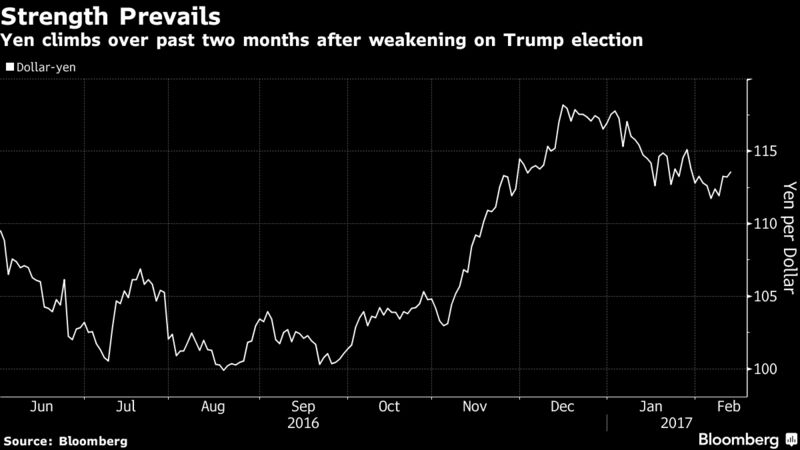

Asia Extends Global Equity Rally as Yen Slides

EghtesadOnline: Rumors about the demise of reflation trades look to have been at least a little exaggerated. Asian stocks extended a global rally as investors looked ahead to data that will provide detail on the strength of U.S. consumer prices and speeches from a range of Federal Reserve officials. The yen weakened Monday after the S&P 500 Index climbed to a record high on Friday. Iron ore surged and copper climbed, buoying commodity producers across Asia.

According to Bloomberg, stock investors last week pushed the global index higher for a third week, while Trump’s promise of a “phenomenal” tax plan snapped a six-week losing streak for the Bloomberg Dollar Spot Index that represented its longest such slump since 2010. The rebound in the latter half of last week saw some of this year’s angst recede after a crescendo of speculation that the so-called Trump reflation trade was withering.

Still, Federal Reserve Vice Chairman Stanley Fischer said over the weekend there remains “significant uncertainty” over the outlook for U.S. fiscal policy. Daniel Tarullo is stepping down as the Fed’s top bank regulator, amplifying the president’s ability to reshape oversight of Wall Street and monetary policy. Fed Chair Janet Yellen faces Congress for two days of testimony this week and the dollar could rally if she suggests a March increase is still in the cards, Bloomberg strategists said.

Stocks in Tokyo gained after Shinzo Abe and U.S. President Donald Trump refrained from arguing about currency levels during the Japanese prime minister’s two-day U.S. visit. Data on Monday showed Japan’s economy continued on a moderate growth path during the final quarter of 2016, driven by rising exports and business investment. Japan’s economy has now expanded for a fourth consecutive quarter for the first time in more than three years.

What’s coming up in the markets:

- India will report on January CPI, and expectations are that inflation slowed.

- Traders will be keeping an eye on January inflation data from the U.S. on Wednesday. That comes between Yellen’s appearances before the House of Representatives and the Senate.

Here are the main market moves on Monday:

Stocks

- The MSCI Asia Pacific Index gained 0.3 percent as of 12:49 p.m. in Tokyo, trading at levels unseen since July 2015. Japan’s Topix index advanced 0.6 percent, near the highest in more than a year.

- Australia’s S&P/ASX 200 Index added 0.7 percent, led by commodities producers. Rio Tinto Ltd. shares climbed toward a three-year high in Sydney trading.

- Hong Kong’s Hang Seng increased 0.6 percent and the Hang Seng China Enterprises Index jumped 1.2 percent to the highest since November 2015.

- The MSCI Emerging Markets Index rose 0.3 percent after adding 1.2 percent last week to the highest since July 2015.

- Futures on the S&P 500 gained 0.2 percent.

Currencies

- The yen slid 0.6 percent to 113.91 per dollar, after its biggest weekly decline since mid-December. The euro dropped 0.2 percent to $1.0620.

- The Bloomberg Dollar Index rose 0.2 percent, adding to last week’s 0.7 percent advance when it climbed for the first week since before the Christmas holiday.

Bonds

- The yield on 10-year Treasury notes added one basis point to 2.42 percent, paring some of last week’s drop.

- Australian 10-year bonds declined, pushing yields up one basis point to 2.71 percent.

Commodities

- Iron ore futures were up 5.6 percent on the Dalian exchange. The raw material used to make steel is trading at the highest in more than two years, after climbing 16 percent over the past five sessions.

- Copper futures rose 1.1 percent, extending Friday’s jump that was the largest since 2013 on the London Metal Exchange.

- Crude futures were flat in New York, after rallying 3.2 percent over the previous three sessions. The International Energy Agency said OPEC achieved a record 90 percent initial compliance with its output-cut deal while demand grew faster than expected.

- Gold fell 0.3 percent to $1,229.73 an ounce.