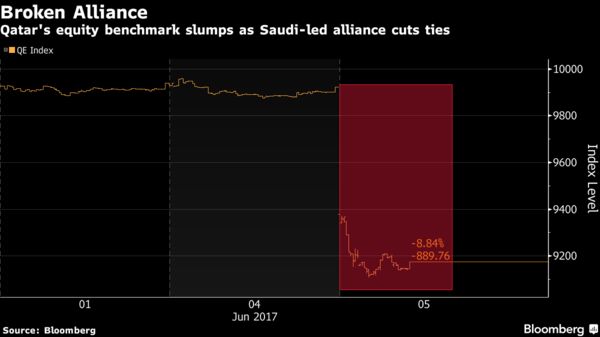

The nation’s dollar bonds tumbled and contracts used to bet the Qatari riyal will weaken surged the most since 2009. More than four times the daily average of shares changed hands on the key stock index in Doha, where many Muslims are fasting for the holy month of Ramadan, as the gauge slipped the most in more than seven years. With Monday’s selloff, the country’s main equity benchmark became the worst performer globally this year, according to Bloomberg.

The disagreement marks an unprecedented low in the relationship between the Arab nations, and for relations in the six-nation Gulf Cooperation Council in particular. It’s a stark reminder to investors of the potential volatility and geopolitical risks associated with the region, at a time when markets like Saudi Arabia and Egypt are intensifying efforts to lure foreign cash.

“For people that don’t know the region very well, they have an image of the Middle East, including the GCC, to be a somewhat unstable region, and I think this maybe confirms what they had feared,” said Tarek Fadlallah, chief executive officer of Nomura Asset Management Middle East. “For those who are familiar with the region, it will be unsettling, but maybe not critical in how they look on making investments for the foreseeable future.”

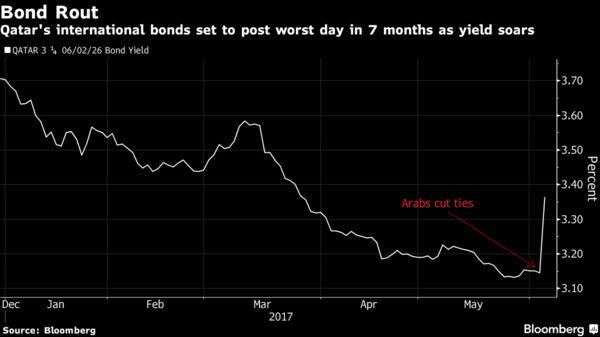

Yields on Qatar’s 3.5 billion dollars in bonds due 2026 increased 23 basis points to 3.366 percent, the highest level since March.

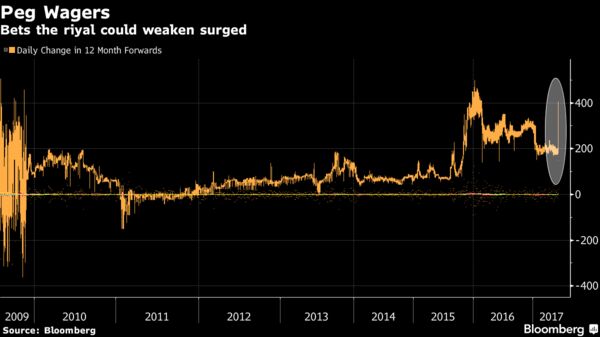

Twelve-month forward contracts for the riyal jumped as much as 203 points to 405 points, the highest level in more than a year, indicating increased bets Qatar could devalue its currency. The riyal is pegged at 3.64 per dollar.

In the equities market, the country’s QE Index fell 7.2 percent as of 11:25 a.m. in Doha. Qatar Gas Transport Ltd., Qatari Investors Group QSC, Gulf International Services QSC and Aamal Co. dropped by the maximum of 10 percent allowed by the exchange. Seven other companies on the country’s 19-member main index dropped between nine and ten percent, including lender Masraf Al Rayan QSC, which contributed the most to the index move.

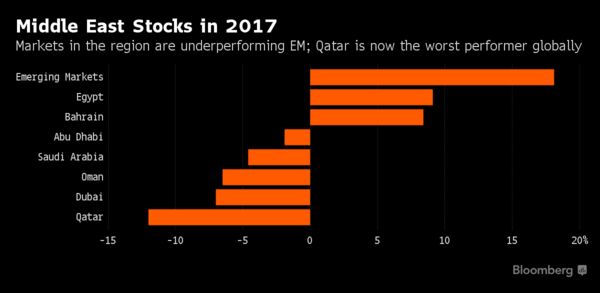

The benchmark is the worst performer globally this year, posting losses close to 12 percent while shares from emerging markets gained more than 18 percent.