Technology companies on the MSCI Asia Pacific Index tumbled, with Samsung Electronics Co. and Tencent Holdings Ltd. leading declines. U.S. stock futures fell after the Nasdaq 100 sank 2.4 percent on Friday. Sterling was steady after the biggest drop in eight months as Prime Minister Theresa May struggled to keep power in the wake of Thursday’s election. Oil rose as Saudi Arabia and Russia sought to reassure investors that output cuts by OPEC and its partners are draining a global glut, Bloomberg reported.

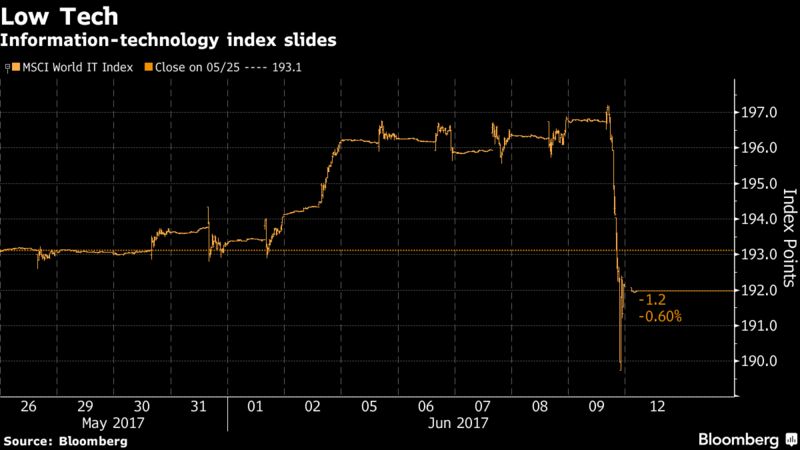

The rout in U.S. tech stocks began when Robert Boroujerdi, global chief investment officer at Goldman Sachs Group Inc., warned that low volatility in Facebook Inc., Amazon.com Inc., Apple Inc., Microsoft Corp. and Google parent Alphabet Inc. may be blinding investors to risks such as cyclicality and regulation.

“There’s a chance U.S. internet technology stocks that have propelled a global stock rally will now serve as a buzz kill,” said Mitsuo Shimizu, deputy general manager at Japan Asia Securities in Tokyo.

Washington remains in the spotlight. Attorney General Jeff Sessions offered to speak to the Senate Intelligence Committee to answer questions about alleged Russian meddling in the 2016 presidential election, after fired FBI director James Comey’s testimony on Thursday. On top of that, investors also face central bank decisions, with the Fed expected to raise interest rates at the conclusion of their two-day meeting.

Here’s what investors will be facing this week:

- Theresa May will address the 1922 Committee of rank-and-file Tory lawmakers on Monday, in a meeting that will test her chances of staying in office.

- Fed policy makers are forecast to raise their benchmark interest rate for the second time this year on Wednesday. Central banks in Japan and Britain are also scheduled to weigh in with policy decisions this week.

Here are the main moves in markets:

Stocks

- Japan’s Topix was little changed as of 1:17 p.m. in Tokyo, while the Nikkei 225 Stock Average slid 0.5 percent, weighed down by declines in Fast Retailing Co. and SoftBank Group Corp.

- South Korea’s Kospi lost 1 percent, with Samsung slumping 1.7 percent. Also, North Korea said it has moved closer to test-firing an intercontinental ballistic missile with the potential of hitting the U.S. mainland.

- Hong Kong’s Hang Seng Index declined 1.2 percent, as Tencent Holdings fell 2.6 percent.

- The Shanghai Composite Index retreated 0.5 percent, after a four-day rally.

- Markets in Australia, Malaysia and the Philippines are closed for holidays.

- S&P 500 Index futures slipped 0.1 percent. The benchmark gauge fell 0.1 percent on Friday, while the tech-heavy Nasdaq Composite Index dropped 1.8 percent. Apple sank 3.9 percent, while Microsoft, Amazon, Facebook and Alphabet all lost more than 2 percent.

Currencies

- The pound rose 0.1 percent to $1.2760, after dropping 1.6 percent on Friday. The euro rose 0.1 percent to $1.1208.

- The South Korean won fell 0.3 percent. The Bank of Korea may need to adjust easing if the economy’s recovery continues, Governor Lee Ju-yeol said in a prepared statement for the central bank’s 67th anniversary.

- The yen added less than 0.1 percent to 110.29 per dollar, after three days of declines.

Bonds

- The yield on 10-year Treasuries headed higher for a fourth day, advancing two basis points to 2.22 percent.

Commodities

- West Texas crude gained 0.6 percent to $46.10 a barrel. Oil slumped almost 4 percent last week as an unexpected increase in U.S. stockpiles cast doubt on OPEC’s ability to rebalance world crude markets.

- Gold rose less than 0.1 percent to $1,267.16 an ounce, after three days of declines.