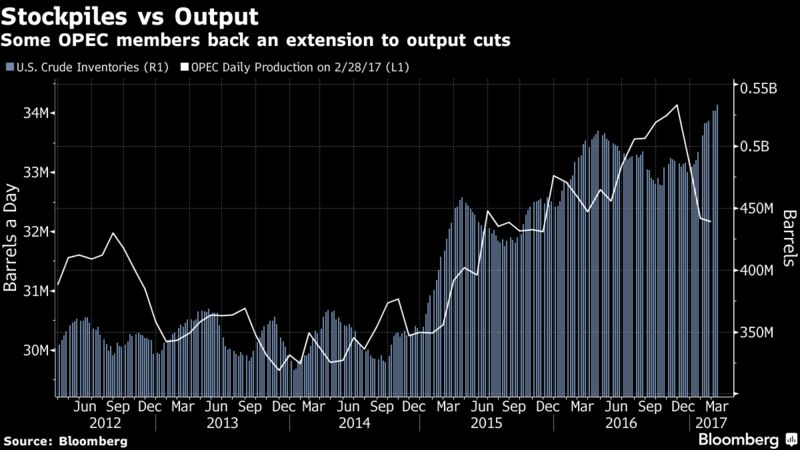

Futures lost as much as percent 1.3 percent in New York, after falling for a third week this month as rising U.S. supplies offset the effect of output curbs by other producers. Five OPEC nations joined with non-member Oman to voice support for prolonging cuts past June, with Kuwait saying it should be for an additional six months. Russia said it needs more time before making a decision, Bloomberg reported.

Oil last week slid to the lowest since November as U.S. stockpiles, output and drilling increased while the Organization of Petroleum Exporting Countries and other nations continued with efforts to ease a global glut. A committee of ministers from Kuwait, Algeria and Venezuela and their counterparts from Russia and Oman, meeting over the weekend, asked OPEC to review the market and make a recommendation in April on rolling over output reductions.

“The relative lack of price reaction perhaps reflects some disappointment that nothing more concrete was forthcoming at the OPEC committee meeting,” said David Wech, an analyst at JBC Energy GmbH in Vienna. “It also shows the market’s increasing skepticism that either a rollover of the cuts can be agreed, or that it would have a lasting and significant impact on balances.”

West Texas Intermediate for May delivery dropped as much as 63 cents to $47.34 a barrel on the New York Mercantile Exchange and was at $47.64 as of 9:45 a.m. London time. Total volume traded was about 9 percent below the 100-day average. Prices rose 27 cents to close at $47.97 on Friday, paring the weekly loss to 1.7 percent.

Brent for May settlement was down 20 cents at $50.60 a barrel on the London-based ICE Futures Europe exchange, and traded at a $2.96 premium to WTI. The global benchmark contract gained 24 cents, or 0.5 percent, to $50.80 on Friday.

Russia needs more time to assess the market, inventories and production in the U.S. and other non-OPEC countries, Energy Minister Alexander Novak said in an interview. The nation has cut its output by 185,000 barrels a day compared with a target of 300,000, Novak said Saturday.

Oil-market news:

- Libya’s biggest oil terminal was loading its first tanker since fighting this month halted shipments. The Suezmax vessel Demetrios, which can carry as much as 1 million barrels, is loading at the port of Es Sider for export to China, according to a person familiar with the matter.

- Rigs targeting crude in the U.S. rose by 21 to 652 last week, the highest level since September 2015, according to data Friday from Baker Hughes Inc.