The Stocks Europe 600 Index gained as much as 0.4 percent before paring the advance, while the euro was on track to end its longest run of losses versus the dollar since February. Energy companies helped lead a gain in emerging-market shares as oil held above $50 a barrel. South Africa’s rand slumped for a sixth day after Finance Minister Pravin Gordhan was dismissed in a political shake-up. Russia’s ruble held declines after a subway blast in the St. Petersburg subway, according to Bloomberg.

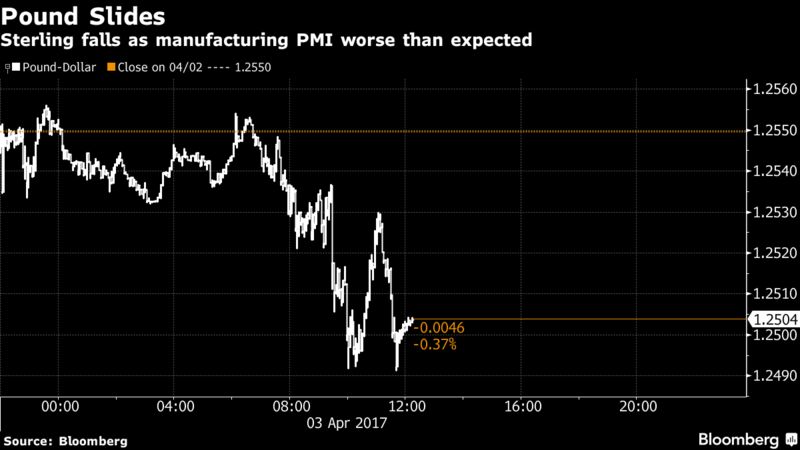

As the second quarter gets going, political developments threaten to cloud the improving global economic outlook. The first major data release showed confidence among Japan’s large manufacturers improved for a second consecutive quarter in the first three months of the year. The pound fell for the first time in three days against the dollar as U.K. manufacturing growth unexpectedly cooled.

"The challenge for markets in an event-filled week will be to contend with the conflicting signals stemming from the Trump administration’s fiscal and trade policy agendas," ING Groep NV strategists, led by Chris Turner, wrote in a note. "In particular, investors will be asking whether the White House clampdown on trade will be aggressive enough to directly thwart any U.S. reflation sentiment founded on renewed tax reform hopes."

What investors will be watching this week:

- Fed speakers include Dudley and Governor Daniel Tarullo. Minutes from the March meeting should put their comments into perspective. Minutes are also due from the European Central Bank’s latest gathering.

- China’s President Xi Jinping will meet U.S. President Donald Trump.

- The Reserve Bank of Australia is projected to keep rates steady Tuesday.

- India’s central bank will probably also hold rates. Inflation numbers are due from Thailand, South Korea and the Philippines.

- U.S. non-farm payrolls are due Friday.

Here are the main moves in markets:

Stocks

- The Stoxx Europe 600 climbed 0.1 percent as of 8:06 a.m. in New York, after increasing 5.5 percent for the first three months of the year, the best quarter in two years.

- Futures on the S&P 500 traded little changed after losing 0.2 percent on Friday.

Currencies

- Britain’s pound fell as much as 0.5 percent to $1.2485 after the worse-than-expected manufacturing data.

- South Africa’s rand tumbled 0.8 percent against the dollar, the most among major global currencies.

- The euro advanced 0.1 percent to $1.0664 and the Bloomberg Dollar index climbed 0.1 percent.

- The ruble retreated 0.1 percent to 54.32 versus the dollar. About 10 people were killed and 20 injured in the subway blast, according to the Interfax news agency.

Bonds

- The yield on 10-year U.K. debt fell 4 basis points, with German Bunds down 3 basis points.

Commodities

- WTI crude was up 0.4 percent at $50.78 a barrel, after the biggest weekly gain of the year. Crude stockpiles are starting to decline in a sign that the production cuts implemented this year are bringing the market to balance, according to OPEC’s Secretary-General Mohammad Barkindo.

- Gold fell 0.1 percent to $1,247.72 per ounce. The metal has alternated between gains and losses for the past six days.