The Stoxx Europe 600 Index fell 0.4 percent. A gauge of the greenback’s strength retreated 0.2 percent as the yen and the euro strengthened. Yields on 10-year U.S. Treasuries dropped three basis points while those on similar-maturity German bund slipped two basis points. Oil declined 1 percent in New York. Gold headed for its biggest gain in almost two weeks, Bloomberg reported.

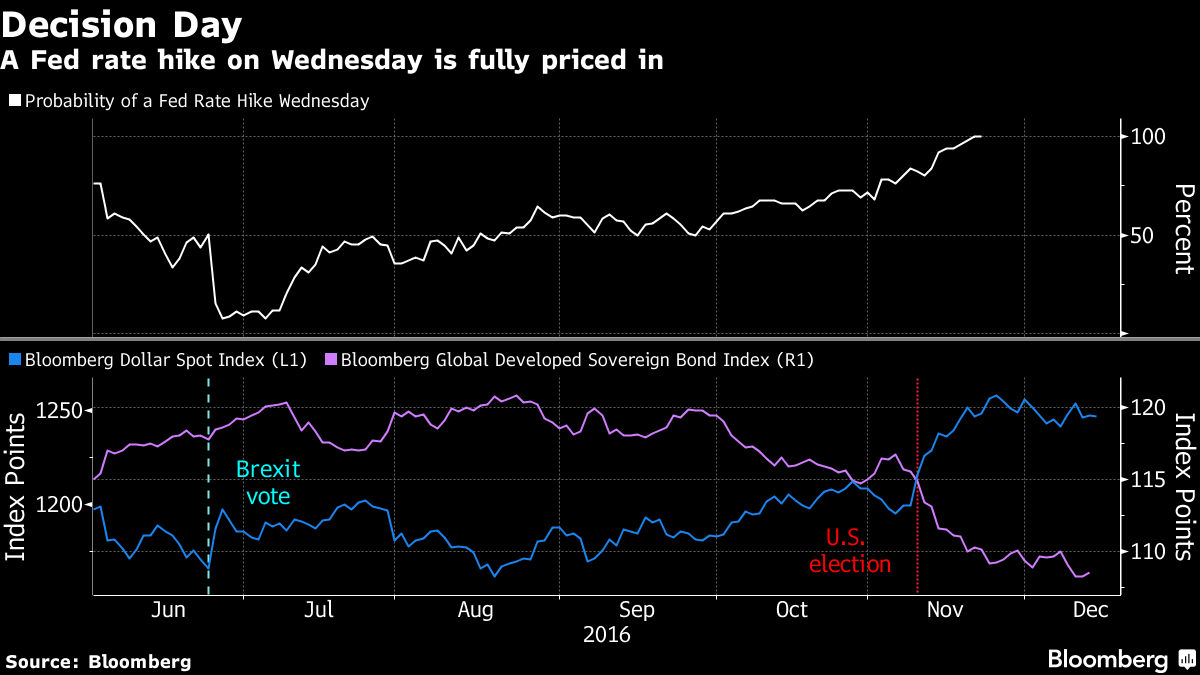

The Fed’s path to tighter monetary policy has been delayed throughout 2016, as first instability in Chinese markets, then the shock votes for Brexit and Donald Trump, put policy makers on the back foot. The U.S. central bank is expected to boost borrowing costs just as the focus shifts back to governments, with fiscal easing at the hands of incoming U.S. President Trump speculated to drive economic growth going forward. After Wednesday, traders see a two-in-three chance of additional rate increases from the Fed by June, futures show.

China’s broadest measure of new lending rose to 1.74 trillion yuan ($252 billion) in November, the biggest increase since March and topping the median estimate of 1.1 trillion yuan in a Bloomberg survey. Japan’s Tankan gauge of sentiment among large manufacturers came in as economists expected for the fourth quarter, rising to 10 from six in the previous period. India reported a 3.15 percent increase in wholesale prices for November.

Stocks

- Almost three stocks fell for each that rose on the Stoxx Europe 600 Index as of 8:07 a.m. London time, as Barclays Plc and Sanofi declined.

- U.S. index futures dropped 0.1 percent after the S&P 500 Index rose 0.7 percent to an all-time high and the Dow Jones Industrial Average neared 20,000 points.

- The MSCI Asia Pacific Index added 0.1 percent. Australia’s S&P/ASX 200 Index climbed 0.7 percent; Tatts Group Ltd. jumped after a consortium including Macquarie Group Ltd. and KKR & Co. offered as much as A$7.3 billion ($5.5 billion) for the company.

- Hong Kong’s Hang Seng Index gained 0.2 percent, while Japan’s Topix dropped 0.1 percent and the Shanghai Composite Index fell 0.5 percent to a five-week low.

Currencies

- The Bloomberg Dollar Spot Index, a gauge of the greenback against 10 major peers, dropped 0.2 percent after rising 0.1 percent on Tuesday.

- The euro strengthened 0.3 percent to $1.0655. The yen advanced 0.2 percent to 114.95 per dollar after pulling back by 0.2 percent last session.

- Traders say the dollar should have a muted reaction to the Fed’s expected 25 basis-point hike, but may see more volatile price action in reaction to Chair Janet Yellen’s subsequent press conference.

Bonds

- Treasuries due in a decade yielded 2.45 percent, down three basis points.

- Germany’s 10-year bond yield dropped two basis points to 0.34 percent

- Japan’s 30-year government bond yield slid seven basis points to 0.73 percent as the nation’s central bank stepped up purchases of longer-term debt.

Commodities

- West Texas Intermediate crude retreated to $52.45 a barrel, following a four-day surge of more than 6 percent.

- U.S. inventories increased by 4.68 million barrels last week, the industry-funded American Petroleum Institute was said to report. Government data Wednesday is forecast to show supplies fell.

- Oil markets will swing into deficit in the first half of 2017 as producers curb supply, according to the International Energy Agency, earlier than its previous forecast.

- Gold added 0.4 percent to $1,162.55 an ounce in the spot market.