The U.S. currency fell against its major peers and gold added to a four-week advance. Japan’s Topix index lost 1.1 percent on the strengthening yen as Asian traders reacted for the first time to Trump’s inauguration. Shares in Shanghai and Taiwan climbed. Copper paced gains among industrial metals as the U.S. president reiterated plans to rebuild infrastructure.

According to Bloomberg, Trump began work as U.S. president after saying he’d place American interests at the forefront of his agenda. His pro-growth campaign-trail pronouncements helped drive a rally in equities since November, while the dollar surged and bonds slumped. Some of those trades are unwinding this month as investors assess whether those moves had pushed prices too far, too fast. Money managers will be dissecting earnings from some of the world’s largest companies this week with Alphabet Inc., Samsung Electronics Co. and Alibaba Group Holding Ltd. all reporting results.

“Markets are now waiting for more evidence that Donald Trump will deliver on fiscal stimulus and deregulation,” said Shane Oliver, Sydney-based global investment strategist at AMP Capital Investors Ltd., which manages about $120 billion. “Shares remain vulnerable to a further correction or consolidation in the next month or so.”

Here are the main moves in markets:

Currencies

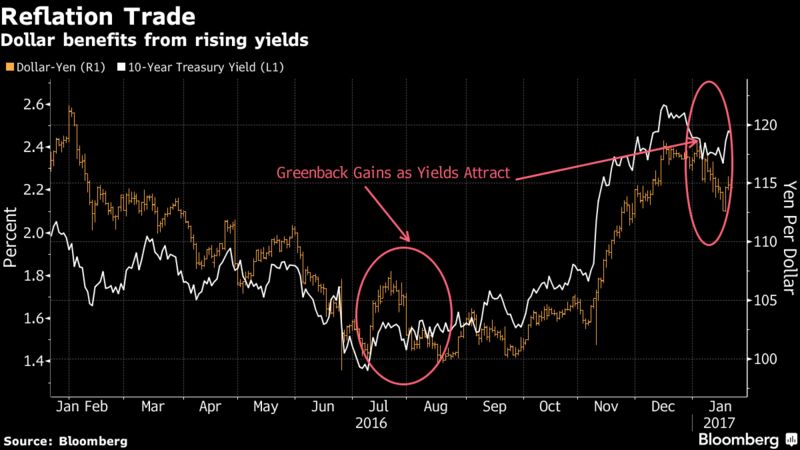

- The yen rose 0.9 percent to 113.61 per dollar as of 1:23 p.m. in Tokyo.

- The Bloomberg Dollar Spot Index slid 0.5 percent. It has fallen for four straight weeks, its longest retreat since February. The currency lost 0.8 percent against the South African rand and 0.7 percent versus the Mexican peso.

Stocks

- Australia’s S&P/ASX 200 Index fell 0.8 percent, after sliding 1.2 percent last week. The gauge reached the highest since May 2015 earlier this month.

- The Shanghai Composite was up 0.3 percent, while the Hang Seng index rose less than 0.1 percent, paring an earlier advance of as much as 0.8 percent. Taiwan’s Taiex index added 0.8 percent.

- Contracts on the S&P 500 Index declined 0.3 percent Monday after the gauge advanced 0.3 percent on Friday.

Bonds

- 10-year Treasury yields declined 3 basis points to 2.44 percent.

- The yield on 10-year Australian government bonds lost 3 basis points to 2.76 percent.

Commodities

- Gold rose 0.5 percent to $1,215.84 an ounce. The metal has increased for 10 of the past 11 sessions.

- West-Texas Intermediate crude oil fell 0.1 percent to $53.18, erasing an earlier gain of as much as 0.5 percent.

- Copper futures jumped 1.5 percent in London. Aluminum added 0.8 percent to the highest since May 2015 while lead and zinc advanced at least 1.1 percent.

- Iron ore dropped 2.1 percent, bringing its four-day decline to almost 5 percent.

Iron ore’s headed for a sharp decline as higher-grade supplies from Brazil and Australia are set to increase, according to Citigroup Inc.