation, and exacerbating a bond rout that had been supercharged by Donald Trump’s victory in last month’s Presidential election. The prospect of increased price pressures is filtering through into the market’s outlook for central-bank policy, with traders seeing 100 percent odds of a rate hike at this week’s Federal Reserve meeting, and a two-in-three chance of additional tightening by June, according to Bloomberg calculations based on fed fund futures

“The spike in oil is behind the further cheapening in global bonds,” said Craig Collins, managing director of rates trading at Bank of Montreal in London. “It’s a foregone conclusion that we’re going to have a 25 basis-point rate hike.”

Commodities

- West Texas Intermediate crude gained 4.3 percent as of 8:32 a.m. New York time, climbing to $53.70 a barrel as Brent added 4.3 percent to $56.68. Both are headed for their highest settlement prices since July last year

- The deal between OPEC members and outside nations, including Russia, was agreed at a meeting in Vienna at the weekend. It should usher in the first global petroleum cuts in 15 years and covers about 60 percent of the world’s output

- Copper futures rallied as much as 1.4 percent in New York before erasing gains and retreating 0.9 percent

- Gold fluctuated, trading down 0.1 percent in the spot market at $1,158.65 an ounce

Bonds

- Ten-year Treasury yields rose as much as six basis points to 2.53 percent. The U.S. Treasury auctions 10-year notes later Monday, and 30-year bonds Tuesday

- Hedge funds and other large speculators raised bearish bets on 10-year Treasuries to the highest in almost two years last week, more than doubling them to a net 228,604 contracts, according to the latest Commodity Futures Trading Commission data

- Germany’s yield curve, as measured by the spread between two- and 30-year bonds reached the steepest since 2014, based on closing prices, while a similar gauge for Japan widened for a fifth day

- U.K. 10-year yields climbed four basis points to 1.49 percent, while those on similar-maturity bunds also added four basis points, to 0.40 percent

Stocks

- The ChiNext index sank 5.5 percent and the Shanghai Composite Index lost 2.5 percent as curbs on insurers’ stock trading and concern about the outlook for the property market spurred selling. Hong Kong’s Hang Seng Index slipped 1.5 percent

- The Stoxx Europe 600 Index fell 0.3 percent, following its biggest weekly rally in almost two years. Still, commodity producers and miners gained, with the Stoxx 600 Oil & Gas Index up 2.2 percent

- Amundi SA rose 7.7 percent after the firm agreed to buy Pioneer Global Asset Management from Italy’s UniCredit SpA. Banca Monte dei Paschi di Siena SpA shares advanced as much as 10.3 percent after the lender’s board met on Sunday and agreed to stick with its original deadline for its capital plan

- Banks and technology shares drove the S&P 500 to a 3.1 percent climb last week, with the U.S. benchmark reaching successive all-time highs as the Dow Jones Industrial Average also rose to records. S&P futures were little changed on Monday

Currencies

- Oil-exporting currencies lead gains against the dollar, with the Russian ruble gaining 2.2 percent and the Norwegian krone and Mexican peso advancing 0.9 percent

- Turkish lira tumbled for a third day, slumping 0.9 percent after twin bombings in Istanbul on Saturday killed 38 and wounded more than 150 people

- The euro gained 0.5 percent to $1.0613, after dropping 1 percent last week