According to Bloomberg, oil broke below $50 a barrel last week for the first time since December as rising U.S. supply offset agreed production cuts by oil-exporting nations. West Texas Intermediate for April delivery dropped as low as $47.09 on Tuesday.

An uptick in energy prices had helped to propel headline inflation in developed markets and juice high-yield bonds and energy stocks, supporting the reflation narrative that has helped to lift global markets. The year-on-year jump in crude prices that gave momentum to the reflation story risks fading in May if oil prices stay at current levels.

It could get worse. Strategists at Commerzbank AG suggest the rebound in U.S. production may send oil prices tumbling to $40 this summer.

As a likely Federal Reserve rate hike looms on Wednesday, and fears grow over stretched valuations in stocks and high-yield bonds after a spirited rally since November, here are a bevy of charts that show the high stakes for market participants.

Feeding Bond Bears

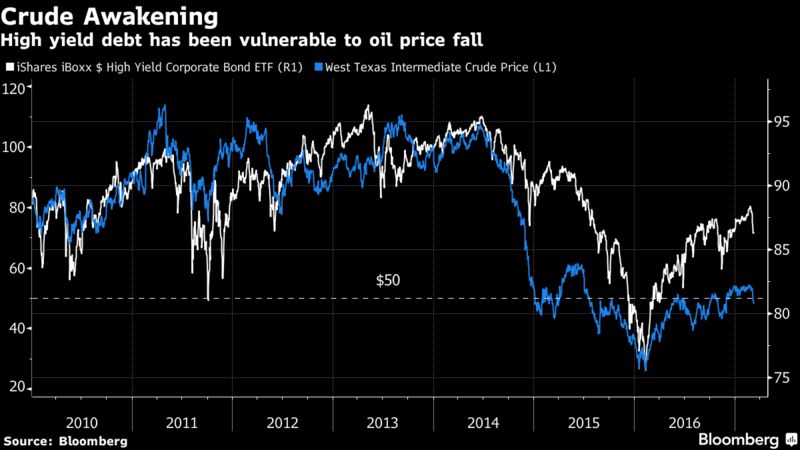

For the past two years, crude prices below $50 have been associated with sharp falls in U.S. high-yield debt. Markets are betting this won’t happen. Credit spreads continue to imply $55 a barrel at the end of the year, according to David Riley, head of credit strategy at BlueBay Asset Management LLP in London.

"A sustained fall below $50 will likely prove a catalyst for a meaningful re-pricing of energy credit," Riley said in a note.

Even though energy companies have embarked on efficiency gains in recent years, Riley is worried about operational leverage, or the sensitivity of operating income to changes in oil prices.

With $50 close to the rate at which a slew of producers break even, a prolonged bout of prices below that threshold could send energy spreads wider by as much as 30 basis points and 140 basis points in U.S. investment-grade and high-yield debt, respectively, he reckons.

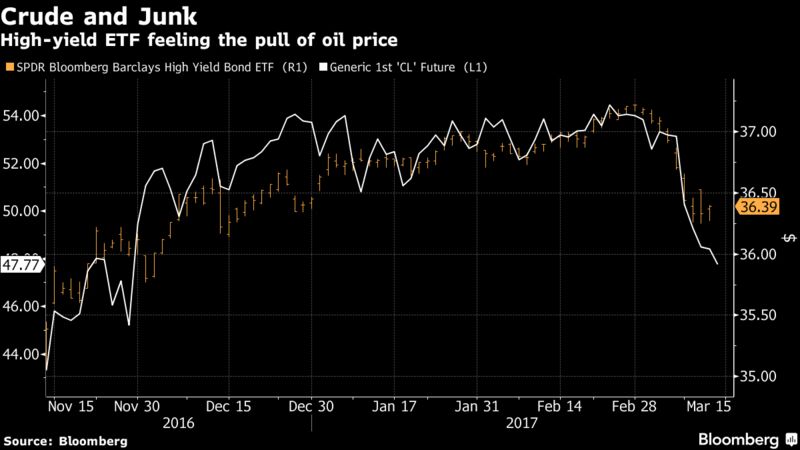

The rebound in energy prices last year -- fed, in part, by hopes of a reflationary lift from fiscal policies in the U.S. -- added fuel to the post-election rally in the Bloomberg Barclays U.S. Corporate High Yield Bond Index. The gauge has notched a total return from the November election of 3.41 percent, with energy issuers, at 5.42 percent, driving the bulk of the gains.

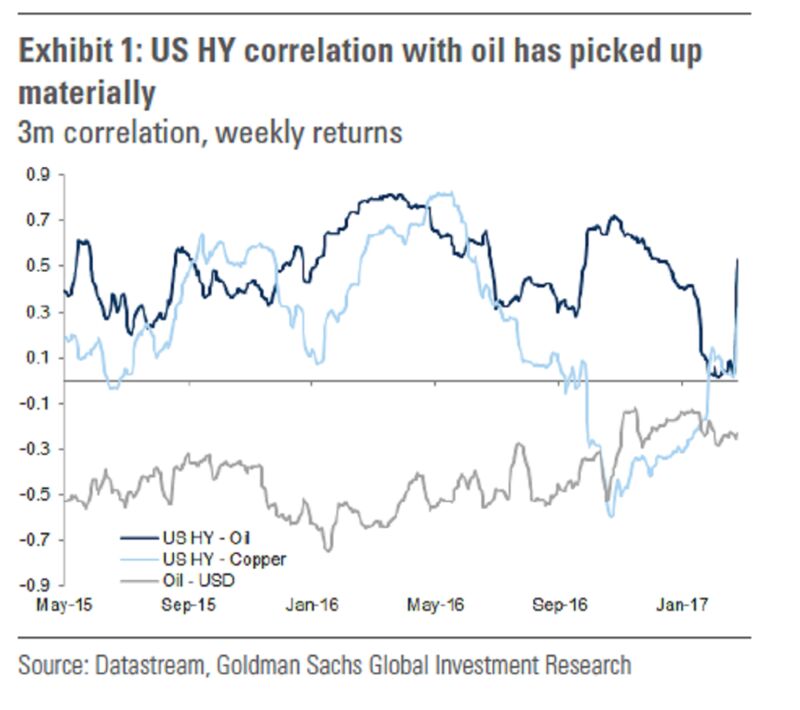

The rally in U.S. credit has left little "buffer for shocks," capping return potential this year, strategists at Goldman Sachs Group Inc. wrote in a client note. The investment bank now prefers investment-grade credit -- a hitherto unloved asset class this year -- in both the U.S. and Europe, citing overstretched valuations in high-yield credit, and the latter’s exposure to event risks, such as commodity-price shocks.

US HY Correlation With Oil Has Jumped - Goldman Sachs Group Inc.

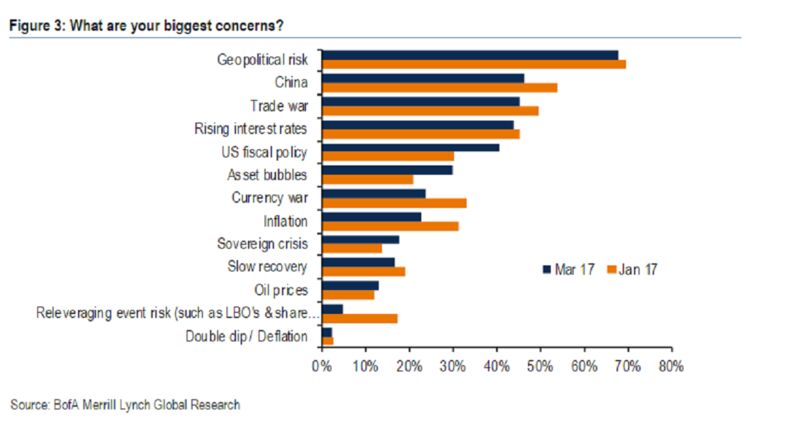

Still, few investors fretted about the outlook for crude last week despite the 9 percent tumble in the WTI benchmark, according to a survey by Bank of America Corp. The survey also showed that investors are now underweight high-yield debt for the first time since December 2008, and expect spreads across-the-board to rise.

Investors List Their Concerns in a Bank of America Corp. Survey

Stocks Outlook

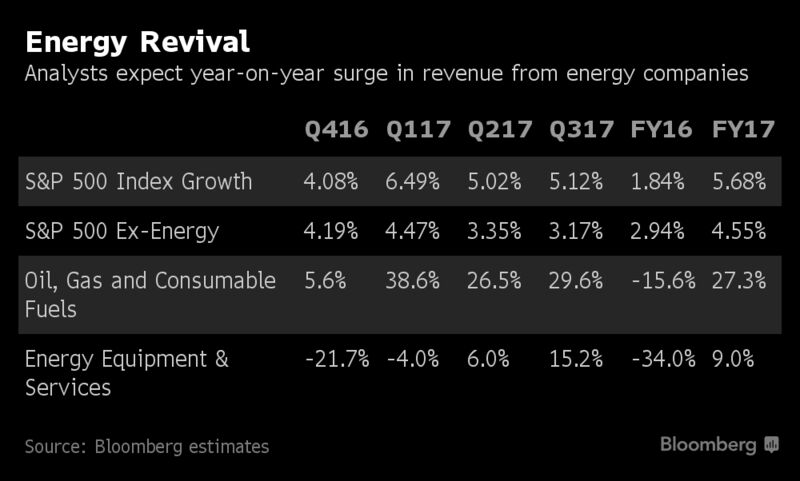

A prolonged bout of weak oil prices may also temper bullish expectations for energy stocks, with sky-high Bloomberg revenue forecasts for the sector this year -- a rebound from last year’s tumult.

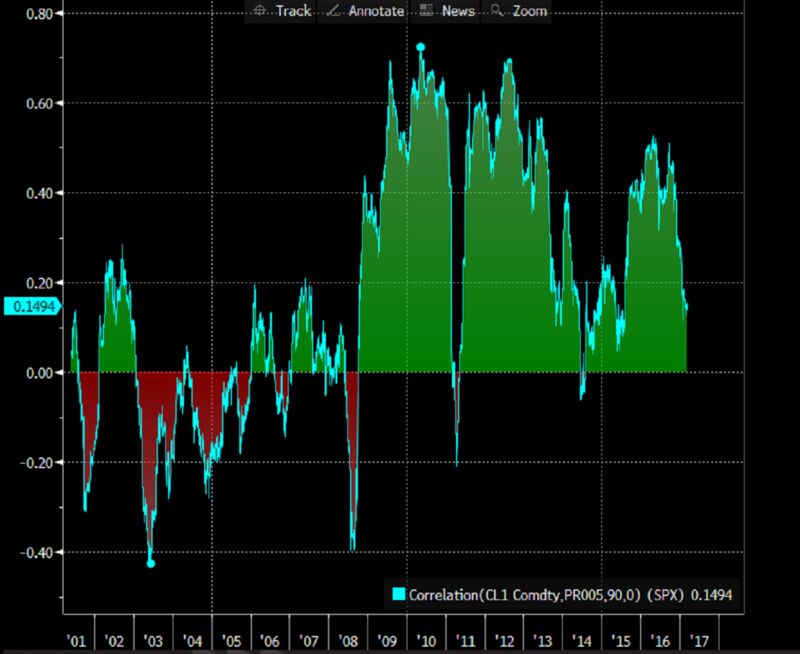

Elsewhere, the relationship between U.S. stocks and oil prices isn’t straightforward.

Oil’s increasing price volatility may matter for equity markets. It’s yet another indication that U.S. stock price volatility is "too low," with the Chicago Board Options Exchange Volatility Index, a gauge of investor anxiety known as the VIX, sitting at historic lows, according to strategists Nick Colas and Jessica Rabe at Convergex Group LLC.

"Either stocks have to become more volatile or oil prices need to calm down. We think the former is more likely than the latter," they wrote in a note to clients.

There’s some solace for investors: Oil and stock-price correlations have fallen in recent years, potentially presaging a return to a pre-crisis norm of benign indifference, Convergex strategists said.

"This means that the days of oil prices driving equity prices are likely coming to a close unless some geopolitical shock recouples them through the linkage of higher gasoline prices and their effect on the U.S. consumer," they wrote.

What’s more, the dollar -- which tends to exhibit a negative relationship with oil prices -- has been relatively stable over the past week, a relief for emerging markets for whom weak crude prices and a strengthening greenback constitute a perfect storm.