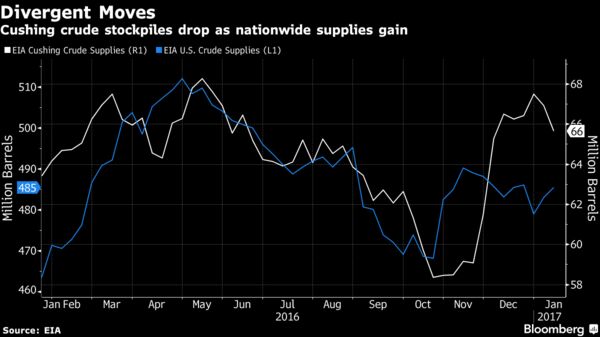

Futures climbed 0.6 percent. Supplies at Cushing, Oklahoma, fell by 1.27 million barrels last week, the Energy Information Administration said. The agency reported that nationwide stockpiles rose 2.35 million barrels, while the industry-funded American Petroleum Institute said there was a 5.04 million-barrel decrease on Wednesday. OPEC output cuts won’t necessarily trigger a “bonanza” of U.S. shale supply, the International Energy Agency said.

According to Bloomberg, oil has held above $50 a barrel since OPEC and nations including Russia agreed late last year to trim supply by about 1.8 million barrels a day to reduce bloated global inventories. While producers from Saudi Arabia to Iraq have signaled they’re implementing the reductions, the IEA predicted a rebound in U.S. shale output as prices rise.

"We would be lower if not for the significant drop at Cushing," Thomas Finlon, director of Energy Analytics Group in Wellington, Florida, said by telephone. "Imports dropped from very high levels, which explains why crude supplies increased by so much."

West Texas Intermediate for February delivery, which expires Friday, rose 29 cents to $51.37 a barrel on the New York Mercantile Exchange. Total volume traded was 17 percent below the 100-day average. The more-active March contract advanced 23 cents to $52.12.

Brent for March settlement advanced 24 cents to $54.16 a barrel on the London-based ICE Futures Europe exchange. The global benchmark closed at a $2.04 premium to March WTI.

Trending Higher

"The oil price has support at $50," Matt Sallee, who helps manage $16.3 billion in oil-related assets at Tortoise Capital Advisors in Leawood, Kansas, said by telephone. "We should trade between $50 and $60 this year. We will approach $60 in the later part of the year and move higher as we go into 2018."

Crude stockpiles at Cushing, which is the delivery point for WTI, dropped to 65.7 million barrels in the week ended Jan. 13, according to the EIA. Nationwide crude inventories rose for a third week, climbing to 485.5 million.

Refineries processed 16.5 million barrels a day of crude last week, down 639,000 barrels from the prior week’s record pace of 17.11 million, the report showed. Refineries operated at 90.7 percent of capacity, down 2.9 percentage point from the prior week, the biggest decline in three months.

Gasoline stockpiles rose 5.95 million barrels to 246.4 million, the highest since March. Inventories of distillate fuel, a category that includes diesel and heating oil, slipped 986,000 to 169.1 million.

As supply curbs by OPEC and Russia drain a global glut, rising prices will spur drilling by U.S. shale explorers that are more efficient after the two-year downturn, according to the IEA. The agency had previously seen American production stagnating in 2017.

Oil-market news:

- OPEC and 11 other producers are making “tremendous efforts” to cut output, according to Secretary-General Mohammad Barkindo.

- The heads of oil traders Gunvor Group and Mercuria Energy Group predict crude prices will range between $50 and $60 a barrel in 2017.

- WTI will average $60 a barrel in 2018, according to the median of 30 analyst estimates compiled by Bloomberg, just $5 higher than what they were forecasting a year ago for 2017.